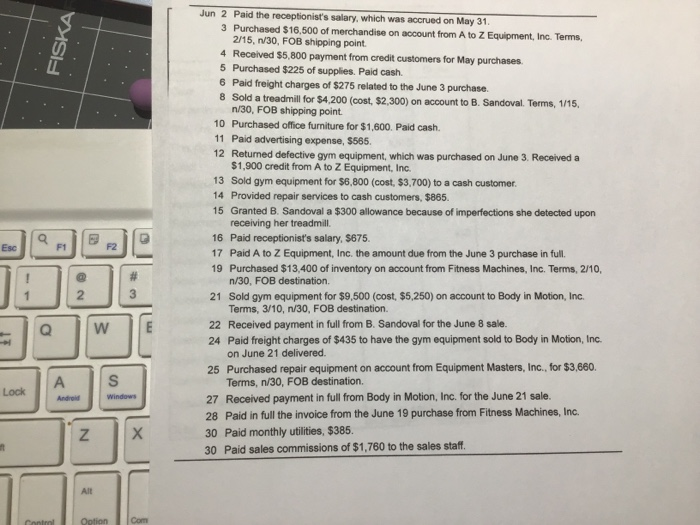

Adam Mazella opened Fitness Equipment Doctor, Inc., on March 1, 2018. On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling and installing gym equipment. The post-closing trial balance for Fitness Equipment Doctor, Inc., as of May 31, 2018, is presented next. (Click the icon to view the May post-closing trial balance.) The following transactions occurred during the month of June: (Click the icon to view the transactions.) Read the requirements Requirement 1. Journalize the transactions that occurred in June. (Record debits first, then credits. Exclude explanations from any journal entries. Round all amounts to the nearest whole dollar.) FISKA Jun 2 Paid the receptionist's salary, which was accrued on May 31. 3 Purchased $16.500 of merchandise on account from A to Z Equipment, Inc. Terms 2/15, 1/30, FOB shipping point. 4 Received $5,800 payment from credit customers for May purchases. 5 Purchased $225 of supplies. Paid cash 6 Paid freight charges of $275 related to the June 3 purchase. 8 Sold a treadmill for $4,200 (cost, $2,300) on account to B. Sandoval. Terms, 1/15. n/30, FOB shipping point 10 Purchased office furniture for $1,600. Paid cash. 11 Paid advertising expense, $566. 12 Retumed defective gym equipment, which was purchased on June 3. Received a $1,900 credit from A to Z Equipment, Inc. 13 Sold gym equipment for $6,800 (cost $3,700) to a cash customer. 14 Provided repair services to cash customers, $865. 15 Granted B. Sandoval a $300 allowance because of imperfections she detected upon receiving her treadmill 16 Paid receptionist's salary, 5675 17 Paid A to Z Equipment, Inc. the amount due from the June 3 purchase in full. 19 Purchased $13,400 of inventory on account from Fitness Machines, Inc. Terms, 2/10, n/30, FOB destination. 21 Sold gym equipment for $9,500 (cost, $5,250) on account to Body in Motion, Inc. Terms, 3/10, 1/30, FOB destination 22 Received payment in full from B. Sandoval for the June 8 sale. 24 Paid freight charges of $435 to have the gym equipment sold to Body in Motion, Inc. on June 21 delivered 25 Purchased repair equipment on account from Equipment Masters, Inc., for $3,660. Terms, n/30, FOB destination. 27 Received payment in full from Body in Motion, Inc. for the June 21 sale. 28 Paid in full the invoice from the June 19 purchase from Fitness Machines, Inc. 30 Paid monthly utilities, $385. 30 Paid sales commissions of $1,760 to the sales staff Esc F1 F2 # 3 2 3 Q Lock Andre S Windows N Alt Control Ootion Com