Answered step by step

Verified Expert Solution

Question

1 Approved Answer

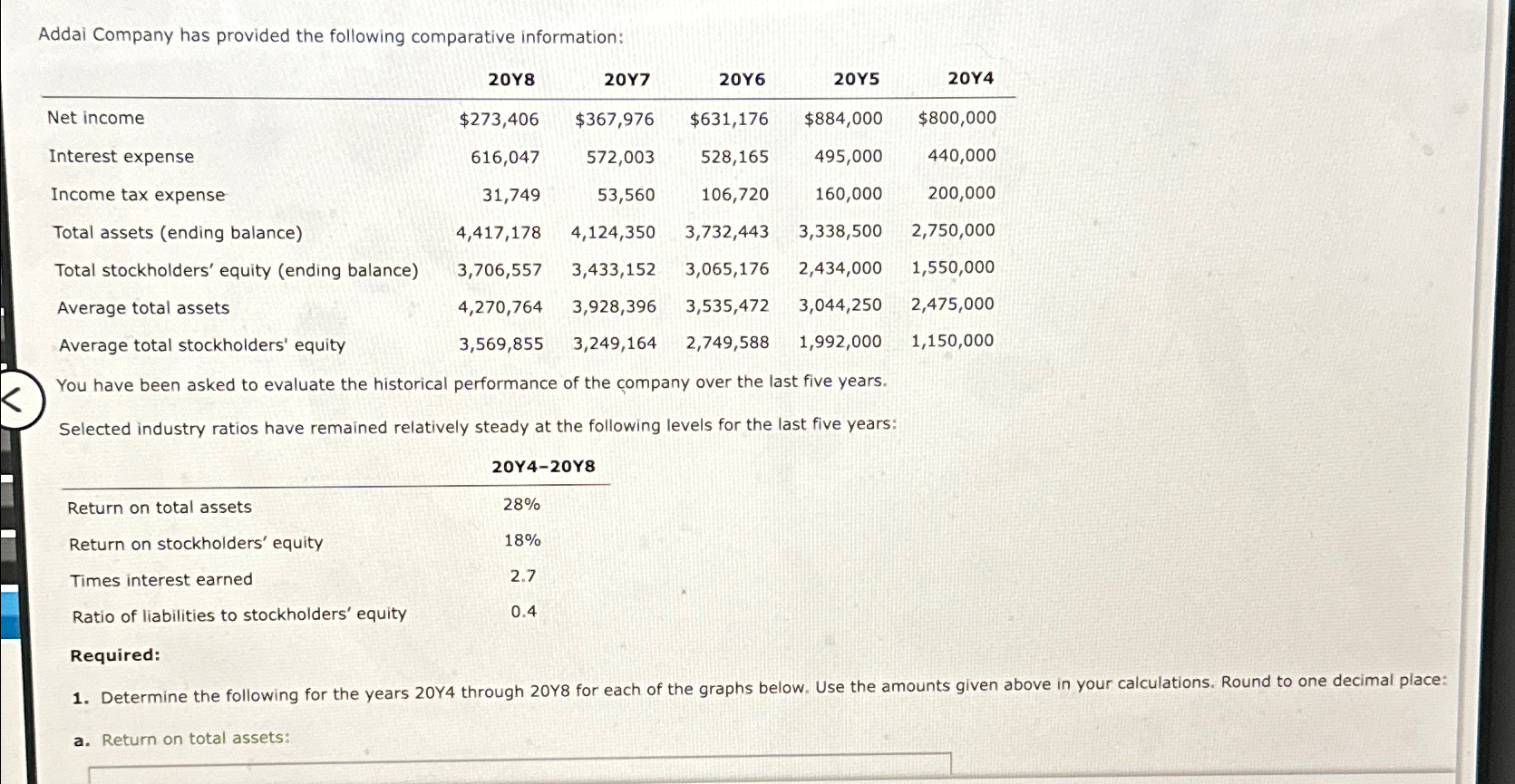

Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income Interest expense Income tax expense $273,406 $367,976 $631,176 $884,000

Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income Interest expense Income tax expense $273,406 $367,976 $631,176 $884,000 $800,000 572,003 53,560 Total assets (ending balance) Total stockholders' equity (ending balance) Average total assets Average total stockholders' equity 616,047 528,165 31,749 106,720 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 3,569,855 3,249,164 2,749,588 1,150,000 495,000 440,000 160,000 200,000 1,992,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4-20Y8 Return on total assets Return on stockholders' equity Times interest earned 28% 18% 2.7 Ratio of liabilities to stockholders' equity Required: 0.4 1. Determine the following for the years 20Y4 through 20Y8 for each of the graphs below. Use the amounts given above in your calculations. Round to one decimal place: a. Return on total assets:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started