Answered step by step

Verified Expert Solution

Question

1 Approved Answer

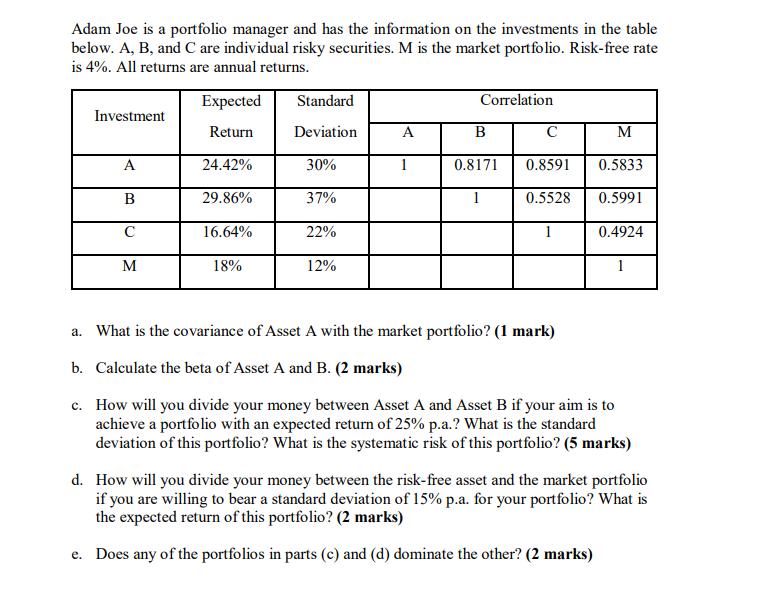

Adam Joe is a portfolio manager and has the information on the investments in the table below. A, B, and C are individual risky

Adam Joe is a portfolio manager and has the information on the investments in the table below. A, B, and C are individual risky securities. M is the market portfolio. Risk-free rate is 4%. All returns are annual returns. Investment A B C M Expected Return 24.42% 29.86% 16.64% 18% Standard Deviation 30% 37% 22% 12% A 1 Correlation B 0.8171 1 C 0.8591 0.5528 1 M 0.5833 0.5991 0.4924 1 a. What is the covariance of Asset A with the market portfolio? (1 mark) b. Calculate the beta of Asset A and B. (2 marks) c. How will you divide your money between Asset A and Asset B if your aim is to achieve a portfolio with an expected return of 25% p.a.? What is the standard deviation of this portfolio? What is the systematic risk of this portfolio? (5 marks) d. How will you divide your money between the risk-free asset and the market portfolio if you are willing to bear a standard deviation of 15% p.a. for your portfolio? What is the expected return of this portfolio? (2 marks) e. Does any of the portfolios in parts (c) and (d) dominate the other? (2 marks)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started