Answered step by step

Verified Expert Solution

Question

1 Approved Answer

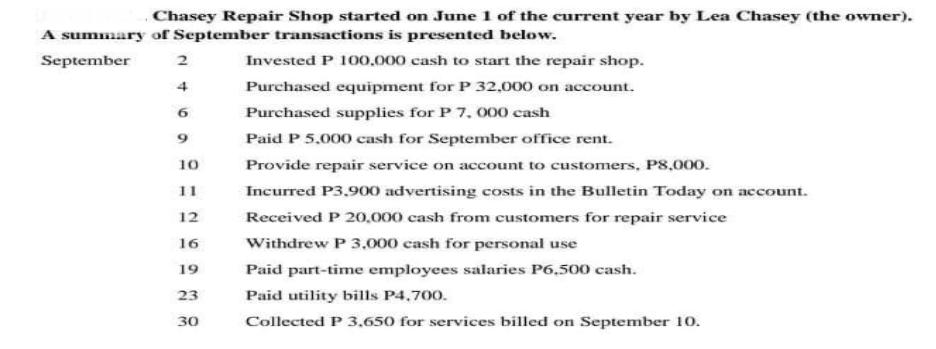

Chasey Repair Shop started on June 1 of the current year by Lea Chasey (the owner). A summary of September transactions is presented below.

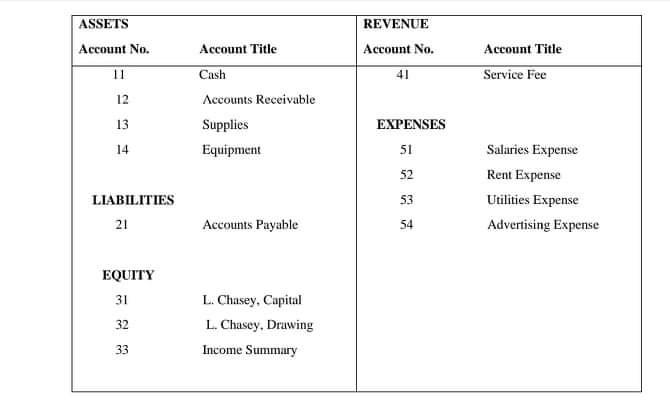

Chasey Repair Shop started on June 1 of the current year by Lea Chasey (the owner). A summary of September transactions is presented below. September Invested P 100.000 cash to start the repair shop. Purchased equipment for P 32,000 on account. Purchased supplies for P 7. o00 cash 9 Paid P 5,000 cash for September office rent. 10 Provide repair service on account to customers, P8,000. 11 Incurred P3,900 advertising costs in the Bulletin Today on account. 12 Received P 20.000 cash from customers for repair service 16 Withdrew P 3,000 cash for personal use 19 Paid part-time employees salaries P6,500 cash. 23 Paid utility bills P4,700. 30 Collected P 3,650 for services billed on September 10. 2. ASSETS REVENUE Account No. Account Title Account No. Account Title 11 Cash 41 Service Fee 12 Accounts Receivable 13 Supplies EXPENSES 14 Equipment 51 Salaries Expense 52 Rent Expense LIABILITIES 53 Utilities Expense 21 Accounts Payable 54 Advertising Expense EQUITY 31 L. Chasey, Capital 32 L. Chasey, Drawing 33 Income Summary EQUITY 31 L. Chasey, Capital 32 L. Chasey, Drawing 33 Income Summary Instruction. Using the data above: A. Journalize the transactions. (You may omit explanations.) Hint: There are only TWO accounts for every transaction. B. Post the recorded transaction in the account ledger

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 2 A Journal entries Journalizing transactions is the first step in the accounting cycle Tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started