Question

Adam, Banie and Saiful are partners sharing profit and losses in the ration 3:2:1 respectively. It was agreed between them that each partner will receive

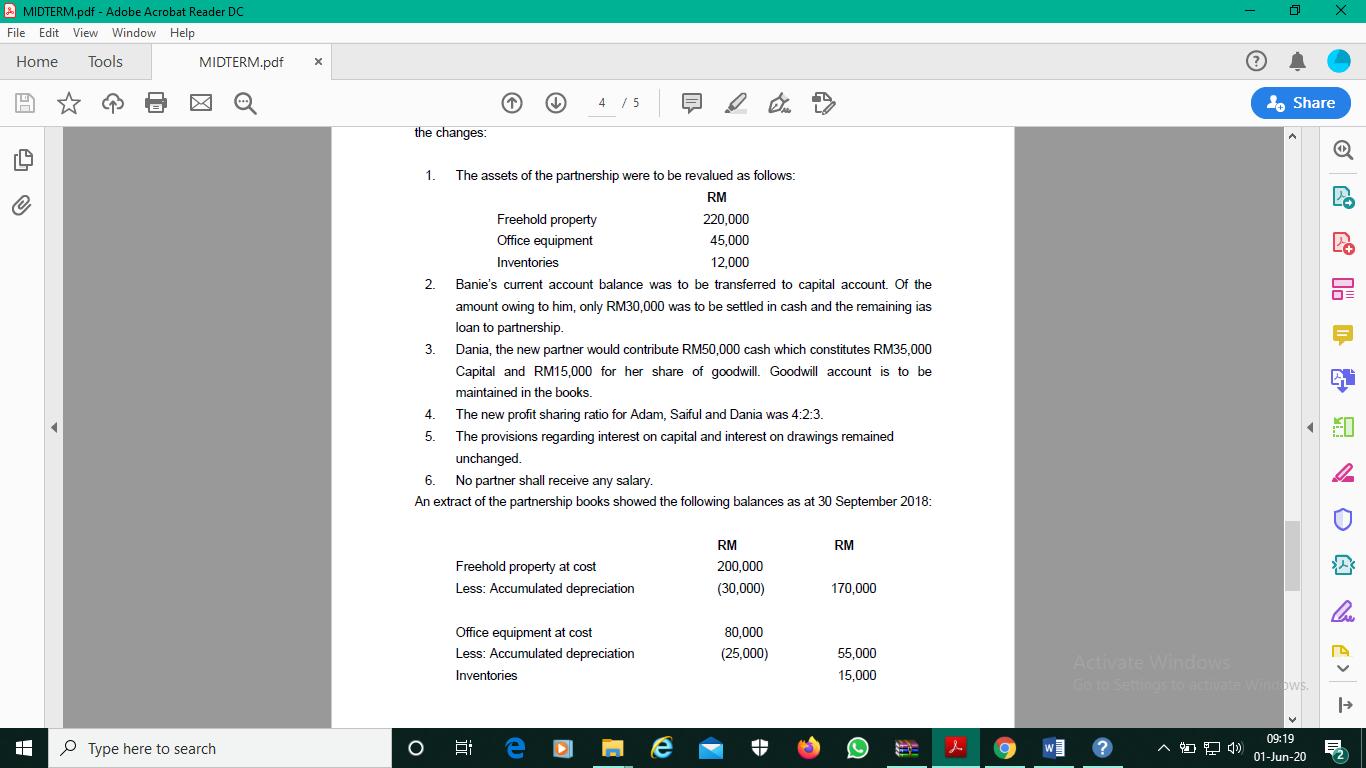

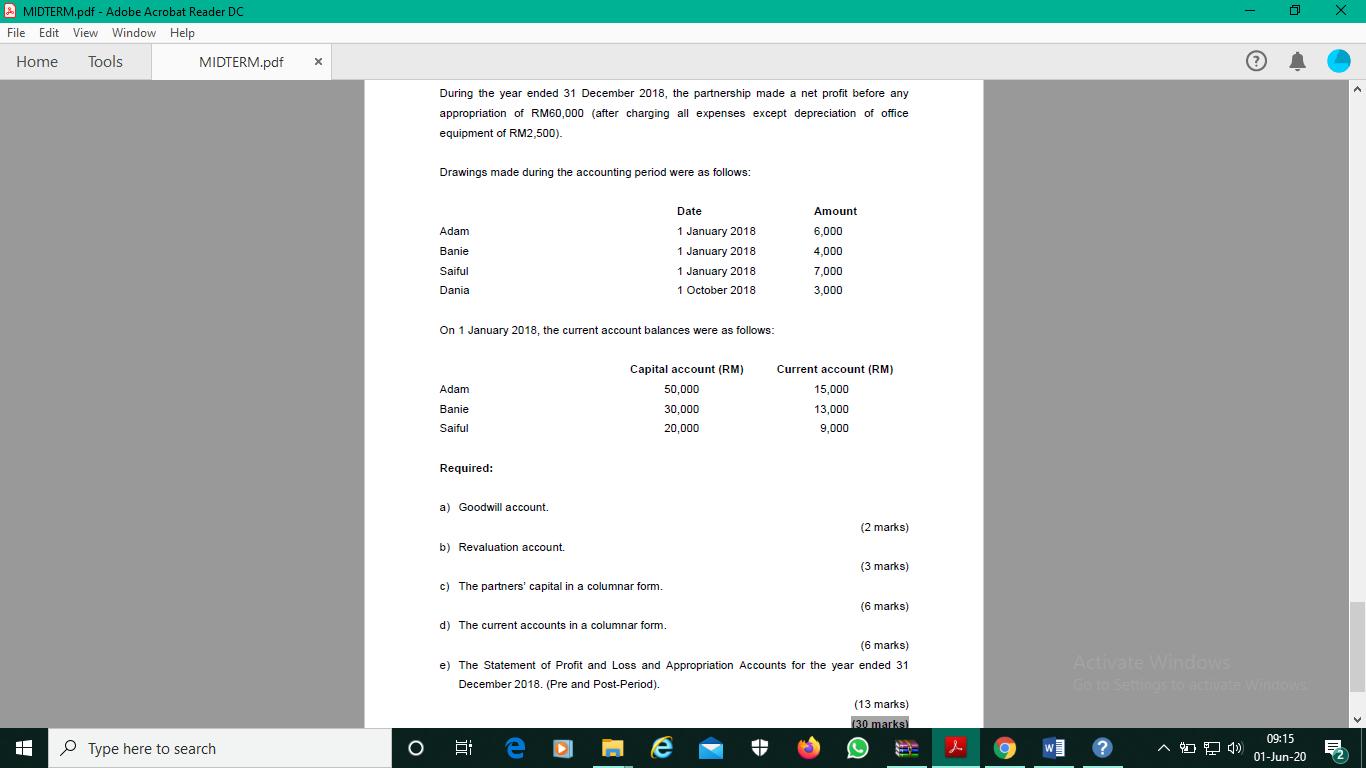

Adam, Banie and Saiful are partners sharing profit and losses in the ration 3:2:1 respectively. It was agreed between them that each partner will receive an interest on beginning capital balance of 10% per annum and will be charged interest on drawings at 6% per annum. As an active partner Saiful is to be paid monthly salary of RM1,800. The accounting period for the business ends at 31 December each year. On 30 September 2018, Banie decided to leave the partnership due to ill-health. A new partner, Dania was admitted into the partnership. The following terms were agreed upon with the changes:

Required:

a) Goodwill account.

b) Revaluation account.

c) The partners’ capital in a columnar form.

d) The current accounts in a columnar form.

e) The Statement of Profit and Loss and Appropriation Accounts for the year ended 31 December 2018. (Pre and Post-Period).

MIDTERM.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools @ A MIDTERM.pdf Type here to search X the changes: 1. O 2. 3. 4. 5. The assets of the partnership were to be revalued as follows: RM 220,000 45,000 12,000 Freehold property Office equipment The new profit sharing ratio for Adam, Saiful and Dania was 4:2:3. The provisions regarding interest on capital and interest on drawings remained unchanged. 6. No partner shall receive any salary. An extract of the partnership books showed the following balances as at 30 September 2018: 4 / 5 Inventories Banie's current account balance was to be transferred to capital account. Of the amount owing to him, only RM30,000 was to be settled in cash and the remaining ias loan to partnership. Dania, the new partner would contribute RM50,000 cash which constitutes RM35,000 Capital and RM15,000 for her share of goodwill. Goodwill account is to be maintained in the books. Freehold property at cost Less: Accumulated depreciation jo Office equipment at cost Less: Accumulated depreciation Inventories e e RM 200,000 (30,000) 80,000 (25,000) RM 170,000 55,000 15,000 Q B d O 0 - Activate Windows Go to Settings to activate Windows. X o Share 09:19 01-Jun-20 Q DA V Cu A>

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Goodwill account Partners Capital RM Adam 50000 Banie 30000 Saiful 20000 Dania 50000 Total 150000 b Revaluation account Partners Capital RM Adam 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started