Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Actuary problem. I provided the answer, please help me to get the answer process. i need no.4. 2. You are told that the one-year spot

Actuary problem. I provided the answer, please help me to get the answer process. i need no.4.

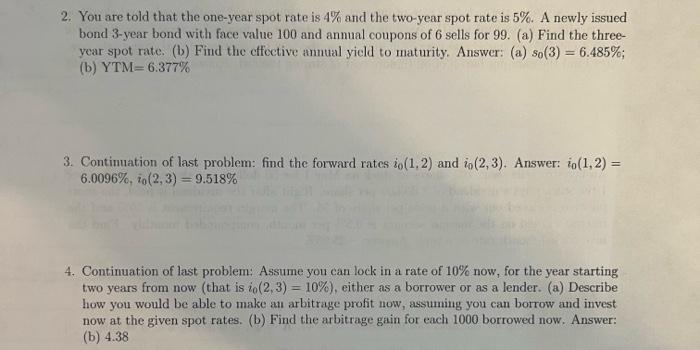

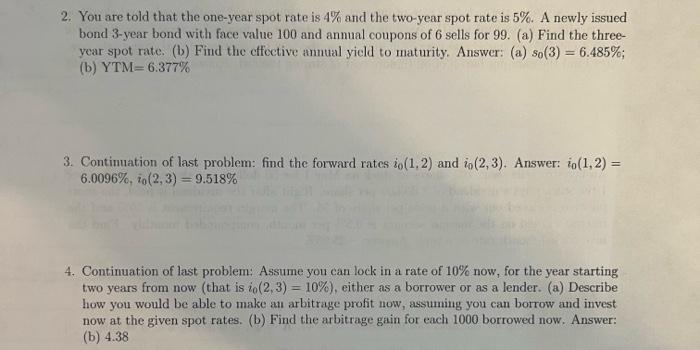

2. You are told that the one-year spot rate is 4% and the two-year spot rate is 5%. A newly issued bond 3-year bond with face value 100 and annual coupons of 6 sells for 99. (a) Find the three- year spot rate. () Find the cffective annual yield to maturity. Answer: (a) so(3) = 6.485%; (b) YTM=6.377% 3. Continuation of last problem: find the forward rates io(1.2) and 1(2,3). Answer: 1o(1,2) = 6.0096%, 10(2,3)=9.518% 4. Continuation of last problem: Assume you can lock in a rate of 10% now, for the year starting two years from now (that is io(2,3) = 10%), either as a borrower or as a lender. (a) Describe how you would be able to make an arbitrage profit now, assuming you can borrow and invest now at the given spot rates. (b) Find the arbitrage gain for each 1000 borrowed now. Answer: (b) 4.38 2. You are told that the one-year spot rate is 4% and the two-year spot rate is 5%. A newly issued bond 3-year bond with face value 100 and annual coupons of 6 sells for 99. (a) Find the three- year spot rate. () Find the cffective annual yield to maturity. Answer: (a) so(3) = 6.485%; (b) YTM=6.377% 3. Continuation of last problem: find the forward rates io(1.2) and 1(2,3). Answer: 1o(1,2) = 6.0096%, 10(2,3)=9.518% 4. Continuation of last problem: Assume you can lock in a rate of 10% now, for the year starting two years from now (that is io(2,3) = 10%), either as a borrower or as a lender. (a) Describe how you would be able to make an arbitrage profit now, assuming you can borrow and invest now at the given spot rates. (b) Find the arbitrage gain for each 1000 borrowed now. Answer: (b) 4.38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started