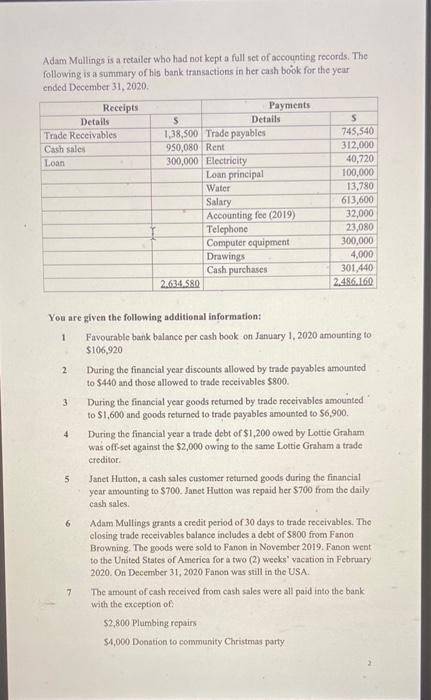

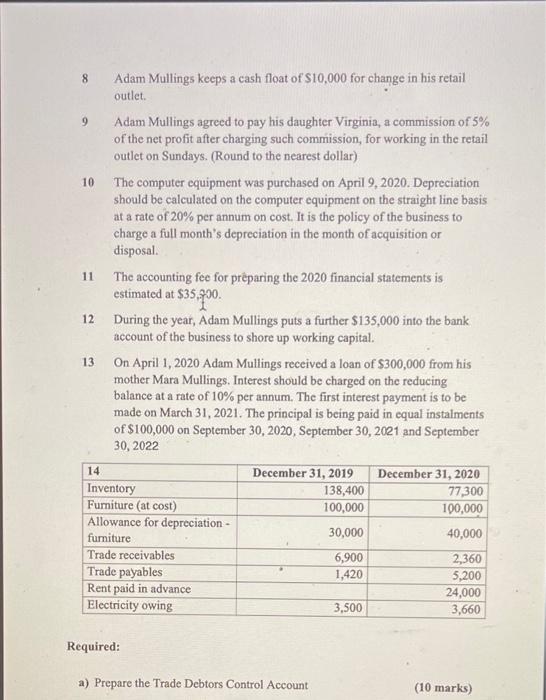

Adam Mullings is a retailer who had not kept a full set of accounting records. The following is a summary of his bank transactions in her cash book for the year ended December 31, 2020. You are given the following additional information: 1 Favourable bank balance per cash book on January 1,2020 amounting to $106,920 2 During the financial year discounts allowed by trade payables amounted to $440 and those allowed to trade receivables $800. 3 During the financial year goods retumed by trado receivables amounted to $1,600 and goods returned to trade payables amounted to $6,900. 4 During tho financial year a trade debt of $1,200 owed by Lottie Graham was off-set against the $2,000 owing to the same Lottie Graham a trade creditor. 5 Jenet Hutton, a cash sales customer returned goods during the financial yoar amounting to $700. Janet Hutton was repaid ber $700 from the daily cash sales. 6 Adaun Mullings grants a credit period of 30 days to trade receivables. The closing trade receivables balance includes a debt of $800 from Fanoo Browning. The goods were sold to Fanon in November 2019. Fanon went: to the United States of America for a two (2) weeks' vacation in February 2020. On December 31, 2020 Fanon was still in the USA. 7 The amount of cash received from cash sales were all paid into the bank with the exception of: $2,800 Plumbing repairs \$4,000 Donation to community Christmas party 8 Adam Mullings keeps a cash float of $10,000 for change in his retail outlet. 9 Adam Mullings agreed to pay his daughter Virginia, a commission of 5% of the net profit after charging such commission, for working in the retail outlet on Sundays. (Round to the nearest dollar) 10 The computer equipment was purchased on April 9, 2020. Depreciation should be calculated on the computer equipment on the straight line basis at a rate of 20% per annum on cost. It is the policy of the business to charge a full month's depreciation in the month of acquisition or disposal. 11 The accounting fee for prparing the 2020 financial statements is estimated at $35,800. 12 During the year, Adam Mullings puts a further $135,000 into the bank account of the business to shore up working capital. 13 On April 1,2020 Adam Mullings received a loan of $300,000 from his mother Mara Mullings. Interest should be charged on the reducing balance at a rate of 10% per annum. The first interest payment is to be made on March 31,2021 . The principal is being paid in equal instalments of $100,000 on September 30, 2020, September 30, 2021 and September 30,2022 Required: a) Prepare the Trade Debtors Control Account (10 marks)