Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam Kleen Enterprise (AKE) was initially set up as a convenient shop selling laundry related items by Adam Bollan. Despite having good results in

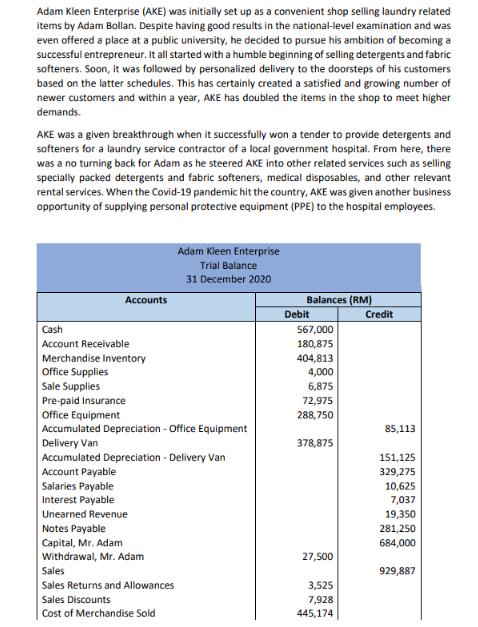

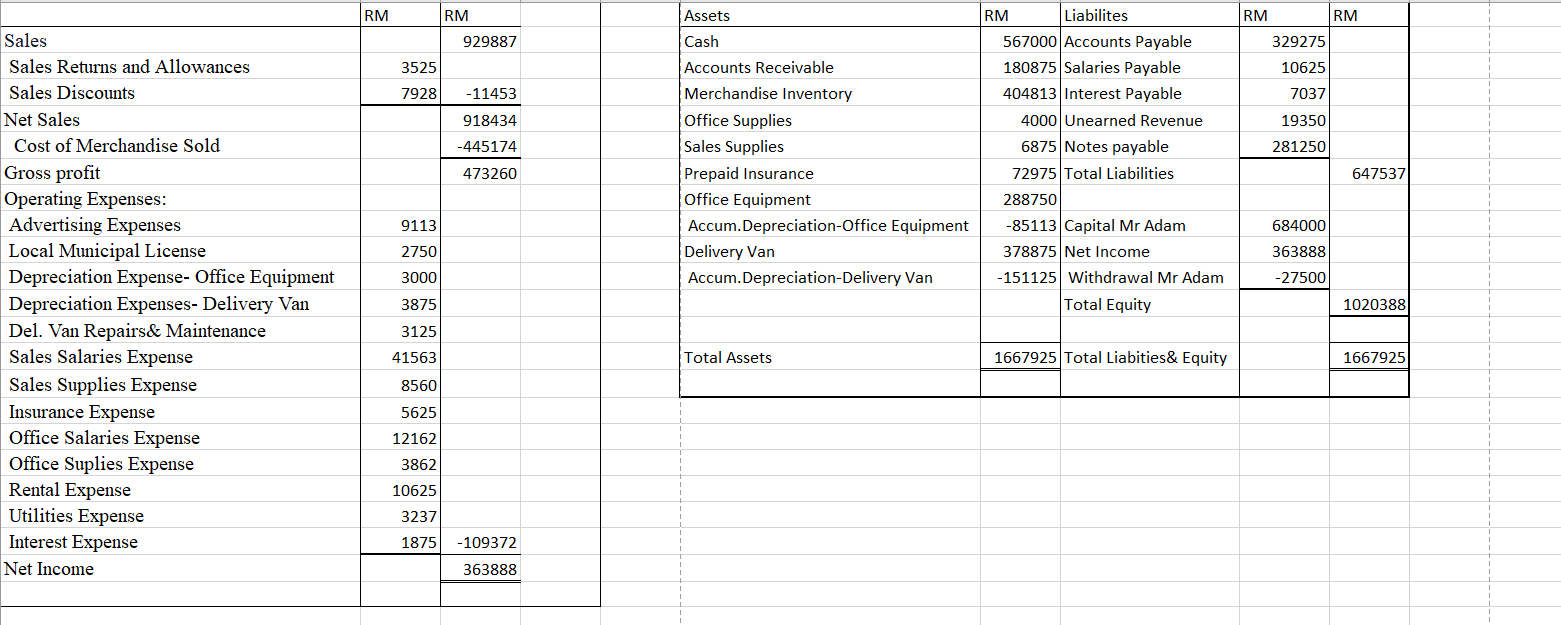

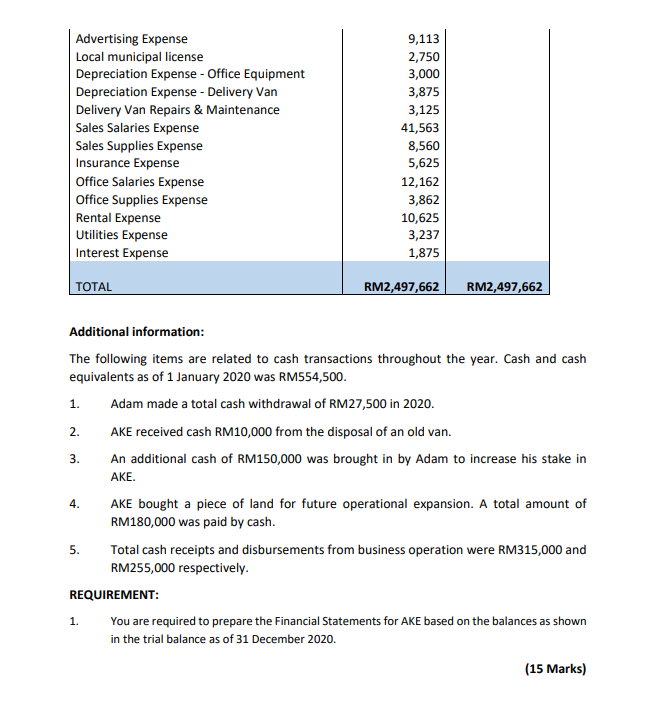

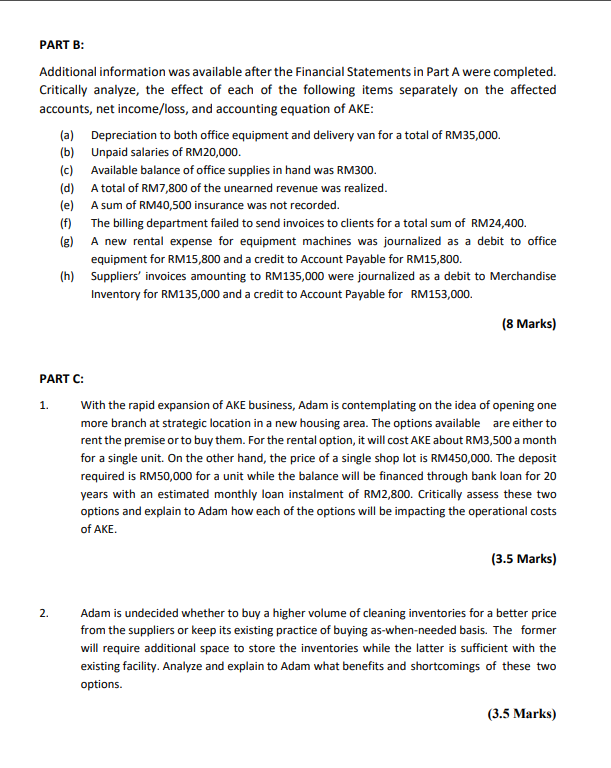

Adam Kleen Enterprise (AKE) was initially set up as a convenient shop selling laundry related items by Adam Bollan. Despite having good results in the national-level examination and was even offered a place at a public university, he decided to pursue his ambition of becoming a successful entrepreneur. It all started with a humble beginning of selling detergents and fabric softeners. Soon, it was followed by personalized delivery to the doorsteps of his customers based on the latter schedules. This has certainly created a satisfied and growing number of newer customers and within a year, AKE has doubled the items in the shop to meet higher demands. AKE was a given breakthrough when it successfully won a tender to provide detergents and softeners for a laundry service contractor of a local government hospital. From here, there was a no turning back for Adam as he steered AKE into other related services such as selling specially packed detergents and fabric softeners, medical disposables, and other relevant rental services. When the Covid-19 pandemic hit the country, AKE was given another business opportunity of supplying personal protective equipment (PPE) to the hospital employees. Adam Kleen Enterprise Trial Balance 31 December 2020 Accounts Balances (RM) Debit Credit Cash 567,000 Account Receivable 180,875 Merchandise Inventory 404,813 Office Supplies 4,000 Sale Supplies 6,875 Pre-paid Insurance 72,975 Office Equipment 288,750 Accumulated Depreciation - Office Equipment 85,113 Delivery Van 378,875 Accumulated Depreciation - Delivery Van 151,125 Account Payable 329,275 Salaries Payable 10,625 Interest Payable Unearned Revenue Notes Payable 7,037 19,350 281,250 Capital, Mr. Adam 684,000 Withdrawal, Mr. Adam 27,500 Sales 929,887 Sales Returns and Allowances 3,525 Sales Discounts 7,928 Cost of Merchandise Sold 445,174 Sales Sales Returns and Allowances Sales Discounts Net Sales Cost of Merchandise Sold Gross profit Operating Expenses: Advertising Expenses 9113 Local Municipal License 2750 Depreciation Expense- Office Equipment 3000 Depreciation Expenses- Delivery Van 3875 RM RM Assets RM 929887 Cash 3525 7928 -11453 Accounts Receivable Merchandise Inventory Liabilites 567000 Accounts Payable 180875 Salaries Payable 404813 Interest Payable RM RM 329275 10625 7037 918434 Office Supplies 4000 Unearned Revenue -445174 Sales Supplies 6875 Notes payable 19350 281250 473260 Prepaid Insurance Office Equipment 72975 Total Liabilities 647537 288750 Accum.Depreciation-Office Equipment Delivery Van -85113 Capital Mr Adam 378875 Net Income 684000 363888 Accum.Depreciation-Delivery Van -151125 Withdrawal Mr Adam Total Equity -27500 1020388 Del. Van Repairs & Maintenance 3125 Sales Salaries Expense 41563 Total Assets 1667925 Total Liabities& Equity 1667925 Sales Supplies Expense 8560 Insurance Expense 5625 Office Salaries Expense 12162 Office Suplies Expense 3862 Rental Expense Utilities Expense Interest Expense Net Income 10625 3237 1875 -109372 363888 Advertising Expense 9,113 Local municipal license 2,750 Depreciation Expense - Office Equipment 3,000 Depreciation Expense - Delivery Van 3,875 Delivery Van Repairs & Maintenance 3,125 Sales Salaries Expense Sales Supplies Expense Insurance Expense Office Salaries Expense Office Supplies Expense Rental Expense Utilities Expense 41,563 8,560 5,625 12,162 3,862 10,625 3,237 Interest Expense TOTAL 1,875 RM2,497,662 RM2,497,662 Additional information: The following items are related to cash transactions throughout the year. Cash and cash equivalents as of 1 January 2020 was RM554,500. 1. Adam made a total cash withdrawal of RM27,500 in 2020. 2. AKE received cash RM10,000 from the disposal of an old van. 3. 4. 5. An additional cash of RM150,000 was brought in by Adam to increase his stake in AKE. AKE bought a piece of land for future operational expansion. A total amount of RM180,000 was paid by cash. Total cash receipts and disbursements from business operation were RM315,000 and RM255,000 respectively. REQUIREMENT: 1. You are required to prepare the Financial Statements for AKE based on the balances as shown in the trial balance as of 31 December 2020. (15 Marks) PART B: Additional information was available after the Financial Statements in Part A were completed. Critically analyze, the effect of each of the following items separately on the affected accounts, net income/loss, and accounting equation of AKE: Depreciation to both office equipment and delivery van for a total of RM35,000. Unpaid salaries of RM20,000. (a) (b) (c) A total of RM7,800 of the unearned revenue was realized. (d) (e) (f) (g) Available balance of office supplies in hand was RM300. A sum of RM40,500 insurance was not recorded. The billing department failed to send invoices to clients for a total sum of RM24,400. A new rental expense for equipment machines was journalized as a debit to office equipment for RM15,800 and a credit to Account Payable for RM15,800. (h) Suppliers' invoices amounting to RM135,000 were journalized as a debit to Merchandise Inventory for RM135,000 and a credit to Account Payable for RM153,000. (8 Marks) PART C: 1. With the rapid expansion of AKE business, Adam is contemplating on the idea of opening one more branch at strategic location in a new housing area. The options available are either to rent the premise or to buy them. For the rental option, it will cost AKE about RM3,500 a month for a single unit. On the other hand, the price of a single shop lot is RM450,000. The deposit required is RM50,000 for a unit while the balance will be financed through bank loan for 20 years with an estimated monthly loan instalment of RM2,800. Critically assess these two options and explain to Adam how each of the options will be impacting the operational costs of AKE. (3.5 Marks) 2. Adam is undecided whether to buy a higher volume of cleaning inventories for a better price from the suppliers or keep its existing practice of buying as-when-needed basis. The former will require additional space to store the inventories while the latter is sufficient with the existing facility. Analyze and explain to Adam what benefits and shortcomings of these two options. (3.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started