Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Boats, Inc. makes luxury speed boats for water skiing. Actual results and the static budget for the year are presented below. Sales commissions

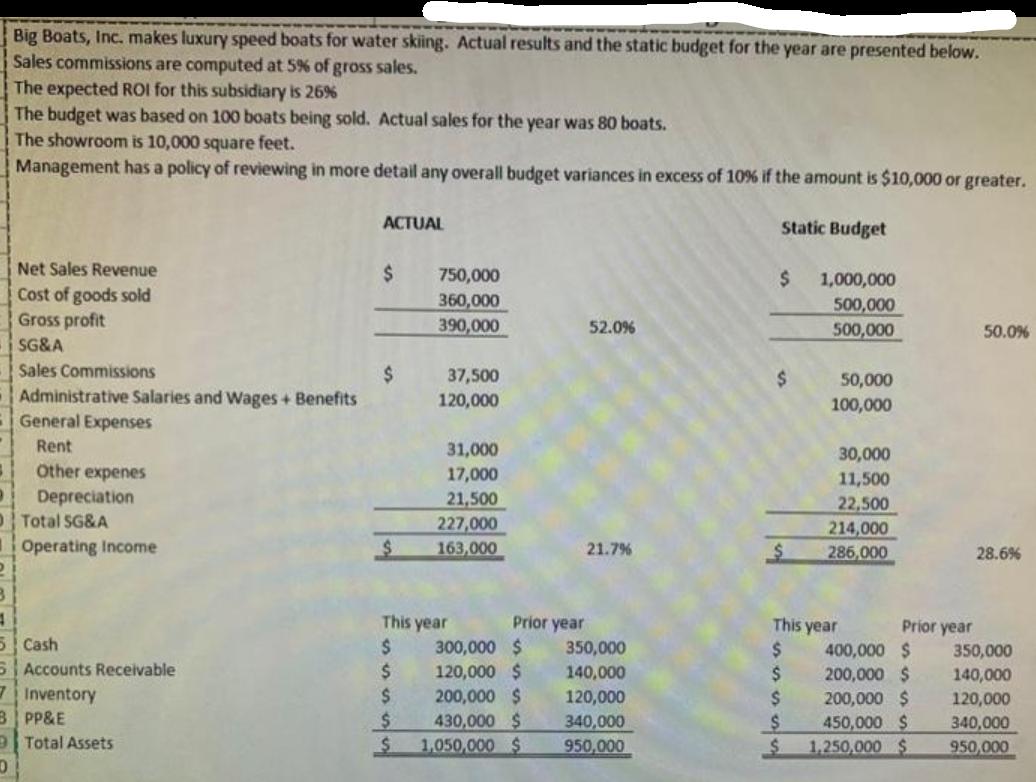

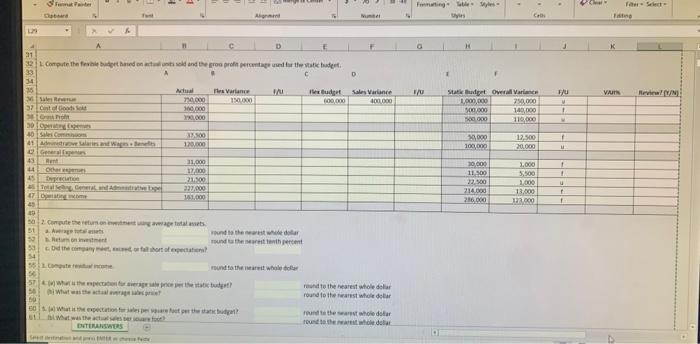

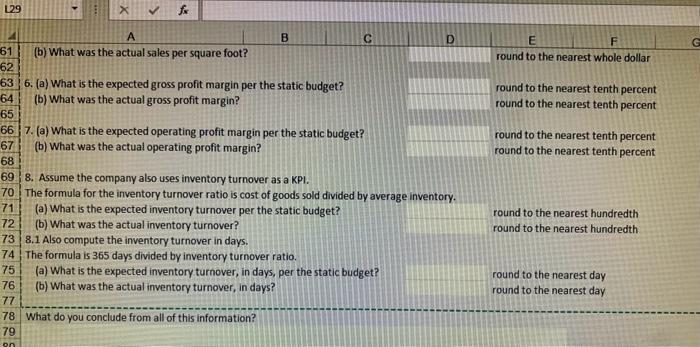

Big Boats, Inc. makes luxury speed boats for water skiing. Actual results and the static budget for the year are presented below. Sales commissions are computed at 5% of gross sales. The expected ROI for this subsidiary is 26% The budget was based on 100 boats being sold. Actual sales for the year was 80 boats. The showroom is 10,000 square feet. Management has a policy of reviewing in more detail any overall budget variances in excess of 10% if the amount is $10,000 or greater. ACTUAL Static Budget Net Sales Revenue $ 750,000 $ 1,000,000 Cost of goods sold 360,000 500,000 Gross profit 390,000 52.0% 500,000 50.0% SG&A Sales Commissions $ 37,500 $ 50,000 Administrative Salaries and Wages + Benefits 120,000 100,000 General Expenses Rent 31,000 30,000 Other expenes Depreciation Total SG&A 17,000 11,500 21,500 22,500 227,000 214,000 Operating Income $ 163,000 21.7% $ 286,000 28.6% This year Prior year This year Prior year 5 Cash $ 300,000 $ 350,000 $ 400,000 $ 350,000 5 Accounts Receivable $ 120,000 $ 140,000 $ 200,000 $ 140,000 Inventory $ 200,000 $ 120,000 $ 200,000 $ 120,000 3 PP&E $ 430,000 $ 340,000 $ 450,000 $ 340,000 Total Assets $ 1,050,000 $ 950,000 $ 1,250,000 $ 950,000 0 129 D 31 321 Compute the fexible budget based on actual units sold and the groo profit percentage used for the static budget. 34 Actual Fes Variance 36 Sales Revenue 37 Cost of Goods Sold Po 750,000 150,000 360,000 190,000 30 Operating Expe 40 Sales Comom 33,500 41 Administrave salaries and Wages Benefits 120,000 42 General genes 43 Rent 31,000 44 Other expenses 17,000 45 21.300 227,000 141,000 Fomating Table Styles H Fiber-Select- c D es Budget 600,000 Sales Variance 400,000 1/0 Static Budget Overall Variance F/U VAN Review(Y/N) 1,000,000 250,000 M 500,000 140,000 1 500,000 110,000 M 50,000 12,500 f 100,000 20,000 M 30,000 1,000 11.500 5500 22,500 1,000 u 214.000 13,000 f 286,000 123,000 1 47 Operating come 49 502 Compute the return on investment using average total assets 51 Return on investment c. Did the company meet, sed or fall short of expectations? 3.Compute reali round to the nearest tenth percent round to the nearest whole dollar round to the nearest whole dollar round to the nearest whole dollar 574) What the expectation for average sale price per the static budg 50 hi What was the actual average sales pr 60 ja) What is the expectation for sales per square foot per the static bud What was the actual sales ser souare foot ENTERANSWERS round to the nearest whole dollar round to the nearest whole dollar 129 61 62 228321 A fx (b) What was the actual sales per square foot? B C D 63 6. (a) What is the expected gross profit margin per the static budget? 64 65 (b) What was the actual gross profit margin? 66 7. (a) What is the expected operating profit margin per the static budget? 67 68 (b) What was the actual operating profit margin? 69 8. Assume the company also uses inventory turnover as a KPI. 70 The formula for the inventory turnover ratio is cost of goods sold divided by average inventory. E F round to the nearest whole dollar round to the nearest tenth percent round to the nearest tenth percent round to the nearest tenth percent round to the nearest tenth percent round to the nearest hundredth round to the nearest hundredth 71 (a) What is the expected inventory turnover per the static budget? 72 (b) What was the actual inventory turnover? 73 8.1 Also compute the inventory turnover in days. 74 The formula is 365 days divided by inventory turnover ratio. 75 (a) What is the expected inventory turnover, in days, per the static budget? round to the nearest day 76 (b) What was the actual inventory turnover, in days? round to the nearest day 77 78 What do you conclude from all of this information? 79 G

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the answers to the multiplechoice quest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started