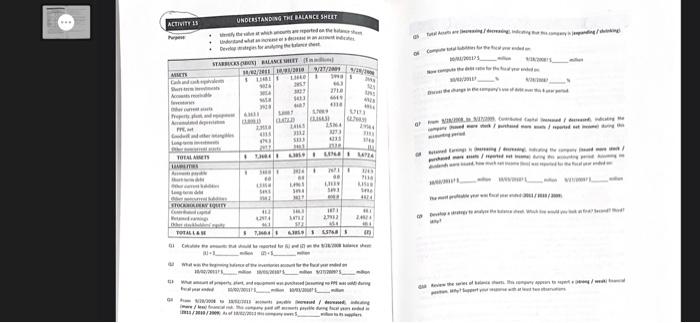

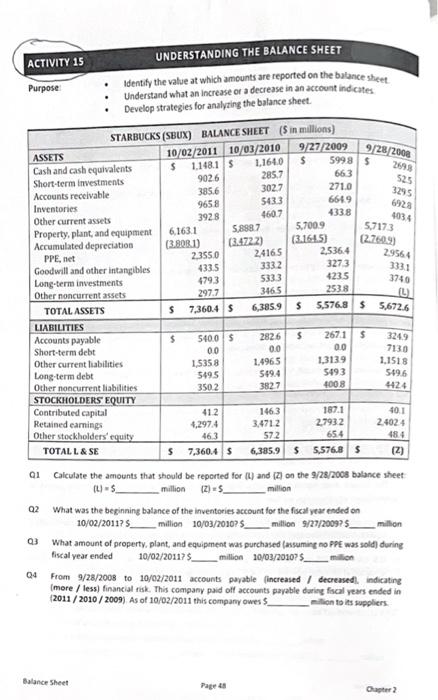

ACTIVITY 15 UNDERSTANDING THE BALANCE SHEET Purpose: * Identify the value at which amounts are reported on the balance sheet. - Understand what an increase or a decrease in an account indicates - Develop strategies for analyring the balance sheet. Q1 Calculate the amounts that should be reported for (t] and [2] on the 9/28/2005 balance sheet [t)=5 million (2)=5 million Q2 What was the beginning balance of the inventories account for the fiscal year ended on 10/02/2011?5 million 10/03/20107.5 million 5/27/2009?5 millon Q3 What amount of property. plant, and equipment was purchased (assuming no FPE was sold) during fiscal year ended 10/02/201175. million 10/03/2010?5 im lish Q4 From 9/28/2008 to 10/02/2011 accounts payable fincreased f decreasedl. indicating (more / less) financial risk. This company paid off accounts payable daring fiscal years ended in {2011/2010/2009} As of 10/02/2011 this company owes 5 Q7 From 2/28/2003 to 9/27/2009, Contributed Capital (increased / decreased), indicating the company (issued more stock / purchased more assets / reported net income) during this accounting period. as Retained Earnings is (increasing / decreasinel indicating the company (issued more stock / purchased more assets / reported net income) during this accounting period. Assuming no dividends were issued, how much net income (loss) was reported for the fical year ended on: 10/02/201175 million 10/03/2010?5 millon 9/27/2009?5 million The most profitable year was fiscal year ended (2011 / 2010/2009). Q9 Develop a strategy to analyze the balance sheet. Which line would you look at first? Second? Third? Why? Q10 Review the series of balance sheets. This company appears to report a (strong / weak) financial position. Why? Support your response with at least two observations. ACTIVITY 15 UNDERSTANDING THE BALANCE SHEET Purpose: * Identify the value at which amounts are reported on the balance sheet. - Understand what an increase or a decrease in an account indicates - Develop strategies for analyring the balance sheet. Q1 Calculate the amounts that should be reported for (t] and [2] on the 9/28/2005 balance sheet [t)=5 million (2)=5 million Q2 What was the beginning balance of the inventories account for the fiscal year ended on 10/02/2011?5 million 10/03/20107.5 million 5/27/2009?5 millon Q3 What amount of property. plant, and equipment was purchased (assuming no FPE was sold) during fiscal year ended 10/02/201175. million 10/03/2010?5 im lish Q4 From 9/28/2008 to 10/02/2011 accounts payable fincreased f decreasedl. indicating (more / less) financial risk. This company paid off accounts payable daring fiscal years ended in {2011/2010/2009} As of 10/02/2011 this company owes 5 Q7 From 2/28/2003 to 9/27/2009, Contributed Capital (increased / decreased), indicating the company (issued more stock / purchased more assets / reported net income) during this accounting period. as Retained Earnings is (increasing / decreasinel indicating the company (issued more stock / purchased more assets / reported net income) during this accounting period. Assuming no dividends were issued, how much net income (loss) was reported for the fical year ended on: 10/02/201175 million 10/03/2010?5 millon 9/27/2009?5 million The most profitable year was fiscal year ended (2011 / 2010/2009). Q9 Develop a strategy to analyze the balance sheet. Which line would you look at first? Second? Third? Why? Q10 Review the series of balance sheets. This company appears to report a (strong / weak) financial position. Why? Support your response with at least two observations