Answered step by step

Verified Expert Solution

Question

1 Approved Answer

actuarial notation 2. A 45-year old was issued a deferred life annuity with the following conditions: (i) Deferred period: 20 years. Level premiums to be

actuarial notation

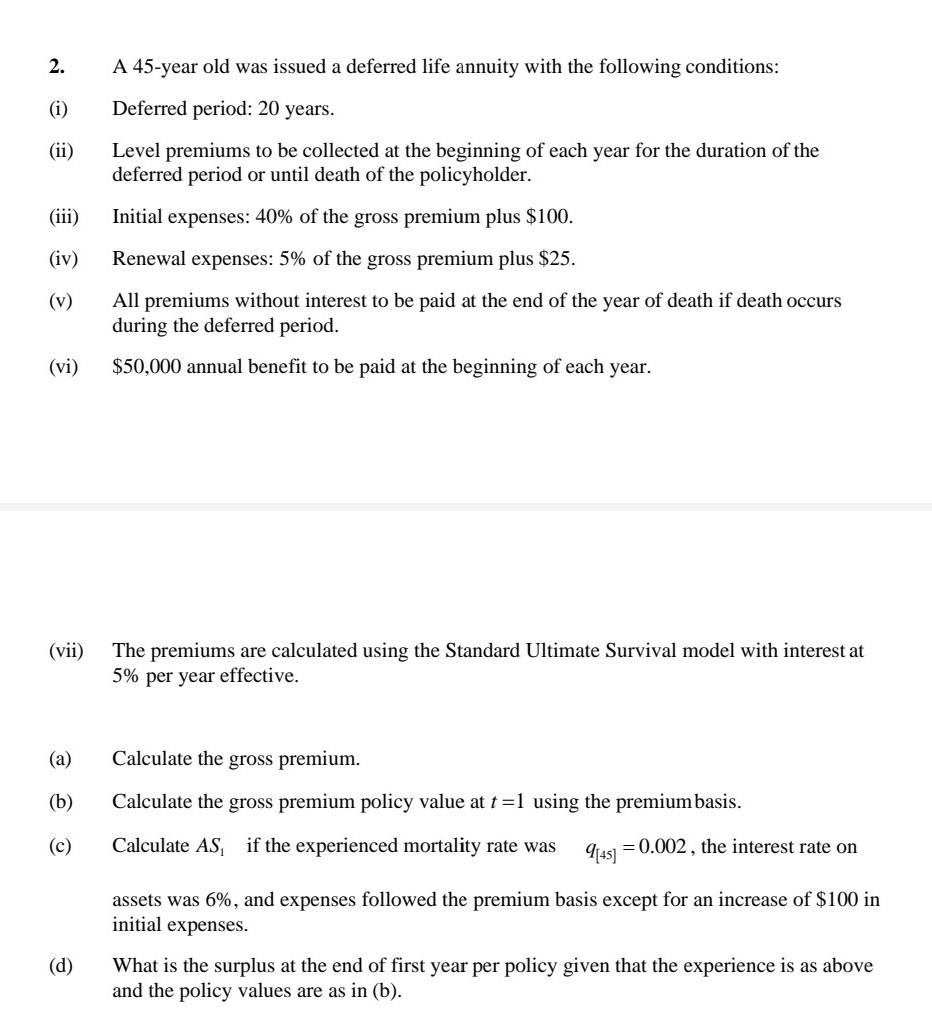

2. A 45-year old was issued a deferred life annuity with the following conditions: (i) Deferred period: 20 years. Level premiums to be collected at the beginning of each year for the duration of the deferred period or until death of the policyholder. Initial expenses: 40% of the gross premium plus $100. (iv) Renewal expenses: 5% of the gross premium plus $25. (v) All premiums without interest to be paid at the end of the year of death if death occurs during the deferred period. $50,000 annual benefit to be paid at the beginning of each year. (vi) (vii) The premiums are calculated using the Standard Ultimate Survival model with interest at 5% per year effective. (a) Calculate the gross premium. (b) Calculate the gross premium policy value at t=1 using the premium basis. Calculate AS, if the experienced mortality rate was 9145] = 0.002, the interest rate on assets was 6%, and expenses followed the premium basis except for an increase of $100 in initial expenses. What is the surplus at the end of first year per policy given that the experience is as above and the policy values are as in (b). 2. A 45-year old was issued a deferred life annuity with the following conditions: (i) Deferred period: 20 years. Level premiums to be collected at the beginning of each year for the duration of the deferred period or until death of the policyholder. Initial expenses: 40% of the gross premium plus $100. (iv) Renewal expenses: 5% of the gross premium plus $25. (v) All premiums without interest to be paid at the end of the year of death if death occurs during the deferred period. $50,000 annual benefit to be paid at the beginning of each year. (vi) (vii) The premiums are calculated using the Standard Ultimate Survival model with interest at 5% per year effective. (a) Calculate the gross premium. (b) Calculate the gross premium policy value at t=1 using the premium basis. Calculate AS, if the experienced mortality rate was 9145] = 0.002, the interest rate on assets was 6%, and expenses followed the premium basis except for an increase of $100 in initial expenses. What is the surplus at the end of first year per policy given that the experience is as above and the policy values are as in (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started