Answered step by step

Verified Expert Solution

Question

1 Approved Answer

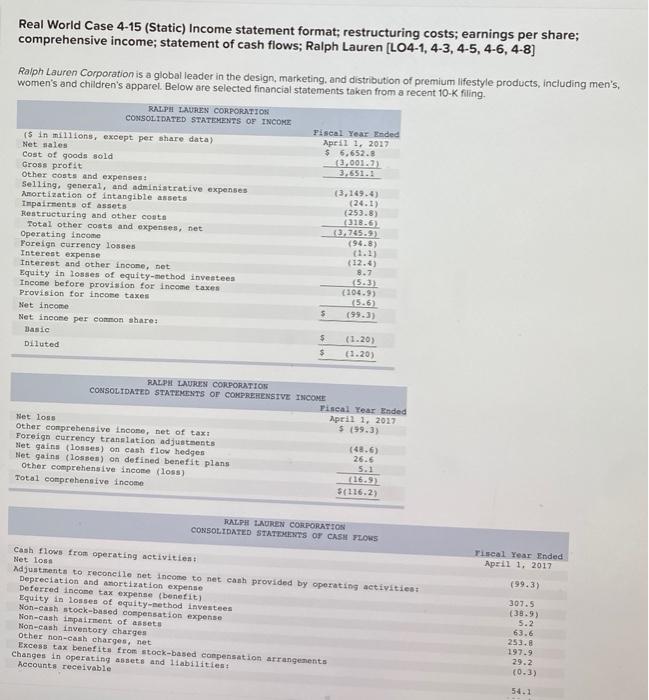

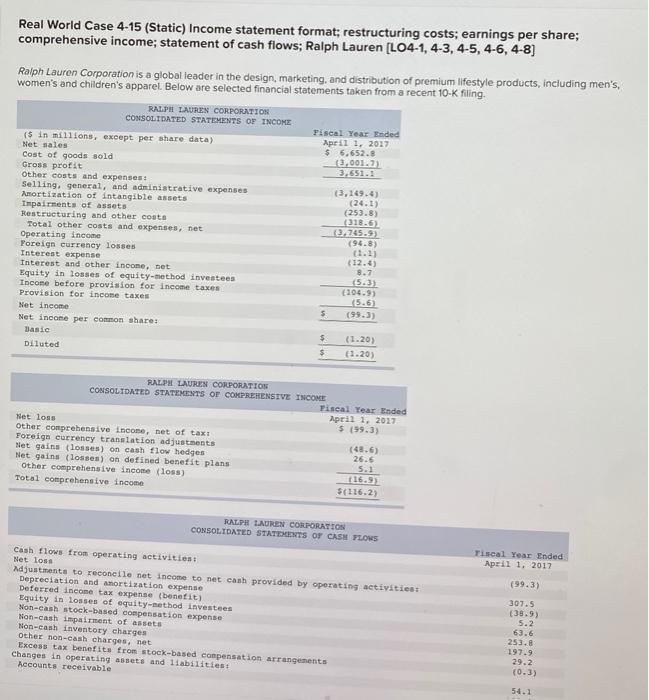

added more Real World Case 4-15 (Static) Income statement format; restructuring costs; earnings per share; comprehensive income; statement of cash flows; Ralph Lauren [LO4-1, 4-3,4-5,4-6,4-8]

added more

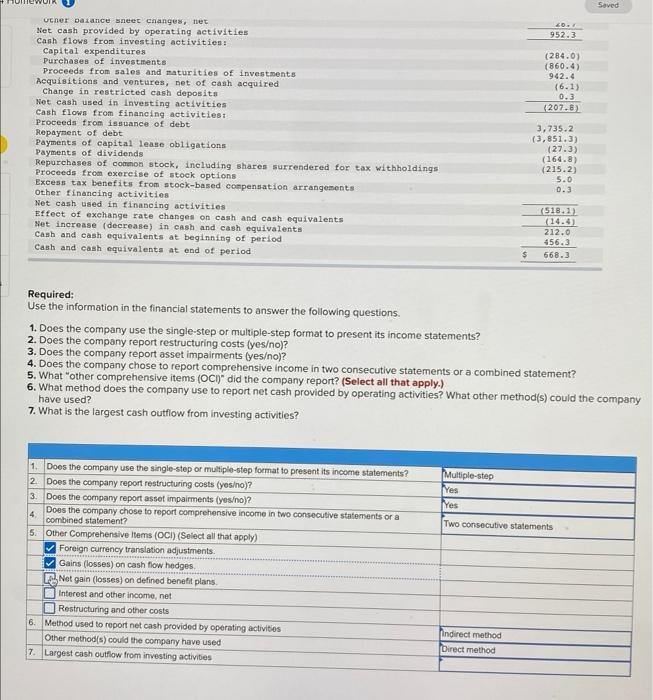

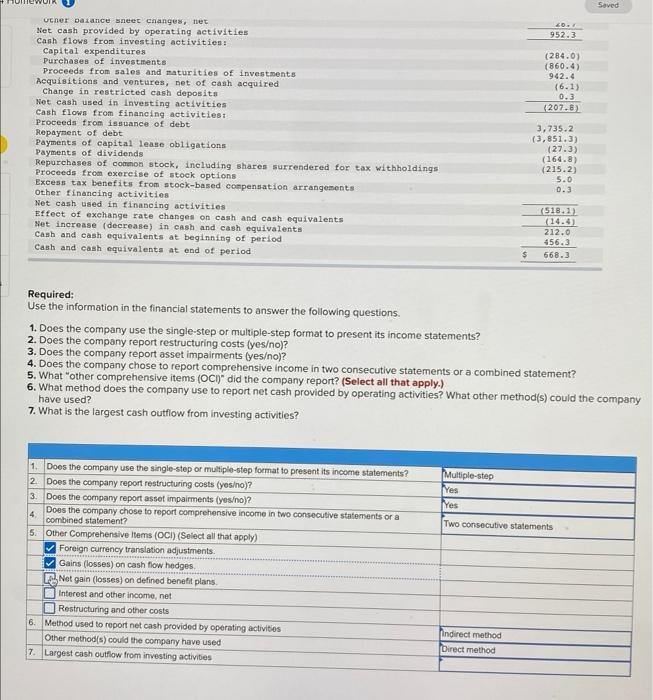

Real World Case 4-15 (Static) Income statement format; restructuring costs; earnings per share; comprehensive income; statement of cash flows; Ralph Lauren [LO4-1, 4-3,4-5,4-6,4-8] Ralph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, inciuding men's, women's and chidren's apparel. Below are selected financial statements taken from a recent 10K filing. Real World Case 4-15 (Static) Income statement format; restructuring costs; earnings per share; comprehensive income; statement of cash flows; Ralph Lauren [LO4-1, 4-3,4-5,4-6,4-8] Ralph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, inciuding men's, women's and chidren's apparel. Below are selected financial statements taken from a recent 10K filing. Required: Use the information in the financial statements to answer the following questions. 1. Does the company use the single-step or multiple-step format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset impairments (yeso)? 4. Does the company chose to report comprehensive income in two consecutive statements or a combined statement? 5. What "other comprehensive items (OCD)" did the company report? (Select all that apply.) 6. What method does the company use to report net cash provided by operating activities? What other method(s) could the compar have used? 7. What is the largest cash outflow from investing activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started