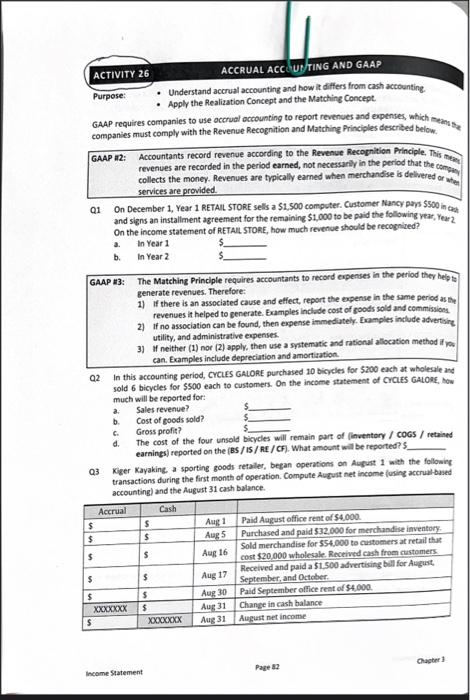

ACTIVITY 26 ACCRUAL ACCOUVTING AND GAAR Purpose: - Understand accrual accounting and how it differs from cash accounting. - Apply the Realization Concept and the Matching Concept. GAAP requires companies to use occrual accounting to report revenues and expenses, which ment Ste companies must comply with the Revenue Recognition and Matching Principles described below. GAAP i2: Accountants record revenue according to the Revenue Recocnition Pinciple, This meeng revenues are recorded in the period earned, not necessarly in the period that the compuy collects the money. Revenues are typically earned when merchandise is delivered or ater services are provided. Q1 On December 1, Year 1 RETAIL STORE sells a $1,500 computer. Customer Tancy pays $00 in cach and signs an installment agreement for the remaining $1,000 to be puid the following verat, Year 2 . On the income statement of RETAIL STORE, how much revenve should be recogniled? a. In Year 1 O b. In Year 2 GAAP U3: The Matching Principle requires accountants to record expenses in the period they helf to generate revenues. Therefore: 1) If there is an associated cause and effect, report the expense in the same period as the revenues it helped to generate. Examples inclade cost of goods sold and commissions. 2) If no association can be found, then expense inmediutely. Eoomples indlude adverting utility, and administrative expenses. 3) If neither (1) nor (2) apply, then use a systematic and rationul allocation method if por can. Examples include depreciation and amortiation. Q2 In this accounting period, CYCLES GALORE purchased 10 birycles for 5200 each at wholeale and sold 6 bicycles for 5500 each to customers. On the income statemeat of CrCiES GALONc, how much will be reported for: a. Sales revenue? b. Cost of goods sold? c. Gross profit? d. The cost of the four unsold bicycles will remain aart of lleventory / cocs / retained earaings) reported on the (BS / LS/AI/CH ). What amount will be reported?s Q3 Kiger Kayaking, a sporting goods retaller, began operations on Augut 1 with the following transactions during the first month of operation. Compute August net income furing accrual bused accounting) and the August 31 cash balance