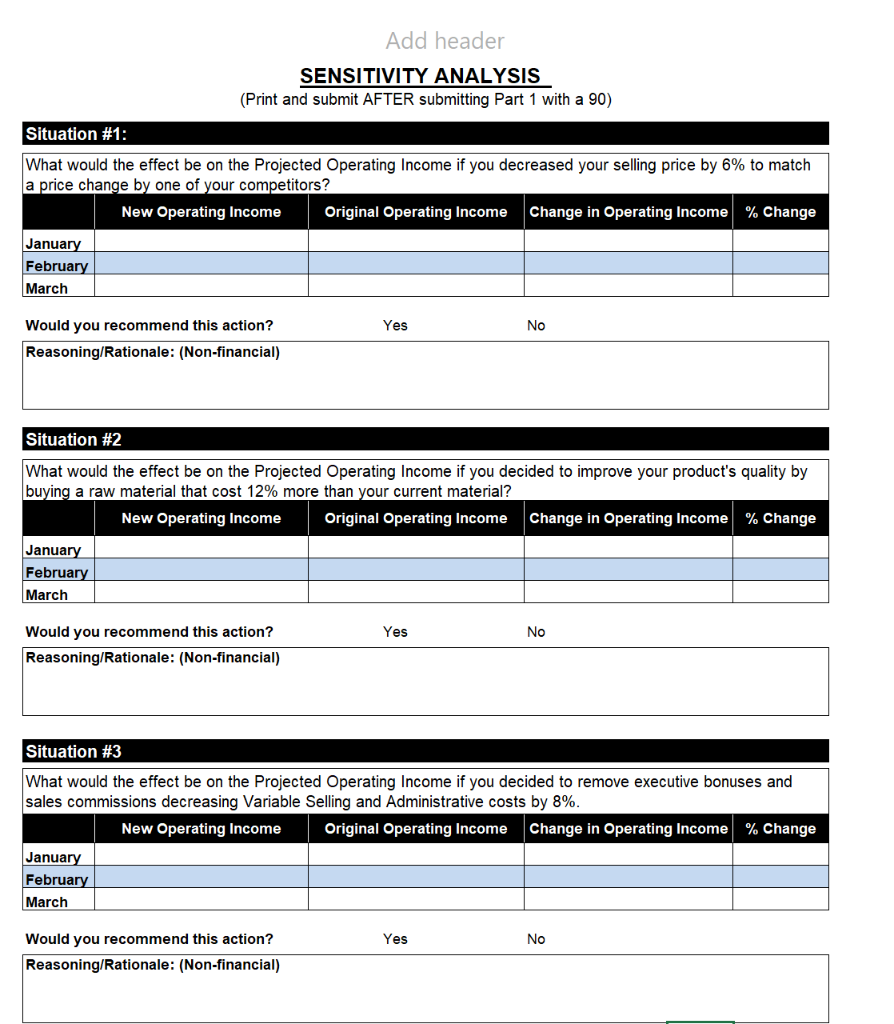

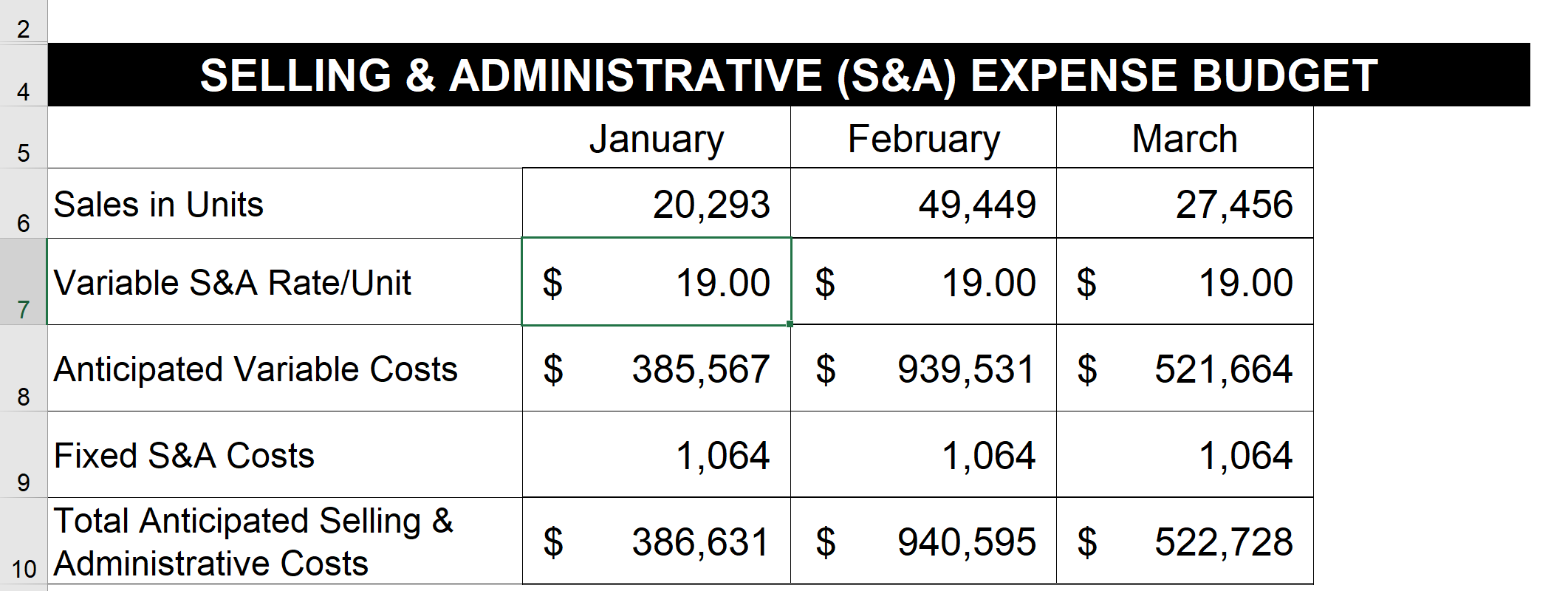

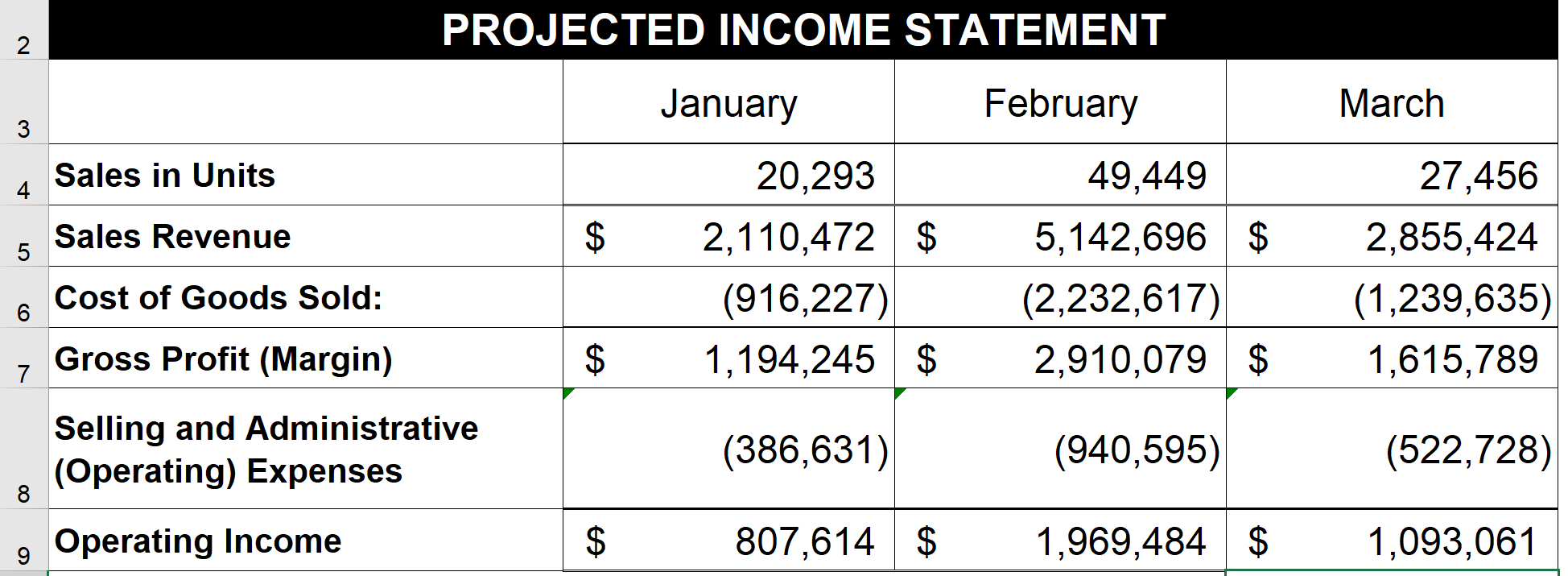

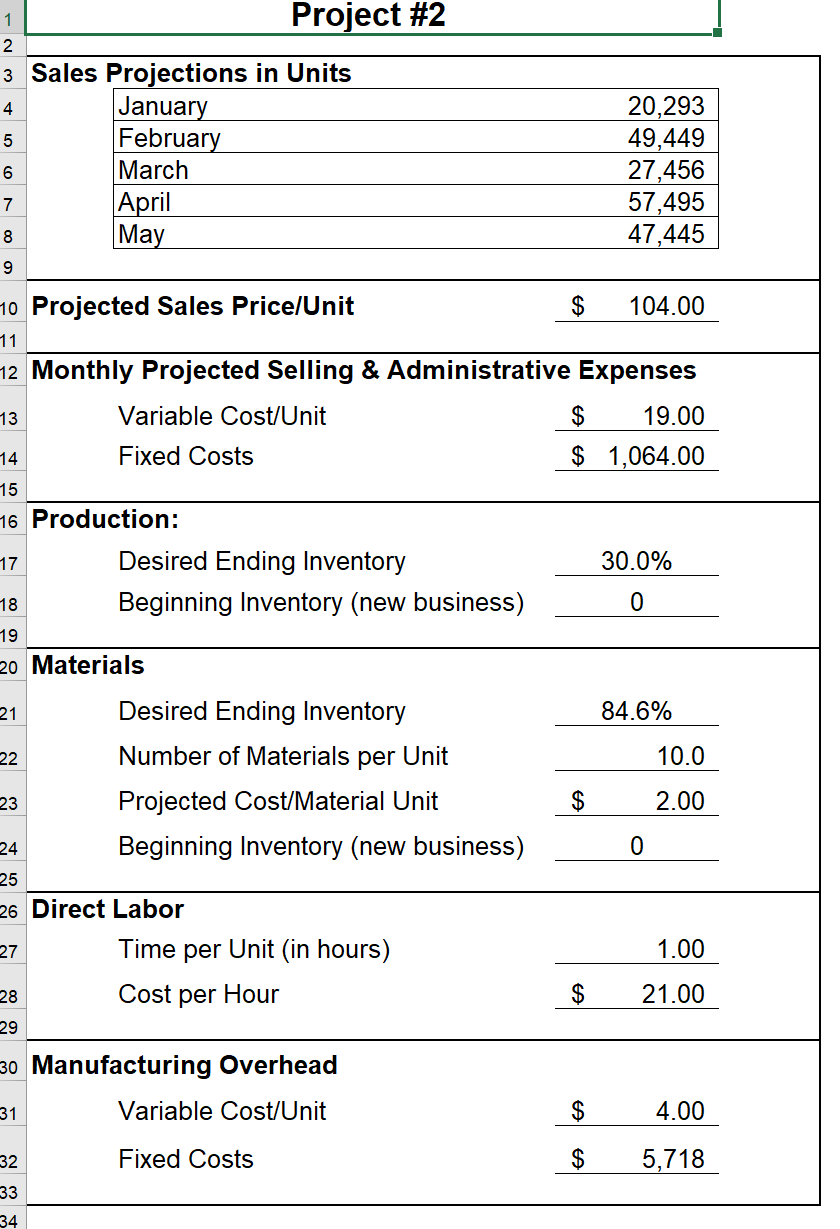

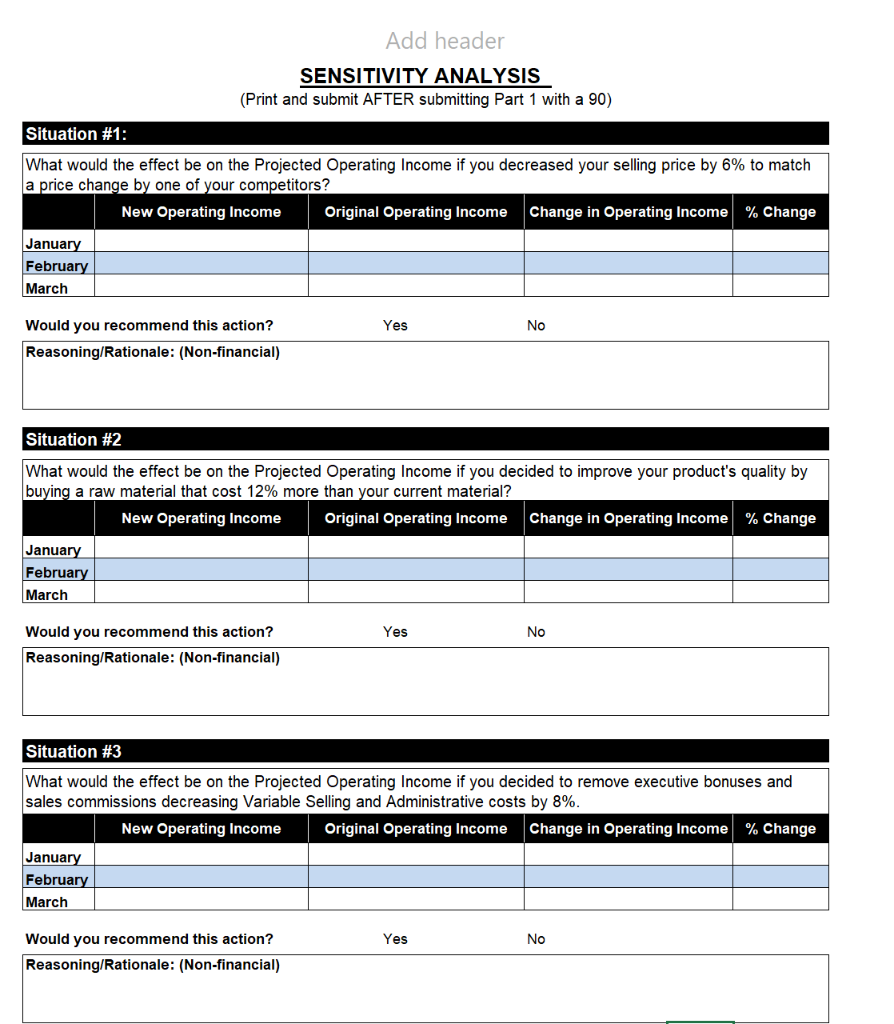

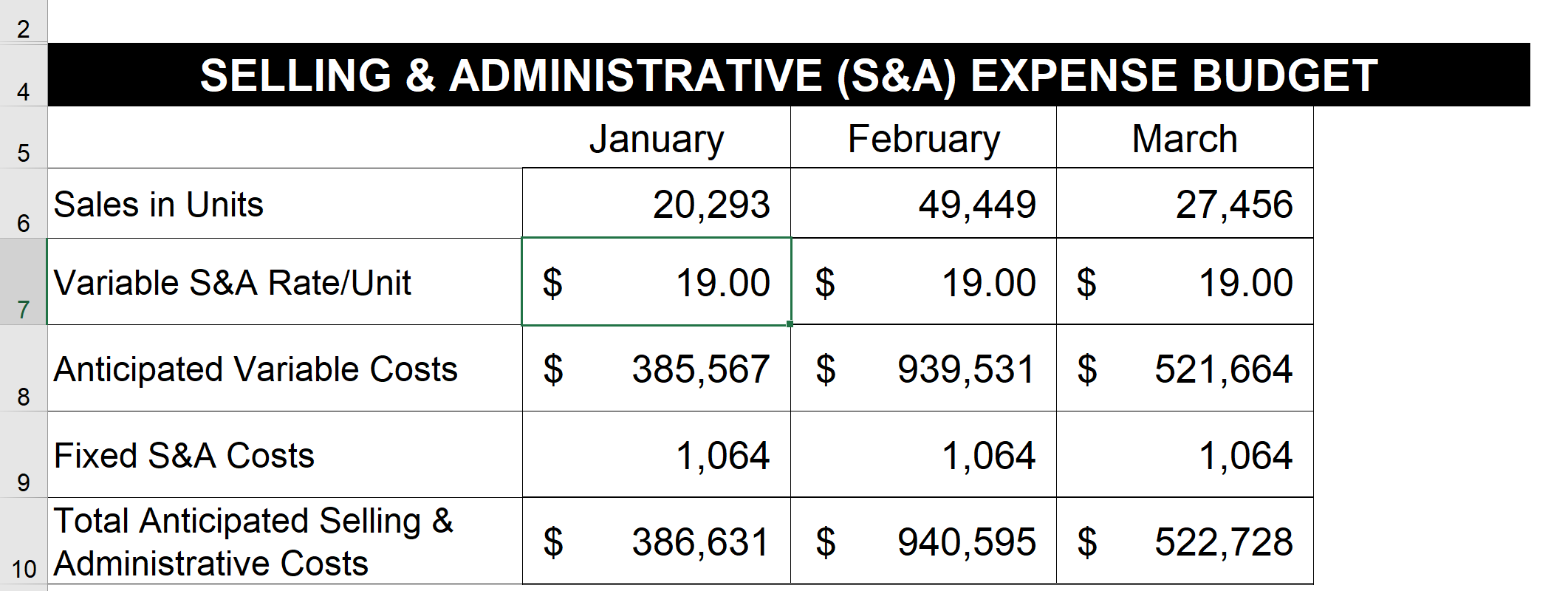

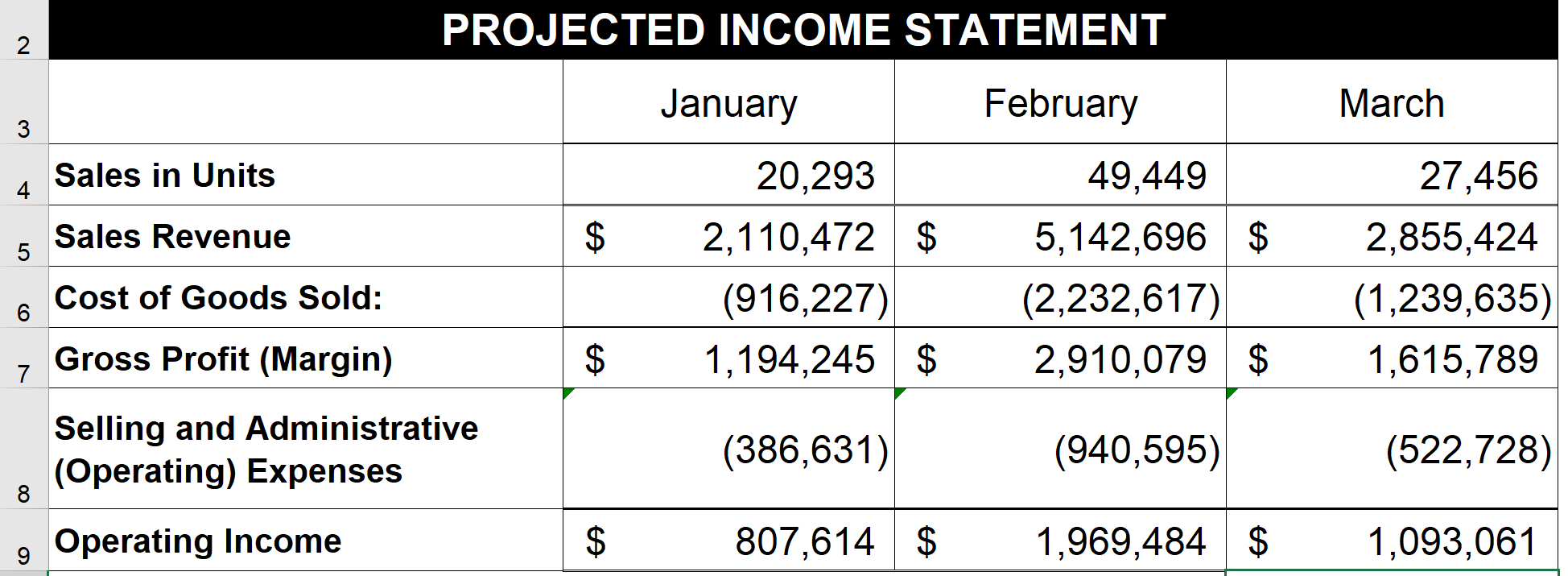

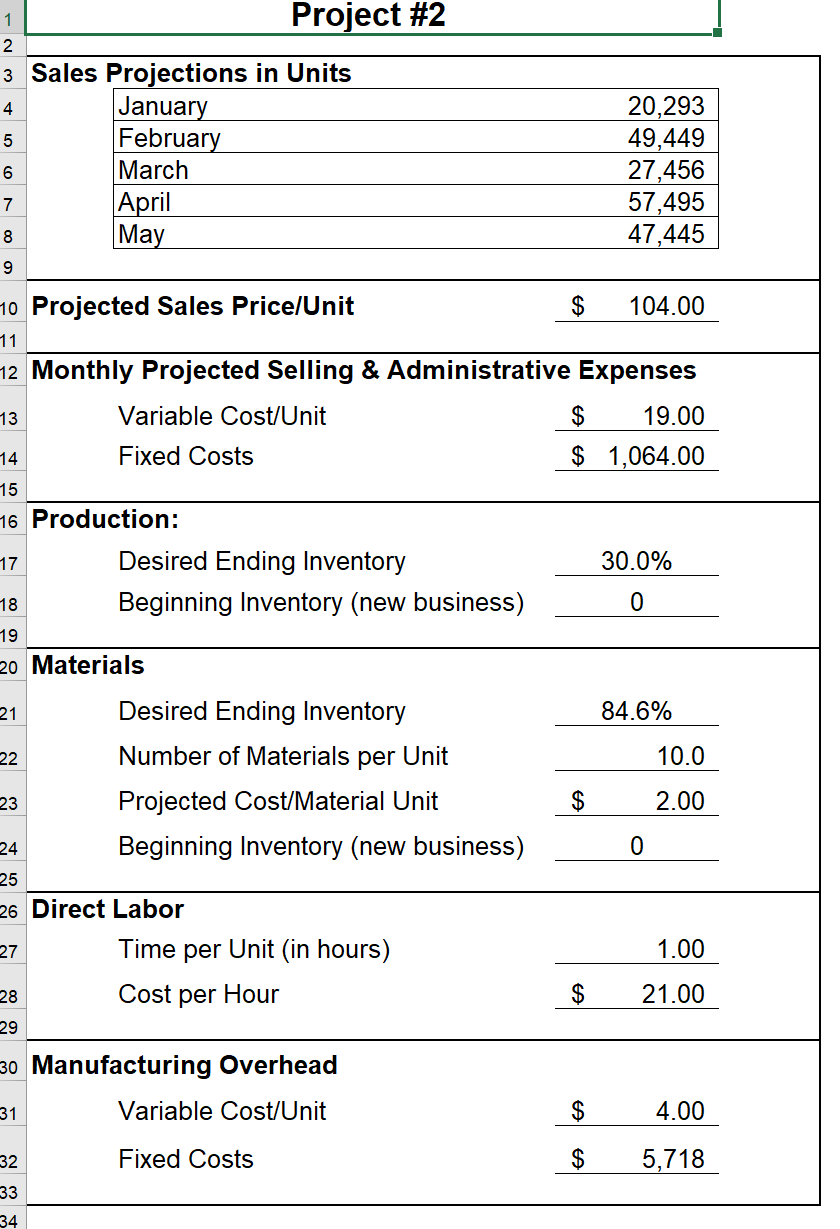

Add header SENSITIVITY ANALYSIS (Print and submit AFTER submitting Part 1 with a 90) Situation #1: What would the effect be on the Projected Operating Income if you decreased your selling price by 6% to match a price change by one of your competitors? New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) Situation #2 What would the effect be on the Projected Operating Income if you decided to improve your product's quality by buying a raw material that cost 12% more than your current material? New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) Situation #3 What would the effect be on the Projected Operating Income if you decided to remove executive bonuses and sales commissions decreasing Variable Selling and Administrative costs by 8%. New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) 2 4 January 5 SELLING & ADMINISTRATIVE (S&A) EXPENSE BUDGET February March Sales in Units 20,293 49,449 27,456 Variable S&A Rate/Unit $ 19.00 $ $ 19.00 $ 19.00 6 7 Anticipated Variable Costs $ 385,567 $ 939,531 $ 521,664 8 1,064 1,064 1,064 Fixed S&A Costs 9 Total Anticipated Selling & 10 Administrative Costs $ 386,631 $ 940,595 $ 522,728 PROJECTED INCOME STATEMENT 2 January February March 3 Sales in Units 4 Sales Revenue $ 5 20,293 2,110,472 $ (916,227) 1,194,245 $ 49,449 5,142,696 $ (2,232,617) 2,910,079 $ 27,456 2,855,424 (1,239,635) 1,615,789 Cost of Goods Sold: 6 Gross Profit (Margin) $ 7 Selling and Administrative (Operating) Expenses (386,631) (940,595) (522,728) 8 Operating Income $ 807,614 $ 1,969,484 $ 1,093,061 9 4 14 1 Project #2 2 3 Sales Projections in Units January 20,293 5 February 49,449 6 March 27,456 7 April 57,495 8 May 47,445 9 10 Projected Sales Price/Unit $ 104.00 11 12 Monthly Projected Selling & Administrative Expenses 13 Variable Cost/Unit $ 19.00 Fixed Costs $ 1,064.00 15 16 Production: 17 Desired Ending Inventory 30.0% 18 Beginning Inventory (new business) 0 19 20 Materials 21 Desired Ending Inventory 84.6% 22 Number of Materials per Unit 10.0 23 Projected Cost/Material Unit $ 2.00 24 Beginning Inventory (new business) 0 25 26 Direct Labor 27 Time per Unit (in hours) 1.00 28 Cost per Hour $ 21.00 29 30 Manufacturing Overhead 31 Variable Cost/Unit $ 4.00 Fixed Costs $ 5,718 32 33 34