Question: Activity Based Costing Case Background information about Tesla's factories from their website. Tesla's factory in Fremont, California is one of the world's most advanced

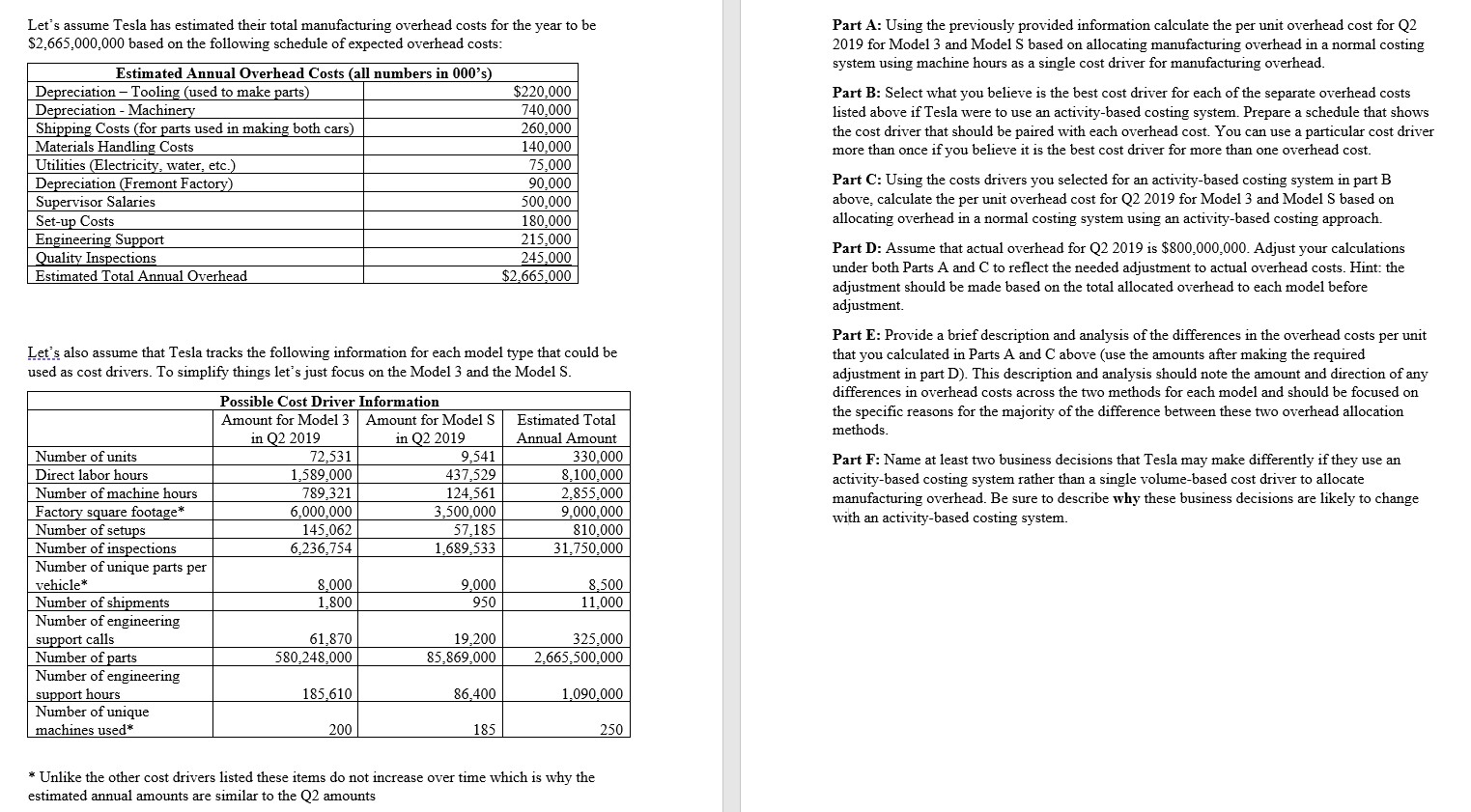

Activity Based Costing Case Background information about Tesla's factories from their website. "Tesla's factory in Fremont, California is one of the world's most advanced automotive plants, with 5.3 million square feet of manufacturing and office space on 370 acres of land. Today, more than 10,000 employees work at the Fremont factory. Prior to Tesla, the facility was home to General Motors from 1962 to 1982, then GM and Toyota's New United Motor Manufacturing, Inc (NUMMI) from 1984 until the partnership ended in 2009. Tesla purchased the facility in 2010 and extensively remodeled it before the first Model S rolled off the line in June 2012. As Tesla continues to deliver more and more vehicles to customers around the world, we always aim for the highest possible level of vehicle craftsmanship, with every Model S, Model X and Model 3 built in Fremont, where the vast majority of the vehicle's components are also made." VISITOR CENTER PAINT From Tesla's 2018 10-k: "Cost of automotive sales revenue includes direct parts, material and labor costs, manufacturing overhead, including depreciation costs of tooling and machinery, shipping and logistic costs, vehicle connectivity costs, allocations of electricity and infrastructure costs related to our Supercharger network, and reserves for estimated warranty expenses." Publicly disclosed vehicle production numbers from Tesla's Q2 2019 were as follows: Model 3 Model S/X Total Vehicle Production Numbers 72,531 14,517 87,048 From Tesla's public disclosures we can see that overhead allocation is likely very important to them. That is, because they currently make three different models of cars in the same factory, and these different models share some component parts that are also manufactured by Tesla (electric motors and battery packs), there will be many common costs that are not able to be directly traced to each type of model. We do not have information on exactly what overhead costs Tesla has or exactly how Tesla allocates overhead because these are not required financial disclosures. However, let's make some assumptions about their overhead costs and cost drivers and see how using activity-based costing techniques to allocate overhead versus using a single overhead rate might affect their overhead allocations and ultimately their business decisions. BODY ASSEMBLY PLASTICS STAMPING "To ramp production to 500,000 cars per year, Tesla alone will require today's entire worldwide supply of lithium-ion batteries. The Tesla Gigafactory was born out of necessity and will supply enough batteries to support Tesla's projected vehicle demand. Today, the Gigafactory produces Model 3 electric motors and battery packs, in addition to Tesla's energy storage Q ZOOM Let's assume Tesla has estimated their total manufacturing overhead costs for the year to be $2,665,000,000 based on the following schedule of expected overhead costs: Estimated Annual Overhead Costs (all numbers in 000's) Depreciation Machinery Materials Handling Costs Depreciation Tooling (used to make parts) Shipping Costs (for parts used in making both cars) Utilities (Electricity, water, etc.) Supervisor Salaries Set-up Costs Depreciation (Fremont Factory) Engineering Support Quality Inspections Estimated Total Annual Overhead $220,000 740,000 260,000 140,000 75,000 90,000 500,000 180,000 215,000 245,000 $2,665,000 Let's also assume that Tesla tracks the following information for each model type that could be used as cost drivers. To simplify things let's just focus on the Model 3 and the Model S. Number of units Direct labor hours Number of machine hours Factory square footage* Number of setups 1,589,000 789,321 in Q2 2019 Possible Cost Driver Information Amount for Model 3 Amount for Model S in Q2 2019 Estimated Total Annual Amount 72,531 9,541 437,529 330,000 8,100,000 124,561 2,855,000 6,000,000 3,500,000 9,000,000 145,062 57,185 810,000 Number of inspections 6,236,754 1,689,533 31,750,000 Number of unique parts per vehicle* 8,000 Number of shipments 1,800 9,000 950 8,500 11,000 Number of engineering support calls 61,870 Number of parts 580,248,000 19,200 85,869,000 325,000 2,665,500,000 Number of engineering support hours 185,610 86,400 1,090,000 Number of unique machines used* 200 185 250 Part A: Using the previously provided information calculate the per unit overhead cost for Q2 2019 for Model 3 and Model S based on allocating manufacturing overhead in a normal costing system using machine hours as a single cost driver for manufacturing overhead. Part B: Select what you believe is the best cost driver for each of the separate overhead costs listed above if Tesla were to use an activity-based costing system. Prepare a schedule that shows the cost driver that should be paired with each overhead cost. You can use a particular cost driver more than once if you believe it is the best cost driver for more than one overhead cost. Part C: Using the costs drivers you selected for an activity-based costing system in part B above, calculate the per unit overhead cost for Q2 2019 for Model 3 and Model S based on allocating overhead in a normal costing system using an activity-based costing approach. Part D: Assume that actual overhead for Q2 2019 is $800,000,000. Adjust your calculations under both Parts A and C to reflect the needed adjustment to actual overhead costs. Hint: the adjustment should be made based on the total allocated overhead to each model before adjustment. Part E: Provide a brief description and analysis of the differences in the overhead costs per unit that you calculated in Parts A and C above (use the amounts after making the required adjustment in part D). This description and analysis should note the amount and direction of any differences in overhead costs across the two methods for each model and should be focused on the specific reasons for the majority of the difference between these two overhead allocation methods. Part F: Name at least two business decisions that Tesla may make differently if they use an activity-based costing system rather than a single volume-based cost driver to allocate manufacturing overhead. Be sure to describe why these business decisions are likely to change with an activity-based costing system. * Unlike the other cost drivers listed these items do not increase over time which is why the estimated annual amounts are similar to the Q2 amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts