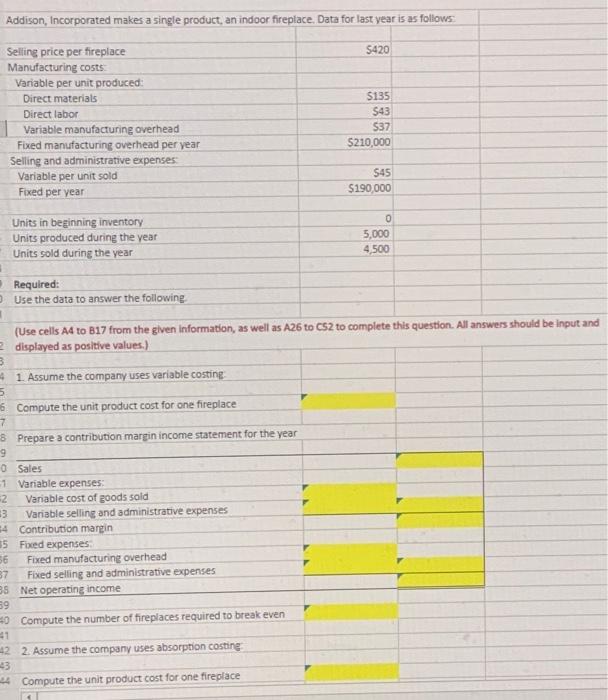

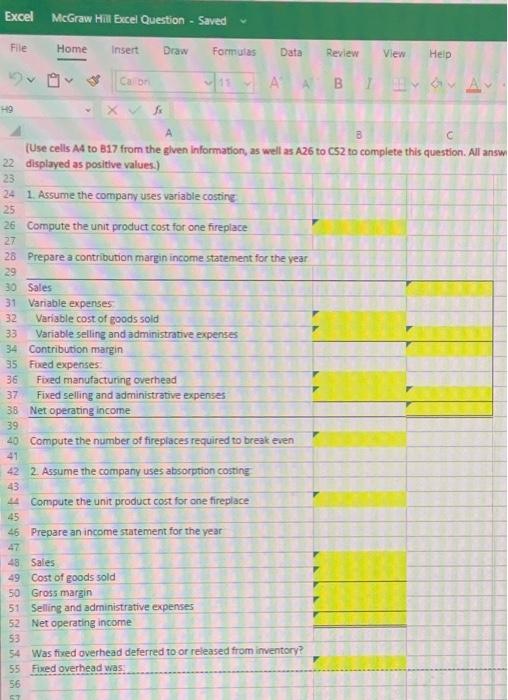

Addison, Incorporated makes a single product, an indoor fireplace. Data for last vear is as follows: Selling price per fireplace Manufacturing costs: Variable per unit produced: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead per vear Selling and administrative expenses: Variable per unit sold Fixed per year Units in beginning inventory Units produced during the year Units sold during the year Required: Use the data to answer the following. $420 $135 $43 537 $210,000 $45 $190,000 0 5,000 4,500 (Use cells A4 to B17 from the given information, as well as A26 to CS2 to complete this question. All answers should be input and displayed as positive values.) 1. Assume the company uses veriable costing: Compute the unit product cost for one fireplace Prepare a contribution margin income statement for the year Sales Variable expenses: Variable cost of goods sold Variable selling and administrative expenses Contribution marzin Fioed expenses: Fixed manufacturing overhead Fixed selling and administrative expenses Net operating income Compute the number of fireplaces required to break even. 2. Assume the company uses absorption costing: Compute the unit product cost for one fireplace Excel McGraw Hili Excel Question - Saved (Use cells A4 to B17 from the given information, as well as A26 to CS2 to complete this question. All answ 22 displayed as positive values) 1. Assume the companv uses variable costing: Compute the unit product cost for one fireplace Prepare a contribution margin income statement for the vear Sales Variable expenses Varisble cost of goods soid Variable selling and administrative expenses Contribution margin Fued expenses: Fixed manufacturine overhead Fixed selling and administrative expenses Net operating income Compute the number of fireplaces required to break even 2. Assume the company uses absorption costing Compute the unit product cost for ane fireplace 45 45. Prepare an income statement for the vear 47. 48 Sales 49 Cost of goods sold 50 Gross margin 51 Selling and administrative expenses 52 Net operating income 53. 54 Was fixed overhead deferred to or released from inventory? 55. Fixed overhead was