Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Activity Rates and Activity-Based Product Costing Hammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe

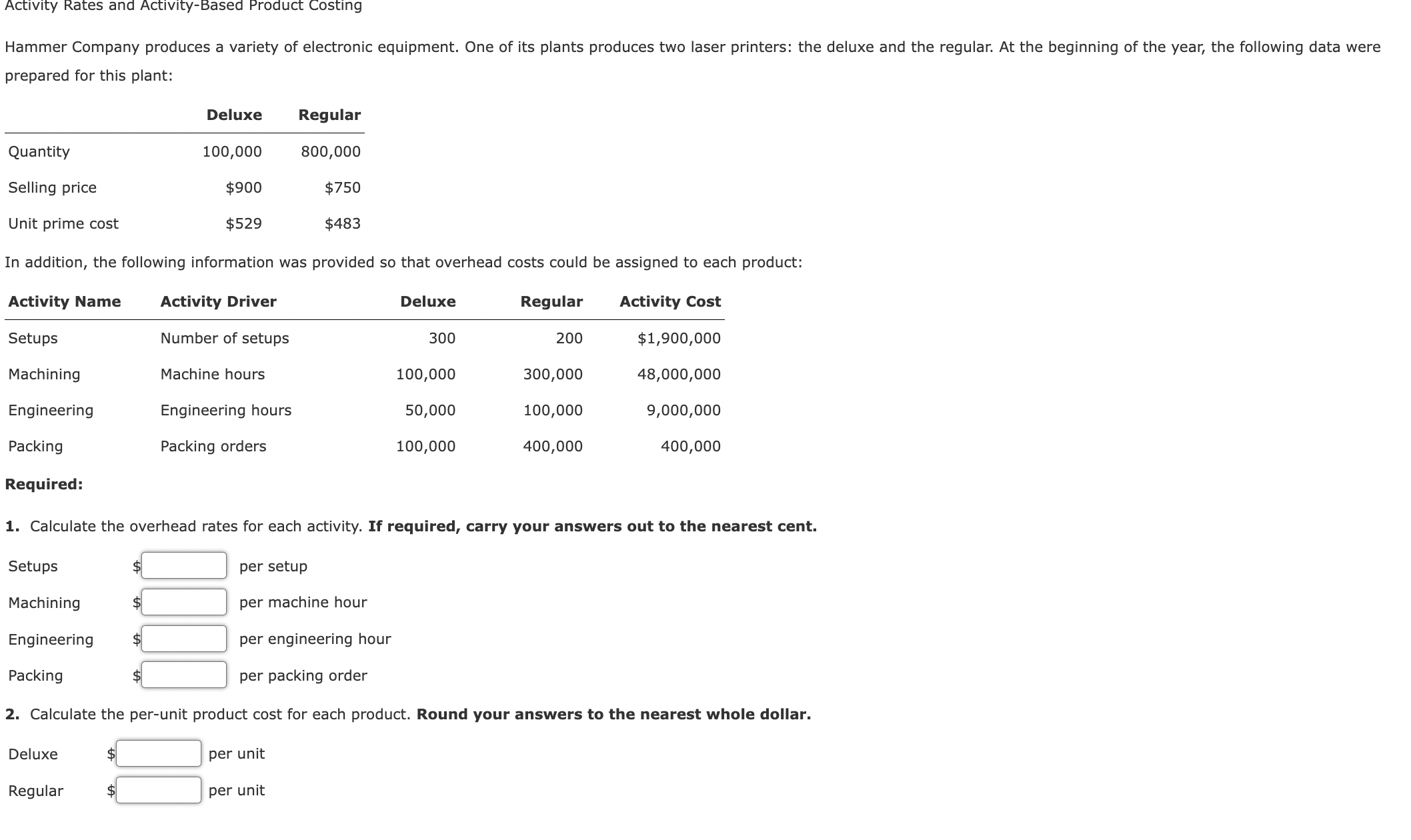

Activity Rates and Activity-Based Product Costing Hammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe and the regular. At the beginning of the year, the following data were prepared for this plant: Quantity Selling price Unit prime cost Deluxe Regular 100,000 800,000 $900 $750 $529 $483 In addition, the following information was provided so that overhead costs could be assigned to each product: Activity Name Activity Driver Deluxe Regular Activity Cost Setups Number of setups 300 200 $1,900,000 Machining Machine hours 100,000 300,000 48,000,000 Engineering Engineering hours 50,000 100,000 9,000,000 Packing Packing orders 100,000 400,000 400,000 Required: 1. Calculate the overhead rates for each activity. If required, carry your answers out to the nearest cent. Setups $ per setup Machining $ per machine hour Engineering $ per engineering hour Packing per packing order 2. Calculate the per-unit product cost for each product. Round your answers to the nearest whole dollar. Deluxe $ Regular per unit per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate the overhead rates for each activity Setups Overhead rate per setup Total cost for setups Total number of setups Overhead rate per setup 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started