Question

Adarmes Adventures manufactures aluminum canoes. In planning for the coming year, CFO Alexis King is considering three different sales targets: 2,500 canoes, 3,000 canoes, and

Adarmes Adventures manufactures aluminum canoes. In planning for the coming year, CFO Alexis King is considering three different sales targets: 2,500 canoes, 3,000 canoes, and 3,500 canoes. Canoes sell for $804 each. The standard variable cost information for a canoe is as follows.

| Direct materials | $ | 334 | ||

| Direct labor | 154 | |||

| Variable overhead | ||||

| Utilities | 35 | |||

| Indirect material | 30 | |||

| Indirect labor | 60 | |||

| Total | $ | 613 |

Annual fixed overhead cost is expected to be:

| Maintenance | $ | 18,830 | ||

| Depreciation | 36,300 | |||

| Insurance | 25,840 | |||

| Rent | 29,110 | |||

| Total | $ | 110,080 |

Alexis King chose to prepare a static budget based on sales of 3,000 canoes. Actual sales were 3,100 canoes at a price of $854 each. The company incurred the following costs for the year:

| Direct material | $ | 1,013,600 | |

| Direct labor | 452,300 | ||

| Variable overhead | 398,400 | ||

| Fixed overhead | 117,980 | ||

| Total | $ | 1,982,280 |

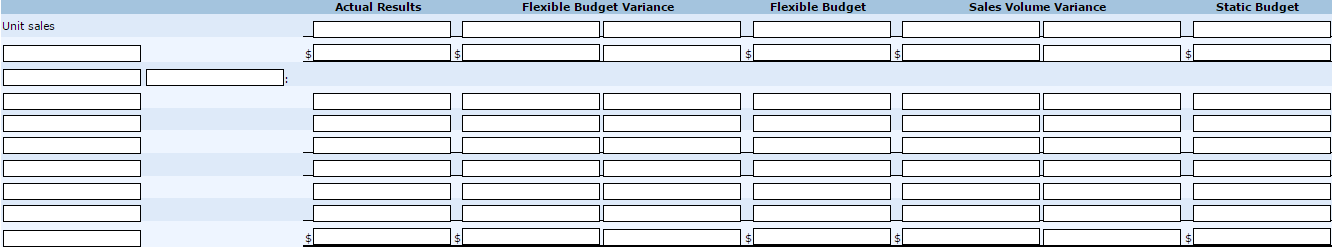

Prepare a performance report for the year that shows the flexible budget and sales volume variances. (If operating income is negative, enter amounts using a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 125. If variance is zero, select "Not Applicable" and enter 0 for the amounts.)

Sales, revenue, Direct labor, overhead, contribution margin, total variable expenses, operating income, total fixed expenses, direct material, variable expenses. (these fit into the blank)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started