Answered step by step

Verified Expert Solution

Question

1 Approved Answer

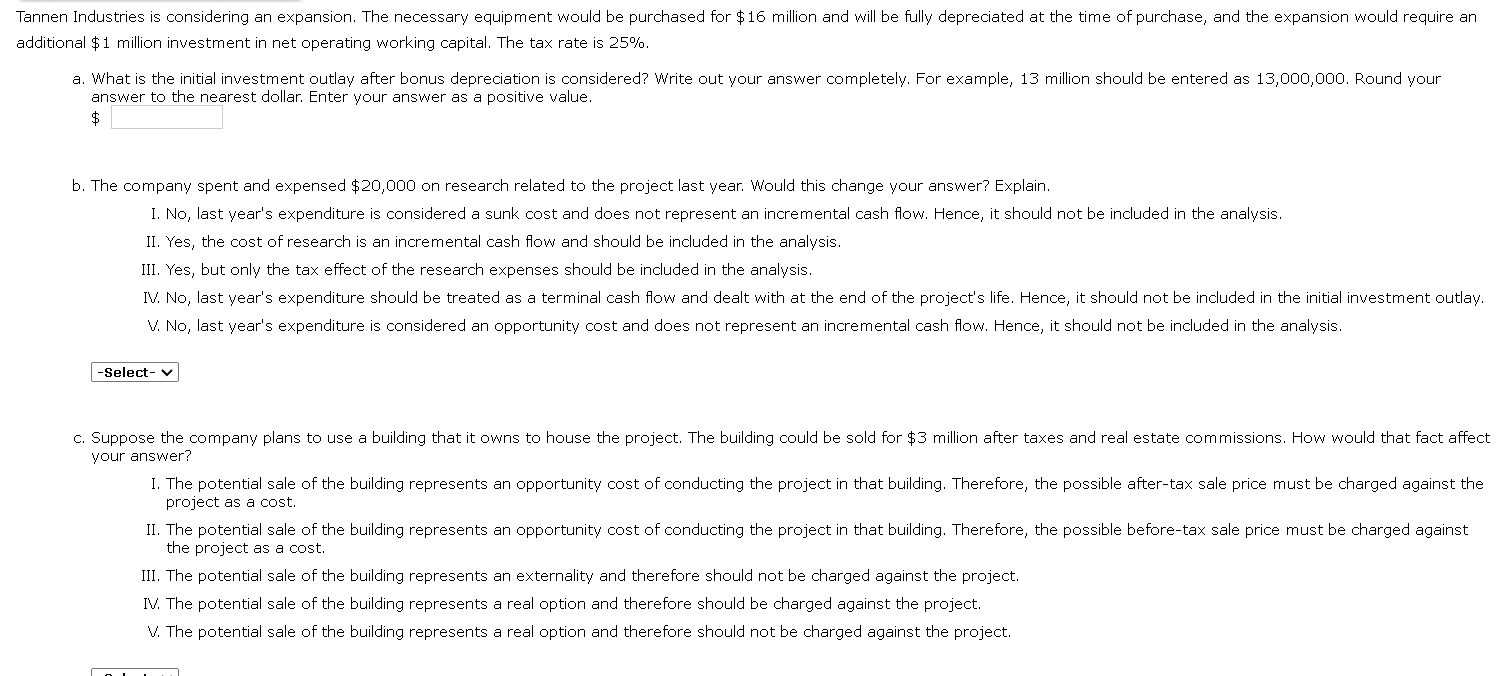

additional $1 million investment in net operating working capital. The tax rate is 25%. anciser th the nearest dollar. Enter your answer as a positive

additional $1 million investment in net operating working capital. The tax rate is 25%. anciser th the nearest dollar. Enter your answer as a positive value. $ b. The company spent and expensed $20,000 on research related to the project last year. Would this change your answer? Explain. I. No, last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. Yes, the cost of research is an incremental cash flow and should be included in the analysis. III. Yes, but only the tax effect of the research expenses should be included in the analysis. V. No, last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. vour answer? project as a cost. the project as a cost. III. The potential sale of the building represents an externality and therefore should not be charged against the project. IV. The potential sale of the building represents a real option and therefore should be charged against the project. V. The potential sale of the building represents a real option and therefore should not be charged against the project

additional $1 million investment in net operating working capital. The tax rate is 25%. anciser th the nearest dollar. Enter your answer as a positive value. $ b. The company spent and expensed $20,000 on research related to the project last year. Would this change your answer? Explain. I. No, last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. Yes, the cost of research is an incremental cash flow and should be included in the analysis. III. Yes, but only the tax effect of the research expenses should be included in the analysis. V. No, last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. vour answer? project as a cost. the project as a cost. III. The potential sale of the building represents an externality and therefore should not be charged against the project. IV. The potential sale of the building represents a real option and therefore should be charged against the project. V. The potential sale of the building represents a real option and therefore should not be charged against the project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started