Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam bought units in a publicly traded partnership, paying ( $ 5 0 0 ) , His Schedule K - 1 showed

Adam bought units in a publicly traded partnership, paying $ His Schedule K showed the following: Box :$ Box : $ Box : $ What is Adam's ending tax basis at the end of the year? $ $ $ $ Mark for follow up

Test Schedule

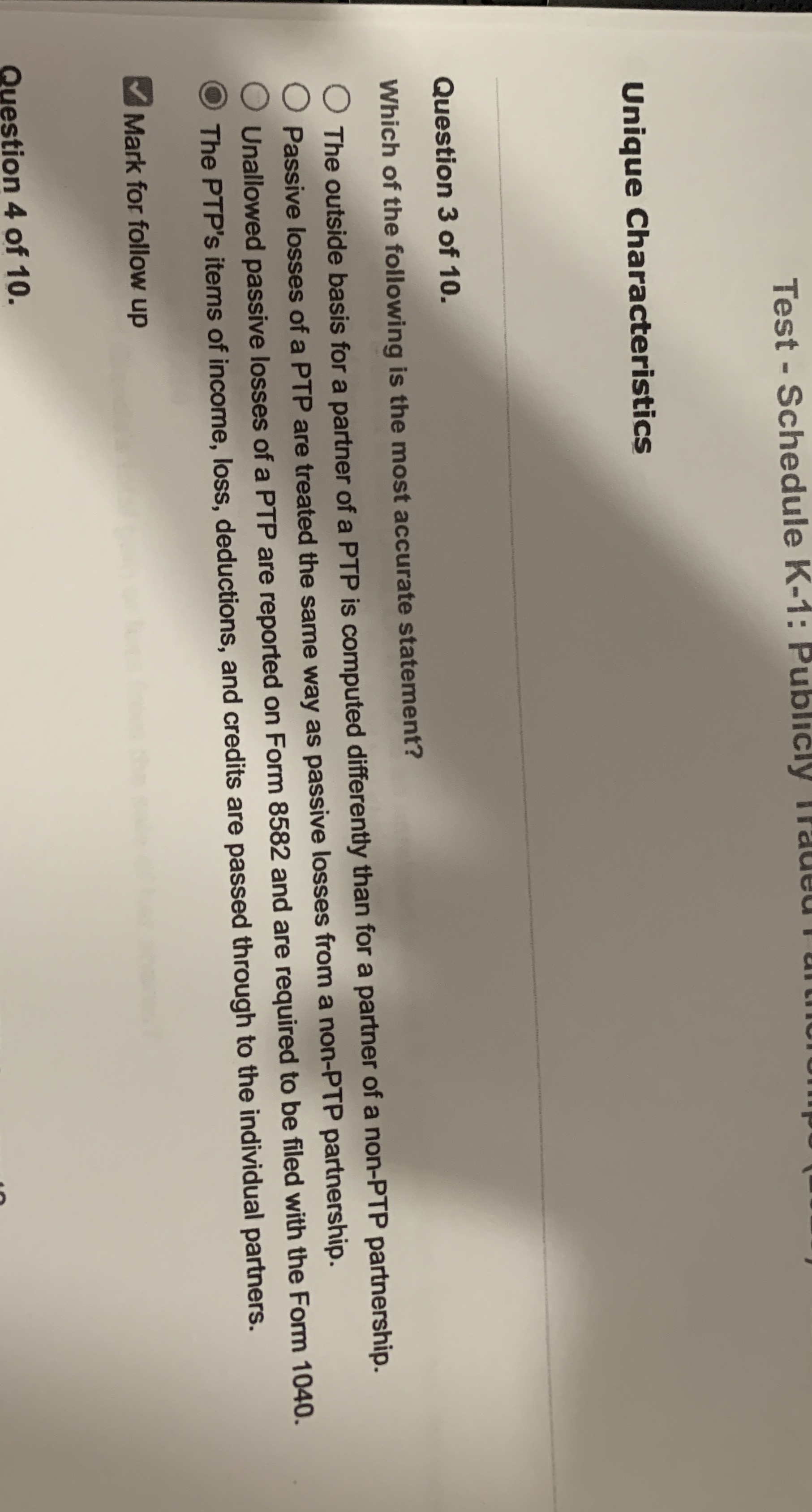

Unique Characteristics

Question of

Which of the following is the most accurate statement?

The outside basis for a partner of a PTP is computed differently than for a partner of a nonPTP partnership.

Passive losses of a PTP are treated the same way as passive losses from a nonPTP partnership.

Unallowed passive losses of a PTP are reported on Form and are required to be filed with the Form

The PTPs items of income, loss, deductions, and credits are passed through to the individual partners.

Mark for follow up

Question of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started