Answered step by step

Verified Expert Solution

Question

1 Approved Answer

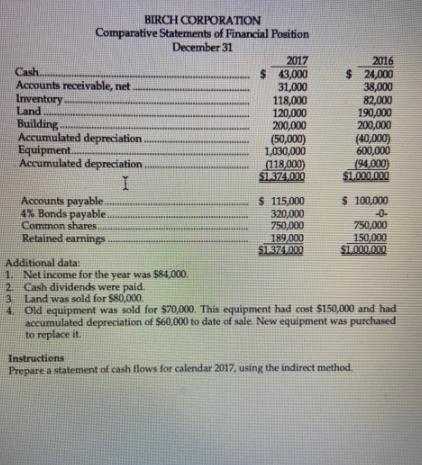

BIRCH CORPORATION Comparative Statements of Financial Position December 31 2017 $ 43,000 31,000 118,000 120,000 200,000 (50,000) 1,030,000 (118.000) $1.374,000 2016 Cash. Accounts receivable,

BIRCH CORPORATION Comparative Statements of Financial Position December 31 2017 $ 43,000 31,000 118,000 120,000 200,000 (50,000) 1,030,000 (118.000) $1.374,000 2016 Cash. Accounts receivable, net Inventory Land $ 24,000 38,000 82,000 190,000 200,000 (40,000) 600,000 (94,000 $1.000.000 Building. Accumulated depreciation Equipment. Accumulated depreciation S 100,000 Accounts payable. 4% Bonds payable.. Common shares. Retained earnings $ 115,000 320,000 750,000 189,000 $1374.000 -0- 750,000 150,000 $1.000.000 Additional data: 1 Net income for the year was $84,000. 2 Cash dividends were paid. 3 Land was sold for $80,000. 4. Old equipment was sold for $70,000. This equipment had cost $150,000 and had accumulated depreciation of S60,000 to date of sale. New equipment was purchased to replace it. Instructions Prepare a statement of cash flows for calendar 2017, using the indirect method

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

CASH FLOW STATEMENT Cash flows from operating activities Net income 84000 Adjustments for noncash ef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started