Answered step by step

Verified Expert Solution

Question

1 Approved Answer

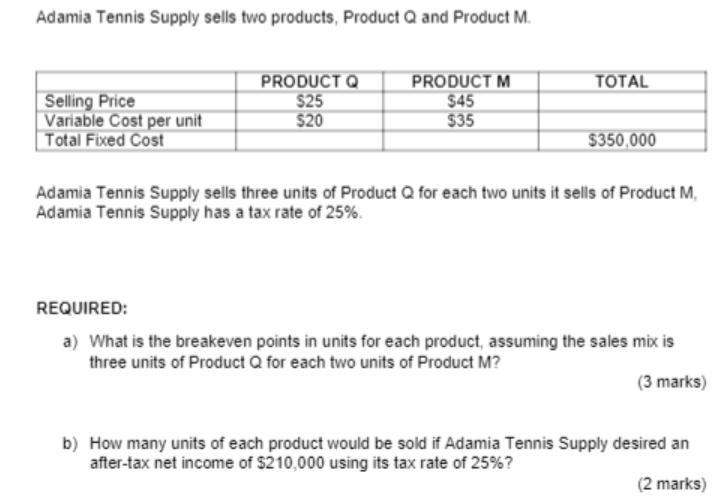

Adamia Tennis Supply sells two products, Product Q and Product M. PRODUCT Q PRODUCT M TOTAL Selling Price $25 $45 Variable Cost per unit

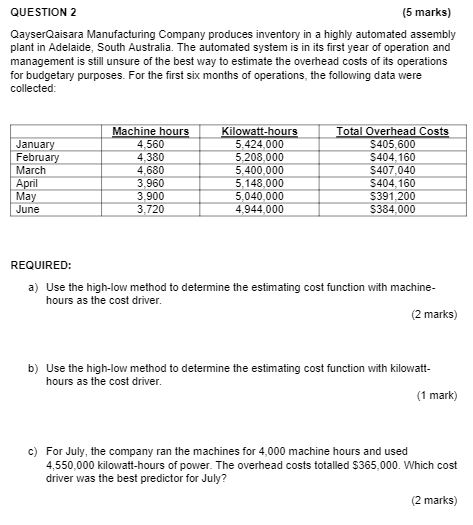

Adamia Tennis Supply sells two products, Product Q and Product M. PRODUCT Q PRODUCT M TOTAL Selling Price $25 $45 Variable Cost per unit $20 $35 Total Fixed Cost $350,000 Adamia Tennis Supply sells three units of Product Q for each two units it sells of Product M Adamia Tennis Supply has a tax rate of 25%. REQUIRED: a) What is the breakeven points in units for each product, assuming the sales mix is three units of Product Q for each two units of Product M? (3 marks) b) How many units of each product would be sold if Adamia Tennis Supply desired an after-tax net income of $210,000 using its tax rate of 25%? (2 marks) QUESTION 2 (5 marks) QayserQaisara Manufacturing Company produces inventory in a highly automated assembly plant in Adelaide, South Australia. The automated system is in its first year of operation and management is still unsure of the best way to estimate the overhead costs of its operations for budgetary purposes. For the first six months of operations, the following data were collected: Machine hours Kilowatt-hours Total Overhead Costs January February 4,560 5,424,000 $405,600 4,380 5,208,000 $404,160 March 4,680 5,400,000 $407,040 April 3.960 5,148,000 $404,160 May 3,900 5,040,000 $391,200 June 3,720 4,944,000 $384,000 REQUIRED: a) Use the high-low method to determine the estimating cost function with machine- hours as the cost driver. (2 marks) b) Use the high-low method to determine the estimating cost function with kilowatt- hours as the cost driver. (1 mark) c) For July, the company ran the machines for 4,000 machine hours and used 4,550,000 kilowatt-hours of power. The overhead costs totalled $365,000. Which cost driver was the best predictor for July? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the breakeven points in units for each product we need to consider the contribution margin per unit for each product The contribution margin is calculated as the selling price per unit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started