Question

ACUSHNET CANADA INC.: THE BONDED WAREHOUSE INITIATIVE1 1 Inspired by ACUSHNET CANADA INC.: THE BONDED WAREHOUSE INITIATIVE in Ivey Management Services, authorized for use in

ACUSHNET CANADA INC.: THE BONDED WAREHOUSE INITIATIVE1

1 Inspired by “ACUSHNET CANADA INC.: THE BONDED WAREHOUSE INITIATIVE” in Ivey Management Services, authorized for use in University of Colorado Boulder BUSM 3021- Spring 2020.

2 All rankings are in terms of revenues. Source: Fortune Brands 2004 annual report

First, read the background about ACI company, then read the problem definition thoroughly and answer the questions according to it.

BACKGROUND

Fortune Brands was a leading consumer brands company, with 2004 sales exceeding US$7 billion. Fortune Brands’ strategy focused on developing market-leading consumer brands amongst four attractive consumer categories: home and hardware, spirits and wine, golf equipment, and office products. Its strategy focused on the strength of its brands: more than 90 percent of its revenues came from No. 1 or No. 2 market positions. Fortune Brands’ goal was to have double digit earnings growth year over year.

The golf equipment category was controlled by Acushnet Company, a subsidiary of Fortune Brands. Acushnet Company was comprised of the Titleist (No. 1 golf ball worldwide and No. 2 golf clubs in the United States), FootJoy (No. 1 golf shoes worldwide, No. 1 golf gloves worldwide and No. 1 golf2 outerwear in the United States), Cobra, and Pinnacle golf brands. Acushnet Canada Inc. (ACI), located in Newmarket, Ontario, was a subsidiary of Acushnet Company and functioned as an independent company. ACI relied on Acushnet Company for the majority of its product development, and ACI’s locally developed products required Acushnet Company approval. Pricing and sales programs were developed by ACI, independent of Acushnet Company; however, ACI did not traditionally stray too far. Fortune Brands’ golf equipment sales exceeded US$1.2 billion in 2004.

Sales of golf products experienced large seasonal fluctuations and peaked in the months leading up to the golfing season. ACI secured relationships with small overseas manufacturers for the manufacturing of golf shoes, gloves, outerwear, and club heads. ACI’s manufacturing requirements often filled their suppliers’ entire capacity. The small size of their suppliers did not allow ACI to take advantage of just-in-time purchasing. In fact, ACI often had to procure inventory four to six months before it was needed in order to ensure that the company would be able to meet customer requirements during the busy season.

Procuring inventory four to six months ahead had negative effects on cash flow. Besides the cost of the goods themselves, ACI paid duties of five percent to 19 percent when Canada Customs cleared the goods.

CANADA CUSTOMS BONDED WAREHOUSES

The Canada Border Services Agency (CBSA) implemented Canada Customs Bonded Warehouses (CCBWs) in 1997. CCBWs were licensed and regulated facilities operated privately where goods could be stored duty-free and tax-free until they were exported or consumed domestically. The time limit for storage was four years. For example, ACI could import Cdn$500,000 of golf shoes in January that they didn’t need until May, and delay the 19 percent duty cost for four months before clearing the goods. This allowed ACI to free up cash to reinvest back into their strong golf brands and into growth opportunities. Perkins commented that ACI was looking to earn 13 percent on capital employed. Perkins thought that a reasonable goal would be to use CCBW to maximize cash flow savings.

Problem Definition

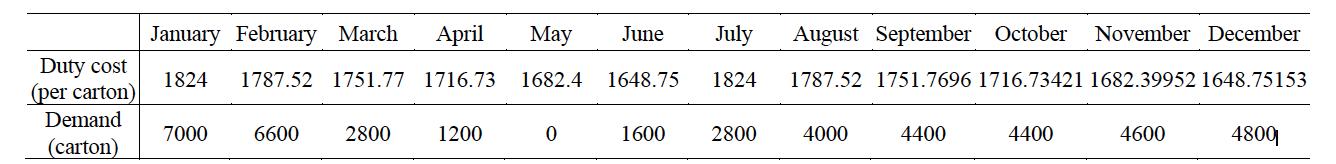

ACI has decided to put an order for golf shoes twice every year and expects to receive one shipment of 960 pallets of shoes by the beginning of January and another shipment of 1250 pallets of shoes by July. Each pallet contains 20 cartons of shoes. Upon arrival to Canada, CBSA takes custody of the shoes. The company should decide how many cartons of shoes to release each month from Customs to supply all their demand while maintaining the lowest cost. For the number of shoes that are released from Customs, the company needs to pay their duty cost. Because of the time value of money, it costs the company more to clear the shoes sooner than it does to release them later. So, the company might decide to delay releasing some of the shoes by a few months. All the shoes however should be released by the end of December. If we consider the value of shoes, the 19 percent duty cost, and the company’s goal to return 13 percent on their investment, the cost of releasing one carton in each month along with the expected amount of demand for each month is listed in the table. Note that the duty cost and the return rate are already considered and you do not need to account for them.

The company can choose to delay releasing some of the shoes and keep them in the CBSA storage facilities. In this case, the company will not have to pay duty until the time the shoes are released but will have to pay $0.36 per month for each carton that is being held in the storage facilities.

- a) Formulate a linear programming model for the problem that minimizes the company’s overall cost. Define the three linear programming elements of the model and write down the formulation.

- b) Write the model in Excel using color-coded and clearly-defined cells, then solve the model using an Excel solver.

- c) Observe the solutions, and very briefly describe your observations. This can include a brief description of what the company should do in plain words.

- d) Now, assume that CBSA storage facilities will not store more than 4000 cartons at a time. The company, however, has an internal storage capacity that can store the rest of the shoes that are not sold and are already released from Customs. There is a $0.1 cost for storing one carton of shoes for one month internally. Note that in order for the company to store the shoes in the internal storage facilities, the shoes must have been released (i.e. the duty cost must have been paid). Write a linear programming model for this problem.

- e) Write the model described in c in Excel and use Excel Solver to solve it.

- f) Describe your observations from the solutions.

Duty cost (per carton) Demand (carton) January February March 1824 April 1787.52 1751.77 1716.73 1682.4 1648.75 7000 6600 2800 1200 May June July 1824 0 1600 2800 August September October November December 1787.52 1751.7696 1716.73421 1682.39952 1648.75153 4000 4400 4400 4600 4800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Linear Programming Model Formulation Lets define the decision variables as follows x Number of cartons of shoes released in January x Number of cartons of shoes released in February x Number of cart...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started