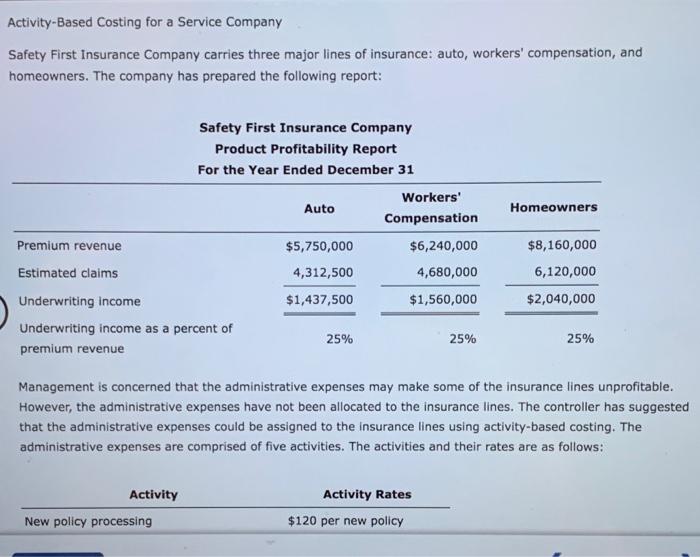

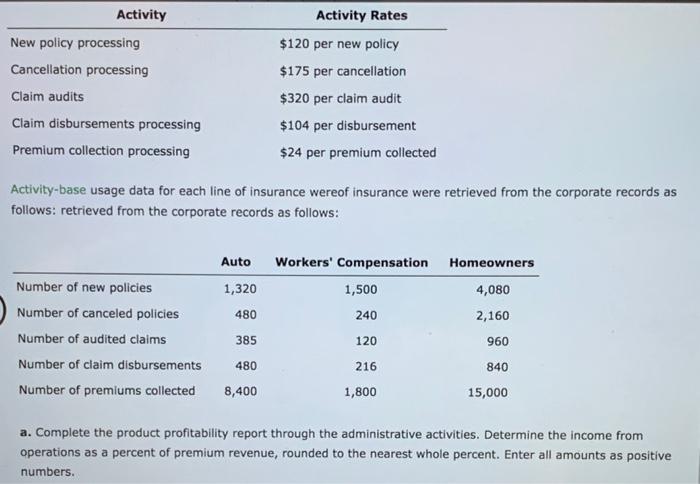

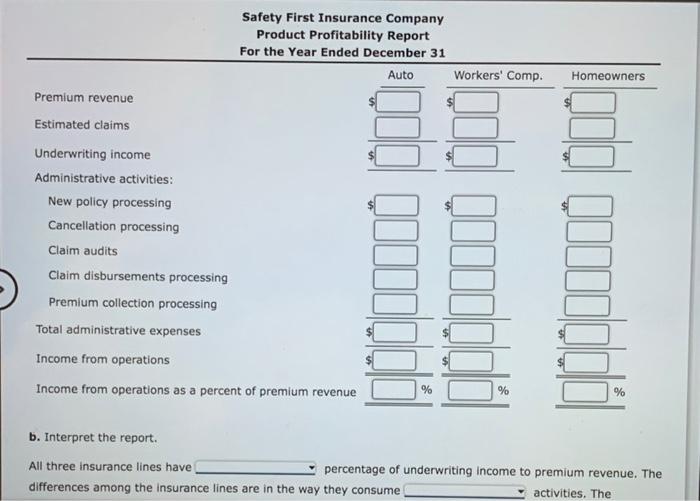

Activity-Based Costing for a Service Company Safety First Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report: Homeowners Safety First Insurance Company Product Profitability Report For the Year Ended December 31 Workers' Auto Compensation Premium revenue $5,750,000 $6,240,000 Estimated claims 4,312,500 4,680,000 Underwriting income $1,437,500 $1,560,000 Underwriting income as a percent of 25% 25% premium revenue $8,160,000 6,120,000 $2,040,000 25% Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity Activity Rates New policy processing $120 per new policy Activity New policy processing Cancellation processing Claim audits Claim disbursements processing Premium collection processing Activity Rates $120 per new policy $175 per cancellation $320 per claim audit $104 per disbursement $24 per premium collected Activity-base usage data for each line of insurance wereof insurance were retrieved from the corporate records as follows: retrieved from the corporate records as follows: Homeowners Auto 1,320 Workers' Compensation 1,500 4,080 480 240 2,160 Number of new policies Number of canceled policies Number of audited claims Number of claim disbursements Number of premiums collected 385 120 960 480 840 216 1,800 8,400 15,000 a. Complete the product profitability report through the administrative activities. Determine the income from operations as a percent of premium revenue, rounded to the nearest whole percent. Enter all amounts as positive numbers. Safety First Insurance Company Product Profitability Report For the Year Ended December 31 Auto Workers' Comp. Homeowners Premium revenue Estimated claims Underwriting income Administrative activities: New policy processing Cancellation processing Claim audits Claim disbursements processing Premium collection processing Total administrative expenses Income from operations Income from operations as a percent of premium revenue (Doottil % % b. Interpret the report. All three insurance lines have percentage of underwriting income to premium revenue. The differences among the insurance lines are in the way they consume activities. The b. Interpret the report. All three insurance lines have percentage of underwriting income to premium revenue. The differences among the insurance lines are in the way they consume activities. The insurance line has the profitability because it has and frequent claims that require more auditing and disbursement processing than do the other two lines. In addition, the Homeowners line has a much higher rate of cancellation relative to the other two lines (over 50% of new policies). Lastly, the Homeowners line has more premium collections compared to the other two lines. Possibly, the Homeowners line is collected in smaller amounts from more customers than the other two lines. In contrast, the line consumes the administrative activities, causing it to be very profitable. The Auto line is in between these two