Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Actuarial Services Limited has its own defined benefit plan. During the year, the company accountant retired, and you were hired to replace her. However, you

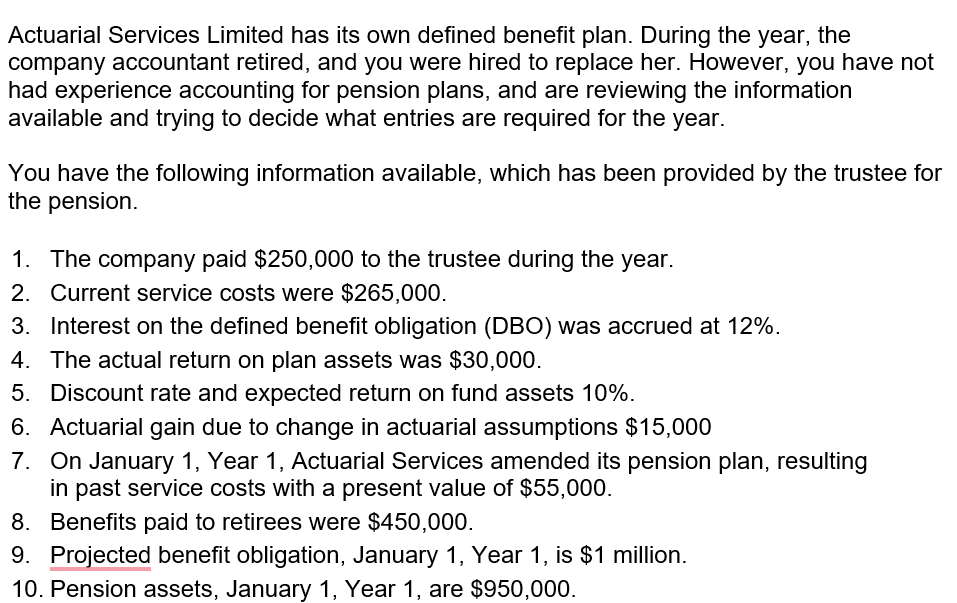

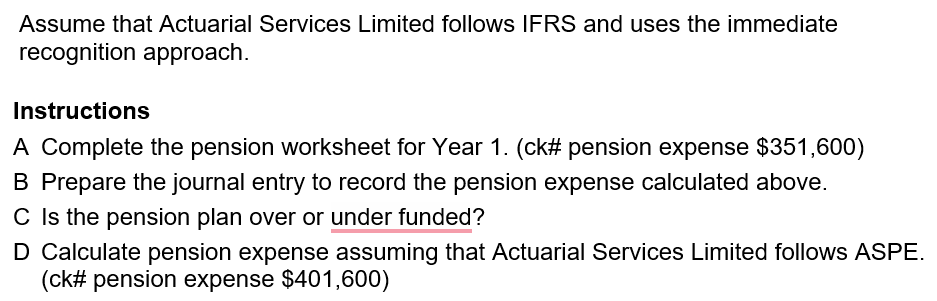

Actuarial Services Limited has its own defined benefit plan. During the year, the company accountant retired, and you were hired to replace her. However, you have not had experience accounting for pension plans, and are reviewing the information available and trying to decide what entries are required for the year. You have the following information available, which has been provided by the trustee for the pension. 1. The company paid $250,000 to the trustee during the year. 2. Current service costs were $265,000. 3. Interest on the defined benefit obligation (DBO) was accrued at 12%. 4. The actual return on plan assets was $30,000. 5. Discount rate and expected return on fund assets 10%. 6. Actuarial gain due to change in actuarial assumptions $15,000 7. On January 1, Year 1, Actuarial Services amended its pension plan, resulting in past service costs with a present value of $55,000. 8. Benefits paid to retirees were $450,000. 9. Projected benefit obligation, January 1 , Year 1 , is $1 million. Assume that Actuarial Services Limited follows IFRS and uses the immediate recognition approach. Instructions A Complete the pension worksheet for Year 1. (ck\# pension expense $351,600 ) B Prepare the journal entry to record the pension expense calculated above. C Is the pension plan over or under funded? Calculate pension expense assuming that Actuarial Services Limited follows ASP (ck\# pension expense $401,600 )

Actuarial Services Limited has its own defined benefit plan. During the year, the company accountant retired, and you were hired to replace her. However, you have not had experience accounting for pension plans, and are reviewing the information available and trying to decide what entries are required for the year. You have the following information available, which has been provided by the trustee for the pension. 1. The company paid $250,000 to the trustee during the year. 2. Current service costs were $265,000. 3. Interest on the defined benefit obligation (DBO) was accrued at 12%. 4. The actual return on plan assets was $30,000. 5. Discount rate and expected return on fund assets 10%. 6. Actuarial gain due to change in actuarial assumptions $15,000 7. On January 1, Year 1, Actuarial Services amended its pension plan, resulting in past service costs with a present value of $55,000. 8. Benefits paid to retirees were $450,000. 9. Projected benefit obligation, January 1 , Year 1 , is $1 million. Assume that Actuarial Services Limited follows IFRS and uses the immediate recognition approach. Instructions A Complete the pension worksheet for Year 1. (ck\# pension expense $351,600 ) B Prepare the journal entry to record the pension expense calculated above. C Is the pension plan over or under funded? Calculate pension expense assuming that Actuarial Services Limited follows ASP (ck\# pension expense $401,600 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started