Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam Au-Yeung, the husband, is 38 years old and is employed by a Canadian public company. Adam's spouse, Annie Au-Yeung, 40 years old and

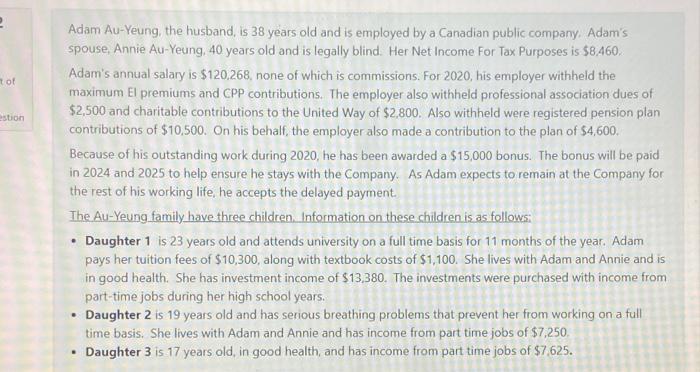

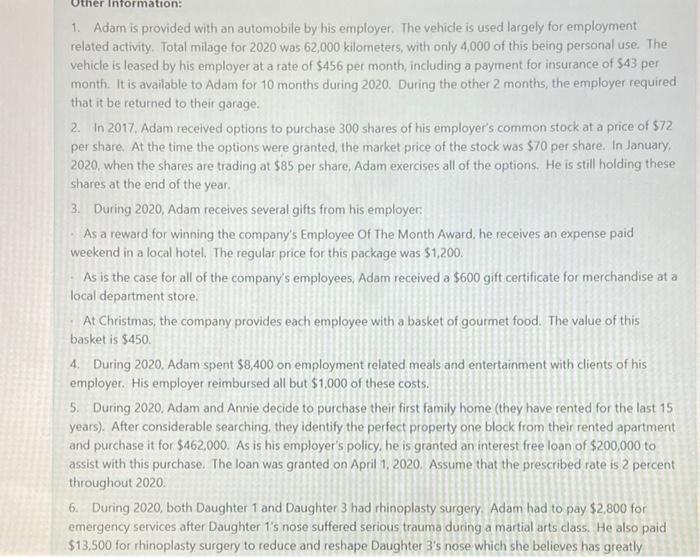

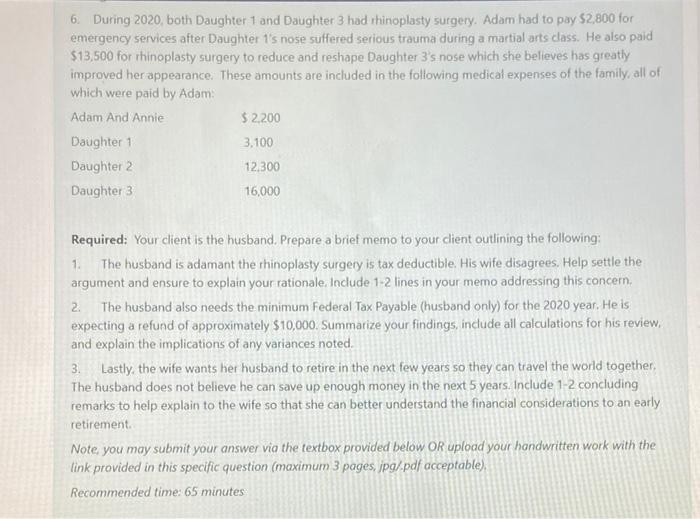

Adam Au-Yeung, the husband, is 38 years old and is employed by a Canadian public company. Adam's spouse, Annie Au-Yeung, 40 years old and is legally blind. Her Net Income For Tax Purposes is $8,460. Adam's annual salary is $120,268, none of which is commissions. For 2020, his employer withheld the maximum El premiums and CPP contributions. The employer also withheld professional association dues of $2,500 and charitable contributions to the United Way of $2.800. Also withheld were registered pension plan contributions of $10,500. On his behalf, the employer also made a contribution to the plan of $4,600. tof estion Because of his outstanding work during 2020, he has been awarded a $15,000 bonus. The bonus will be paid in 2024 and 2025 to help ensure he stays with the Company. As Adam expects to remain at the Company for the rest of his working life, he accepts the delayed payment. The Au-Yeung family have three children. Information on these children is as follows: Daughter 1 is 23 years old and attends university on a full time basis for 11 months of the year. Adam pays her tuition fees of $10,300, along with textbook costs of $1,100. She lives with Adam and Annie and is in good health. She has investment income of $13,380. The investments were purchased with income from part-time jobs during her high school years. Daughter 2 is 19 years old and has serious breathing problems that prevent her from working on a full time basis. She lives with Adam and Annie and has income from part time jobs of $7,250. Daughter 3 is 17 years old, in good health, and has income from part time jobs of $7.625. Information: 1. Adam is provided with an automobile by his employer. The vehicle is used largely for employment related activity. Total milage for 2020 was 62,000 kilometers, with only 4,000 of this being personal use. The vehicle is leased by his emplayer at a rate of $456 per month, including a payment for insurance of $43 per month. It is available to Adam for 10 months during 2020. During the other 2 months, the employer required that it be returned to their garage. 2. In 2017, Adam received options to purchase 300 shares of his employer's common stock at a price of $72 per share. At the time the options were granted, the market price of the stock was $70 per share. In January, 2020, when the shares are trading at $85 per share, Adam exercises all of the options. He is still holding these shares at the end of the year. 3. During 2020, Adam receives several gifts from his employer: As a reward for winning the company's Employee Of The Month Award, he receives an expense paid weekend in a local hotel. The regular price for this package was $1,200. As is the case for all of the company's employees, Adam received a $600 gift certificate for merchandise at a local department store. At Christmas, the company provides each employee with a basket of gourmet food. The value of this basket is $450. 4. During 2020, Adam spent $8,400 on employment related meals and entertainment with clients of his employer. His employer reimbursed all but $1,000 of these costs. 5. During 2020. Adam and Annie decide to purchase their first family home (they have rented for the last 15 years). After considerable searching, they identify the perfect property one block from their rented apartment and purchase it for $462,000. As is his employer's policy. he is granted an interest free loan of $200,000 to assist with this purchase. The loan was granted on April 1, 2020. Assume that the prescribed rate is 2 percent throughout 2020. 6. During 2020, both Daughter 1 and Daughter 3 had rhinoplasty surgery. Adam had to pay $2,800 for emergency services after Daughter 1's nose suffered serious trauma during a martial arts class. He also paid $13,500 for rhinoplasty surgery to reduce and reshape Daughter 3's nose which she believes has greatly 6. During 2020, both Daughter 1 and Daughter 3 had rhinoplasty surgery. Adam had to pay $2,800 for emergency services after Daughter 1's nose suffered serious trauma during a martial arts class. He also paid $13,500 for rhinoplasty surgery to reduce and reshape Daughter 3's nose which she believes has greatly improved her appearance. These amounts are included in the following medical expenses of the family, all of which were paid by Adam: Adam And Annie $2,200 Daughter 1 3.100 Daughter 2 12,300 Daughter 3 16,000 Required: Your client is the husband. Prepare a brief memo to your client outlining the following: The husband is adamant the rhinoplasty surgery is tax deductible. His wife disagrees. Help settle the argument and ensure to explain your rationale. Include 1-2 lines in your memo addressing this concern. 1. The husband also needs the minimum Federal Tax Payable (husband only) for the 2020 year. He is expecting a refund of approximately $10,000. Summarize your findings, include all calculations for his review, and explain the implications of any variances noted. 2. 3. Lastly, the wife wants her husband to retire in the next few years so they can travel the world together, The husband does not believe he can save up enough money in the next 5 years. Include 1-2 concluding remarks to help explain to the wife so that she can better understand the financial considerations to an early retirement. Note, you may submit your answer via the textbox provided below OR upload your handwritten work with the link provided in this specific question (maximum 3 pages, jpg/,pdf acceptable), Recommended time: 65 minutes

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 To Adam AuYeung From Your Name Date 19 August 2021 SubjectRegarding the argument with your wife on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started