Answered step by step

Verified Expert Solution

Question

1 Approved Answer

/Activity 8 Purpose: RATIO ANALYSIS Asset Turnover Understand the information provided by the asset turnover ratio. - Identify the expected range and whether an

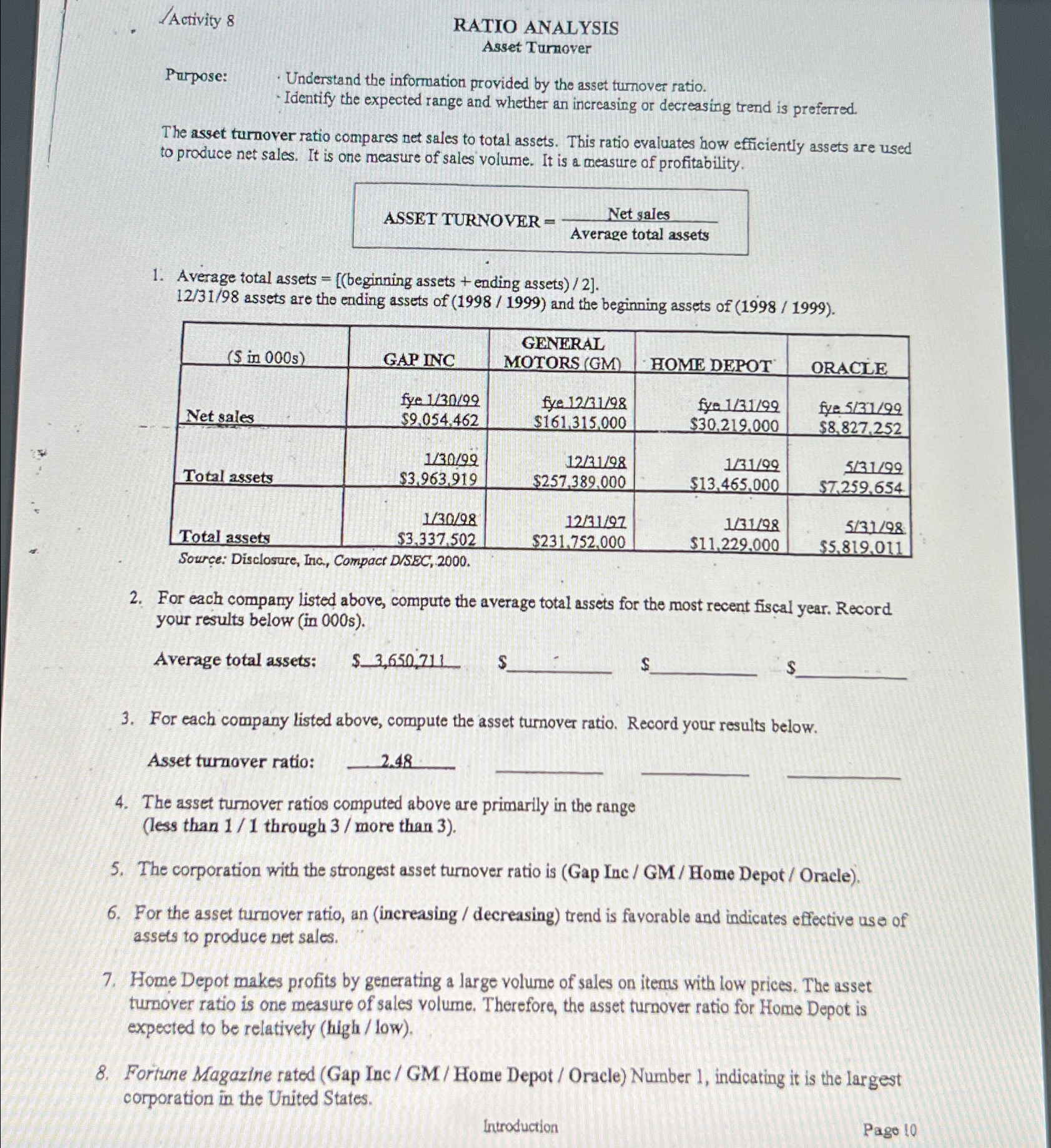

/Activity 8 Purpose: RATIO ANALYSIS Asset Turnover Understand the information provided by the asset turnover ratio. - Identify the expected range and whether an increasing or decreasing trend is preferred. The asset turnover ratio compares net sales to total assets. This ratio evaluates how efficiently assets are used to produce net sales. It is one measure of sales volume. It is a measure of profitability. ASSET TURNOVER = Net sales Average total assets 1. Average total assets = [(beginning assets + ending assets)/2]. 12/31/98 assets are the ending assets of (1998/1999) and the beginning assets of (1998/1999). ($ in 000s) GAP INC GENERAL MOTORS (GM) HOME DEPOT ORACLE Net sales fye 1/30/99 $9.054,462 fye 12/31/98 $161,315,000 fye 1/31/99 $30,219,000 fye 5/31/99 $8,827,252 Total assets 1/30/99 $3,963,919 Total assets 1/30/98 $3,337,502 Source: Disclosure, Inc., Compact D/SEC, 2000. 5/31/99 $7,259,654 5/31/98 $5,819,011 2. For each company listed above, compute the average total assets for the most recent fiscal year. Record your results below (in 000s). 12/31/98 $257,389,000 1/31/99 $13,465,000 12/31/97 $231,752,000 1/31/98 $11,229,000 Average total assets: $ 3,650,711 S $ 3. For each company listed above, compute the asset turnover ratio. Record your results below. Asset turnover ratio: 2.48 4. The asset turnover ratios computed above are primarily in the range (less than 1/1 through 3 / more than 3). 5. The corporation with the strongest asset turnover ratio is (Gap Inc / GM/Home Depot / Oracle). 6. For the asset turnover ratio, an (increasing / decreasing) trend is favorable and indicates effective use of assets to produce net sales. 7. Home Depot makes profits by generating a large volume of sales on items with low prices. The asset turnover ratio is one measure of sales volume. Therefore, the asset turnover ratio for Home Depot is expected to be relatively (high/low). 8. Fortune Magazine rated (Gap Inc/GM/Home Depot / Oracle) Number 1, indicating it is the largest corporation in the United States. Introduction Page 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started