Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Activity base costing QUESTION 1 Art Wooden Furniture (AWF), is a manufacturing company that build factory-made wooden furniture. Budgeted manufacturing overhead costs for the year

Activity base costing

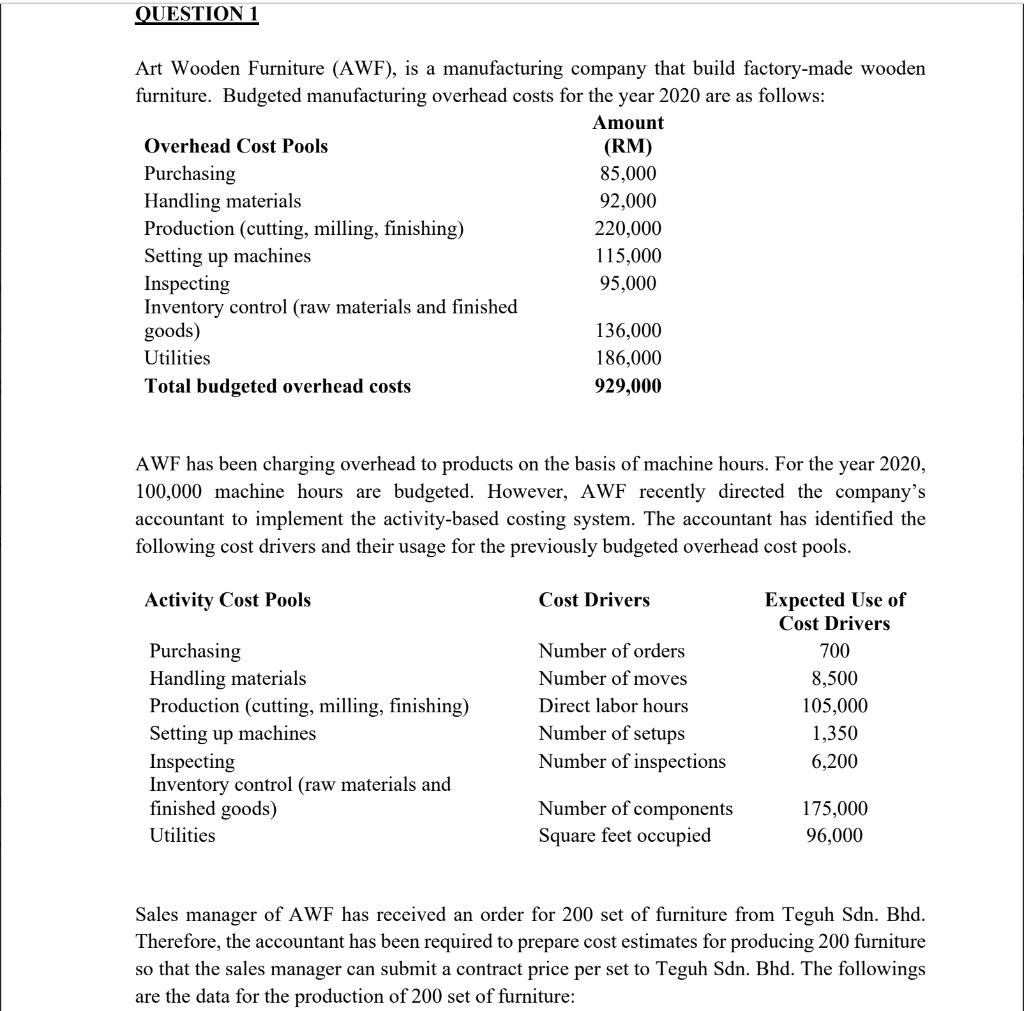

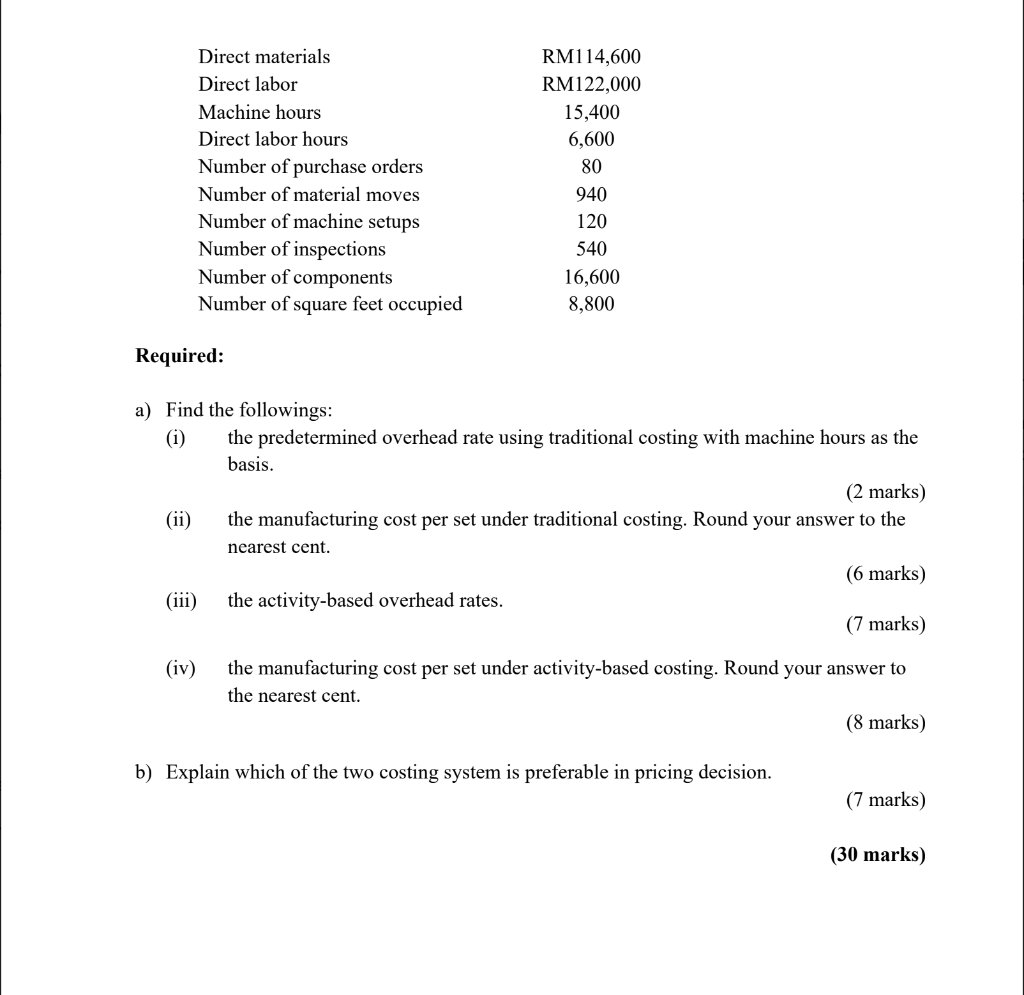

QUESTION 1 Art Wooden Furniture (AWF), is a manufacturing company that build factory-made wooden furniture. Budgeted manufacturing overhead costs for the year 2020 are as follows: Amount Overhead Cost Pools (RM) Purchasing 85,000 Handling materials 92,000 Production (cutting, milling, finishing) 220,000 Setting up machines 115,000 Inspecting 95,000 Inventory control (raw materials and finished goods) 136,000 Utilities 186,000 Total budgeted overhead costs 929,000 AWF has been charging overhead to products on the basis of machine hours. For the year 2020, 100,000 machine hours are budgeted. However, AWF recently directed the company's accountant to implement the activity-based costing system. The accountant has identified the following cost drivers and their usage for the previously budgeted overhead cost pools. Activity Cost Pools Cost Drivers Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Number of orders Number of moves Direct labor hours Number of setups Number of inspections Expected Use of Cost Drivers 700 8,500 105,000 1,350 6,200 Number of components Square feet occupied 175,000 96,000 Sales manager of AWF has received an order for 200 set of furniture from Teguh Sdn. Bhd. Therefore, the accountant has been required to prepare cost estimates for producing 200 furniture so that the sales manager can submit a contract price per set to Teguh Sdn. Bhd. The followings are the data for the production of 200 set of furniture: Direct materials Direct labor Machine hours Direct labor hours Number of purchase orders Number of material moves Number of machine setups Number of inspections Number of components Number of square feet occupied RM114,600 RM122,000 15,400 6,600 80 940 120 540 16,600 8,800 Required: a) Find the followings: (i) the predetermined overhead rate using traditional costing with machine hours as the basis. (2 marks) (ii) the manufacturing cost per set under traditional costing. Round your answer to the nearest cent. (6 marks) (iii) the activity-based overhead rates. (7 marks) (iv) the manufacturing cost per set under activity-based costing. Round your answer to the nearest cent. (8 marks) b) Explain which of the two costing system is preferable in pricing decision. (7 marks) (30 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started