Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adam Tran Winery is located in the Niagara area of southern Ontario. Adam Tran started the winery in the early 1970s as a means

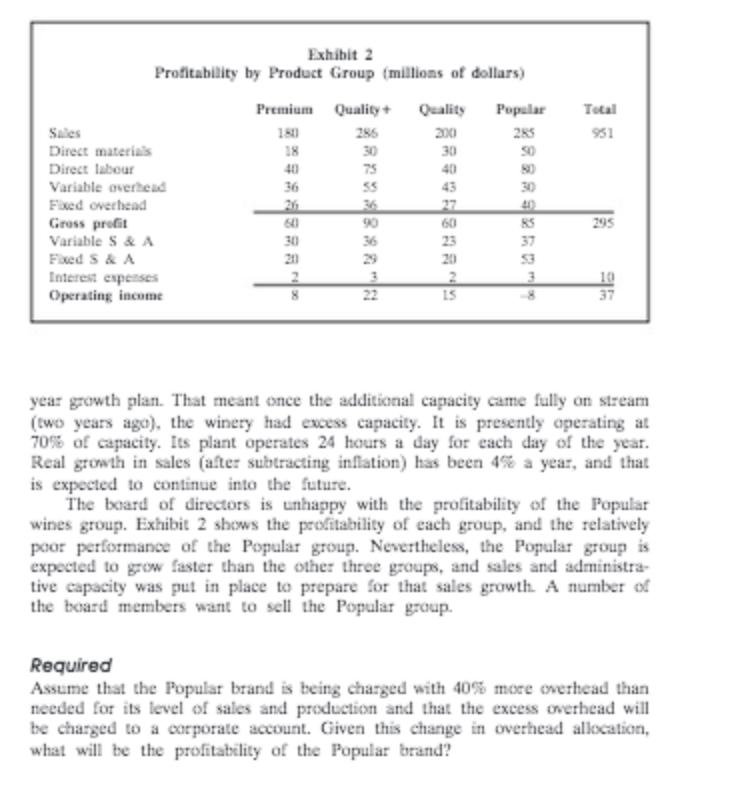

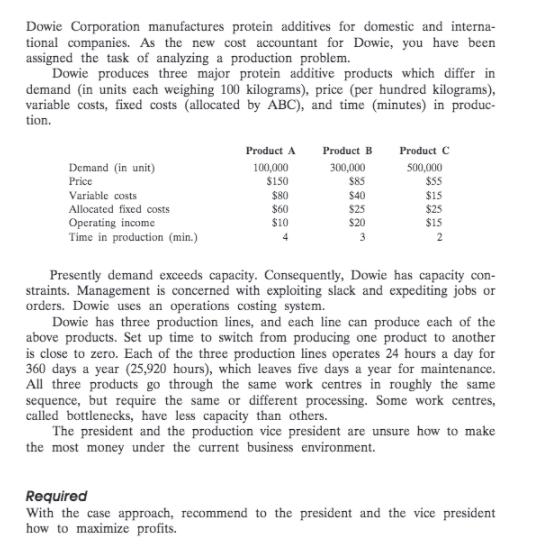

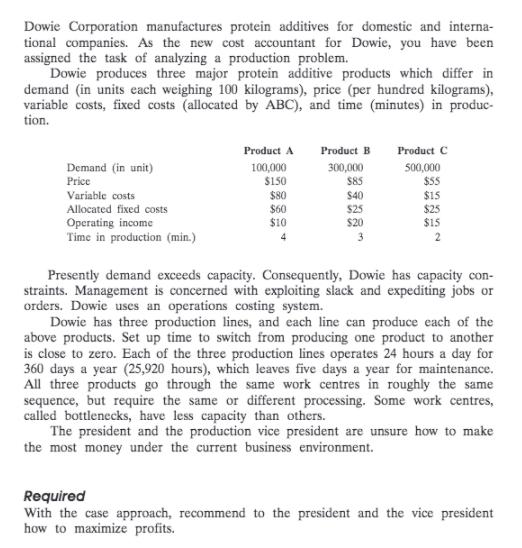

Adam Tran Winery is located in the Niagara area of southern Ontario. Adam Tran started the winery in the early 1970s as a means of using the excess grapes from his vineyard. By experimenting with grapes and processing tech- niques, Adam Tran Winery has been able to produce an increasing number of quality wines. Starting in the early 2000s, the children and grandchildren of Adam Tran were aperating and expanding the winery. It was contracting with local vineyards for all grapes used in production. There are 30 varieties of wine that are placed into four Adam Tran groups for production, marketing, and management purposes. The groups are Premium brands, Quality+, Quality, and Popular. The profitability of Adam Tran Winery is shown in Exhibit 1. Each group is managed by a senior vice president, and all told the presi- dent that the allocation of excess eapacity is unfair. There are complaints that 100% of plant capacity overhead is being allocated to group production costs rather than the capacity being used. This allocation largely refers to the amorti- zation of production assets, as noted in Exhibit 1. The winery mainly focused on the ong term production and marketing of quality wines. Three years ago, the plant capacity was increased to meet a 20- Exhibit 1 Operating Income (millions of dollars) Sales $951 S599 Cost of goods sold Amortization of prodaction assets Gress profit Selling and administrative expenses Amortization of selling and administrative assets Interest expenses Operating income 57 5295 $238 10 10 Exhibit 2 Profitability by Product Group (millions of dollars) Premium Quality+ Quality Popular Tetal Sales 180 286 200 285 951 Direct materiais 18 30 30 Direct labour Variable overhead Fixed overhead 40 75 40 80 36 55 43 30 26 640 27 40 Gross profit Variable S & A 90 60 85 295 30 36 23 20 37 Fixed S& A 20 29 53 Interest expenses Operating income 2 3. 22 15 10 37 year growth plan. That meant once the additional capacity came fully on stream (two years ago), the winery had excess capacity. It is presently operating at 70% of capacity. Its plant operates 24 hours a day for each day of the year. Real growth in sales (after subtracting inflation) has been 4% a year, and that is expected to continue into the future. The board of directors is unhappy with the profitability of the Popular wines group. Exhibit 2 shows the profitability of each group, and the relatively poor performance of the Popular group. Nevertheless, the Popular group is expected to grow faster than the other three groups, and sales and administra- tive capacity was put in place to prepare for that sales growth. A number of the board members want to sell the Popular group. Required Assume that the Popular brand is being charged with 40% more overhead than needed for its level of sales and production and that the excess overhead will be charged to a corporate account. Given this change in overhead allocation, what will be the profitability of the Popular brand? Dowie Corporation manufactures protein additives for domestic and interna- tional companies. As the new cost accountant for Dowie, you have been assigned the task of analyzing a production problem. Dowie produces three major protein additive products which differ in demand (in units each weighing 100 kilograms), price (per hundred kilograms), variable costs, fixed costs (allocated by ABC), and time (minutes) in produc- tion. Product A Product B Product C Demand (in unit) Price 100,000 300,000 $85 500,000 $150 $5 Variable costs $80 $40 $15 $25 $20 $25 $60 $10 Allocated fixed costs Operating income Time in production (min.) $15 3 Presently demand exceeds capacity. Consequently, Dowie has capacity con- straints. Management is concerned with exploiting slack and expediting jobs or orders. Dowie uses an operations costing system. Dowie has three production lines, and each line can produce each of the above products. Set up time to switch from producing one product to another is close to zero. Each of the three production lines operates 24 hours a day for 360 days a year (25,920 hours), which leaves five days a year for maintenance. All three products go through the same work centres in roughly the same sequence, but require the same or different processing. Some work centres, called bottlenecks, have less capacity than others. The president and the production vice president are unsure how to make the most money under the current business environment. Required With the case approach, recommend to the president and the vice president how to maximize profits. Dowie Corporation manufactures protein additives for domestic and interna- tional companies. As the new cost accountant for Dowie, you have been assigned the task of analyzing a production problem. Dowie produces three major protein additive products which differ in demand (in units each weighing 100 kilograms), price (per hundred kilograms), variable costs, fixed costs (allocated by ABC), and time (minutes) in produc- tion. Product A Product B Product C Demand (in unit) 100,000 $150 300,000 S85 500,000 $55 Price Variable costs $80 $40 $15 $60 $10 $25 $20 $25 $15 Allocated fixed costs Operating income Time in production (min.) 3 Presently demand exceeds capacity. Consequently, Dowie has capacity con- straints. Management is concerned with exploiting slack and expediting jobs or orders. Dowie uses an operations costing system. Dowie has three production lines, and each line can produce each of the above products. Set up time to switch from producing one product to another is close to zero. Each of the three production lines operates 24 hours a day for 360 days a year (25,920 hours), which leaves five days a year for maintenance. All three products go through the same work centres in roughly the same sequence, but require the same or different processing. Some work centres, called bottlenecks, have less capacity than others. The president and the production vice president are unsure how to make the most money under the current business environment. Required With the case approach, recommend to the president and the vice president how to maximize profits.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 2 Operating Income per production minute produc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started