Answered step by step

Verified Expert Solution

Question

1 Approved Answer

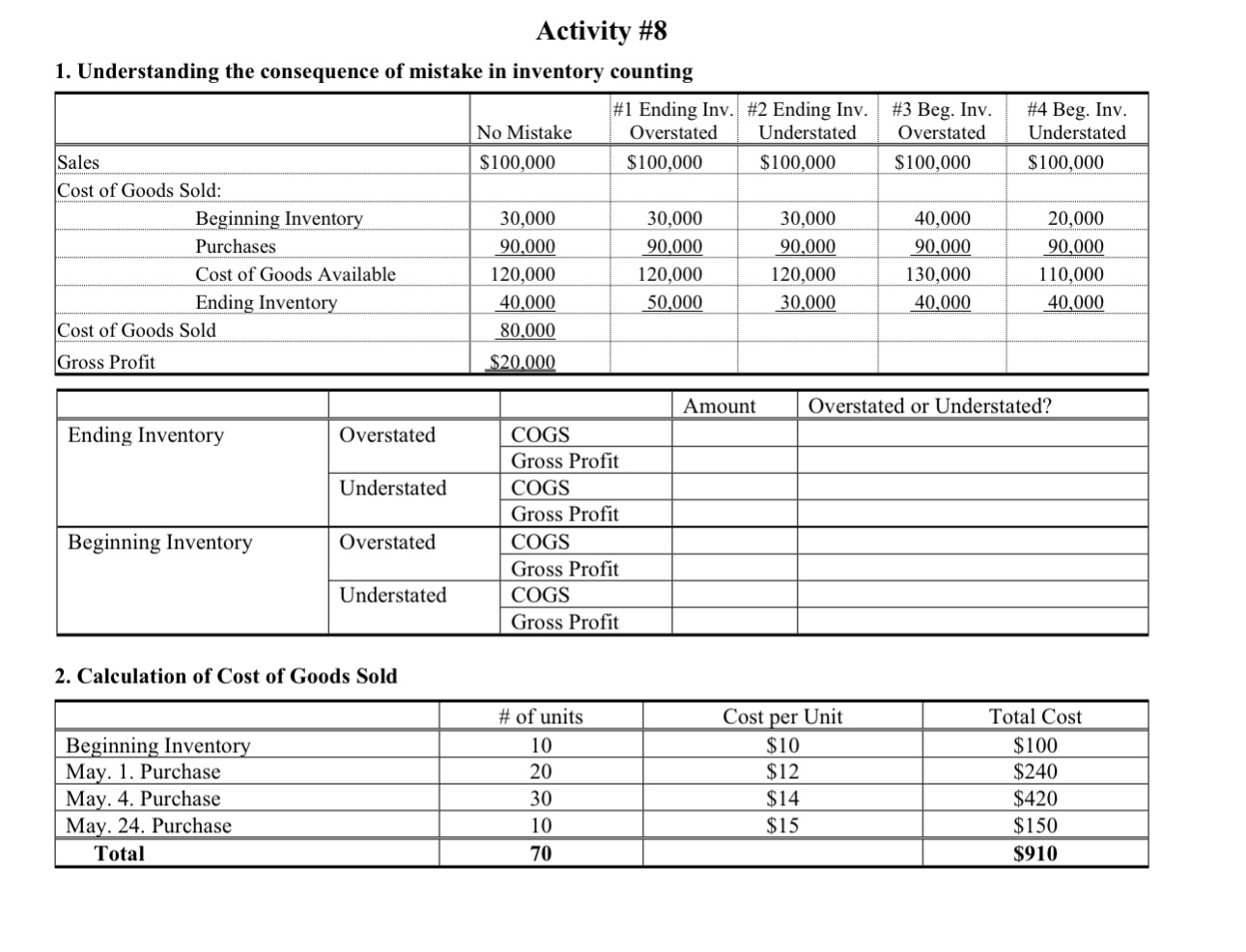

Activity #8 1. Understanding the consequence of mistake in inventory counting #1 Ending Inv. #2 Ending Inv. #3 Beg. Inv. No Mistake Overstated Understated

Activity #8 1. Understanding the consequence of mistake in inventory counting #1 Ending Inv. #2 Ending Inv. #3 Beg. Inv. No Mistake Overstated Understated $100,000 $100,000 $100,000 Overstated $100,000 #4 Beg. Inv. Understated $100,000 Sales Cost of Goods Sold: Beginning Inventory 30,000 30,000 30,000 40,000 20,000 Purchases 90,000 90,000 90,000 90,000 90,000 Cost of Goods Available 120,000 120,000 120,000 130,000 110,000 Ending Inventory 40,000 50,000 30,000 40,000 40,000 Cost of Goods Sold 80,000 Gross Profit $20,000 Amount Overstated or Understated? Ending Inventory Overstated COGS Gross Profit Understated COGS Gross Profit Beginning Inventory Overstated COGS Gross Profit Understated COGS Gross Profit 2. Calculation of Cost of Goods Sold Beginning Inventory May. 1. Purchase May. 4. Purchase May, 24. Purchase Total # of units Cost per Unit Total Cost 10 $10 $100 20 $12 $240 30 $14 $420 10 $15 $150 70 $910

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainlylets analyze the impact of inventory counting mistakes on the financial statements 1 Understanding the Consequence of Mistakes in Inventory Counting Table Summary Scenario Ending Inventory CO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started