Question

Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Incorporated, on December 31, 2022. Adams paid a total of $603,000 in cash

Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Incorporated, on December 31, 2022. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adamss acquisition. On December 31, 2022, Barstow had the following account balances:

AccountBook ValueFair ValueCurrent assets$ 160,000$ 160,000Land120,000150,000Buildings (10-year remaining life)220,000200,000Equipment (5-year remaining life)160,000200,000Patents (10-year remaining life)050,000Notes payable (due in 5 years)(200,000)(180,000)Common stock(180,000)0Retained earnings, 12/31/22(280,000)0December 31, 2024, adjusted trial balances for the two companies follow:

AccountAdams CorporationBarstow, IncorporatedDebitsCurrent assets$ 610,000$ 250,000Land380,000150,000Buildings490,000250,000Equipment873,000150,000Investment in Barstow, Incorporated702,0000Cost of goods sold480,00090,000Depreciation expense100,00055,000Interest expense40,00015,000Dividends declared110,00070,000Total debits$ 3,785,000$ 1,030,000CreditsNotes payable$ 860,000$ 230,000Common stock510,000180,000Retained earnings, 1/1/241,367,000340,000Revenues940,000280,000Investment income108,0000Total credits$ 3,785,000$ 1,030,000At year-end, there were no intra-entity receivables or payables.

Required:

a. Determine the annual excess amortization.

b. Determine Adamss method of accounting for its investment in Barstow.

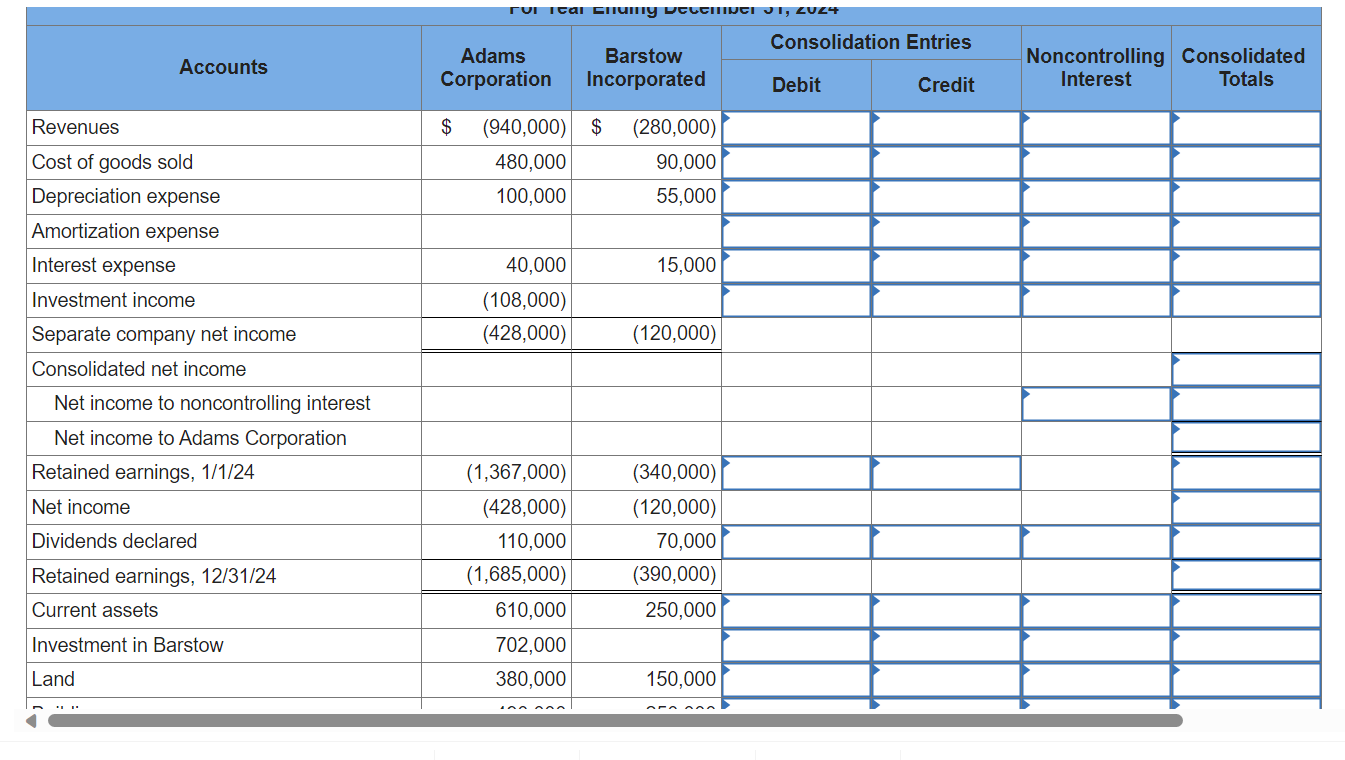

c. and d. Prepare a consolidation worksheet for Adams Corporation and Barstow, Incorporated, as of December 31, 2024.Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Incorporated, on December 31, 2022. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adamss acquisition. On December 31, 2022, Barstow had the following account balances:

AccountBook ValueFair ValueCurrent assets$ 160,000$ 160,000Land120,000150,000Buildings (10-year remaining life)220,000200,000Equipment (5-year remaining life)160,000200,000Patents (10-year remaining life)050,000Notes payable (due in 5 years)(200,000)(180,000)Common stock(180,000)0Retained earnings, 12/31/22(280,000)0December 31, 2024, adjusted trial balances for the two companies follow:

AccountAdams CorporationBarstow, IncorporatedDebitsCurrent assets$ 610,000$ 250,000Land380,000150,000Buildings490,000250,000Equipment873,000150,000Investment in Barstow, Incorporated702,0000Cost of goods sold480,00090,000Depreciation expense100,00055,000Interest expense40,00015,000Dividends declared110,00070,000Total debits$ 3,785,000$ 1,030,000CreditsNotes payable$ 860,000$ 230,000Common stock510,000180,000Retained earnings, 1/1/241,367,000340,000Revenues940,000280,000Investment income108,0000Total credits$ 3,785,000$ 1,030,000At year-end, there were no intra-entity receivables or payables.

Required:

a. Determine the annual excess amortization.

b. Determine Adamss method of accounting for its investment in Barstow.

c. and d. Prepare a consolidation worksheet for Adams Corporation and Barstow, Incorporated, as of December 31, 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started