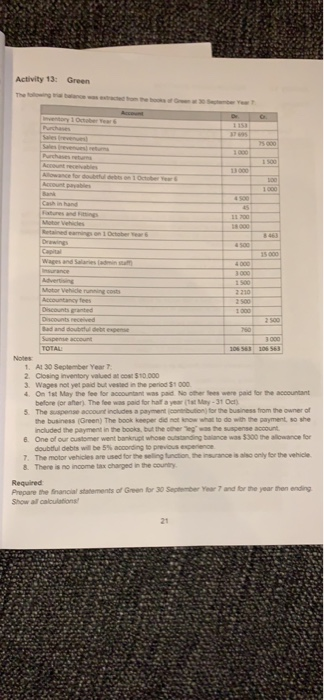

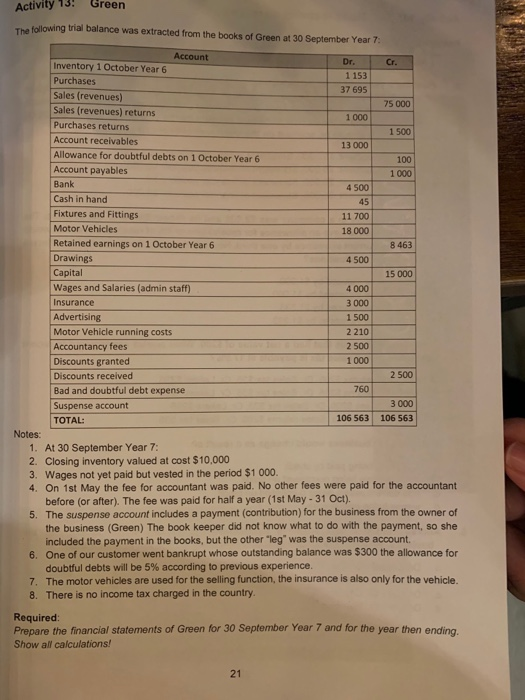

Activity 13: Green 1. Al 30 September Year : 2. Closing inventory valued at $10 000 3. Wages not yet paid but v ed in the period 1 000 4. On tot Mary the fee for account was paid others were paid for the accountant before for her. The fee was paid for halay May-31 ) 5. The suspense account includes a payment contribution to the business from the owner of the business Green) The bookkeeper did not what to do with the payment so she included the payment in the book, but ther e was the s ense account 6. One of our customer went bankrupt whose standing bace was $300 the towance for doubtfuldebts will be 5according to previous excence 7. The motor vehicles are used for the eligunction. Ther e is only for the vehicle & There is no income tax charged in the country and for the year the ending Required Prepare the financial statements of Green for 30 September Show all calculations Activity 13! Green following trial balance was extracted from the books of Green at 30 September Year 1500 Account Inventory 1 October Year 6 Dr. Cr. Purchases 37 695 Sales (revenues) 75 000 Sales (revenues) returns 1000 Purchases returns 1 500 Account receivables Allowance for doubtful debts on 1 October Year 6 Account payables Bank 4 500 Cash in hand Fixtures and Fittings 11 700 Motor Vehicles 18 000 Retained earnings on 1 October Year 6 8463 Drawings 4500 Capital Wages and Salaries (admin staff) 4 000 Insurance 3 000 Advertising Motor Vehicle running costs 2210 Accountancy fees 2 500 Discounts granted 1000 Discounts received 2 500 Bad and doubtful debt expense 760 Suspense account 3000 TOTAL: 106 563 106 563 Notes: 1. At 30 September Year 7: 2. Closing inventory valued at cost $10,000 3. Wages not yet paid but vested in the period $1 000. 4. On 1st May the fee for accountant was paid. No other fees were paid for the accountant before (or after). The fee was paid for half a year (1st May - 31 Oct). 5. The suspense account includes a payment contribution) for the business from the owner of the business (Green) The book keeper did not know what to do with the payment, so she included the payment in the books, but the other "leg" was the suspense account. 6. One of our customer went bankrupt whose outstanding balance was $300 the allowance for doubtful debts will be 5% according to previous experience. 7. The motor vehicles are used for the selling function, the insurance is also only for the vehicle 8. There is no income tax charged in the country. Required: Prepare the financial statements of Green for 30 September Year 7 and for the year then ending Show all calculations! 21