Answered step by step

Verified Expert Solution

Question

1 Approved Answer

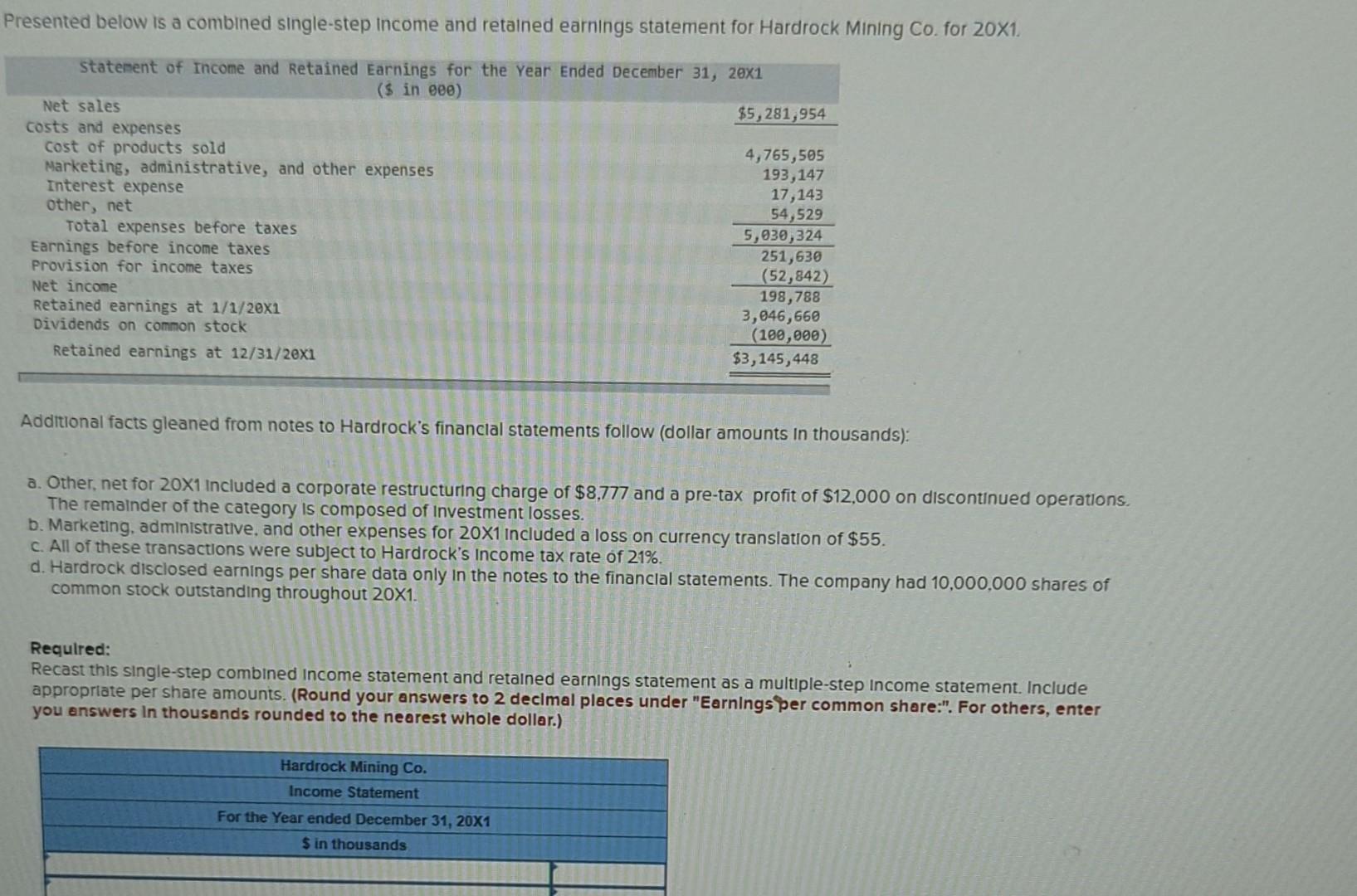

Additional facts gleaned from notes to Hardrock's financlal statements follow (dollar amounts In thousands): a. Other, net for 201 included a corporate restructuring charge of

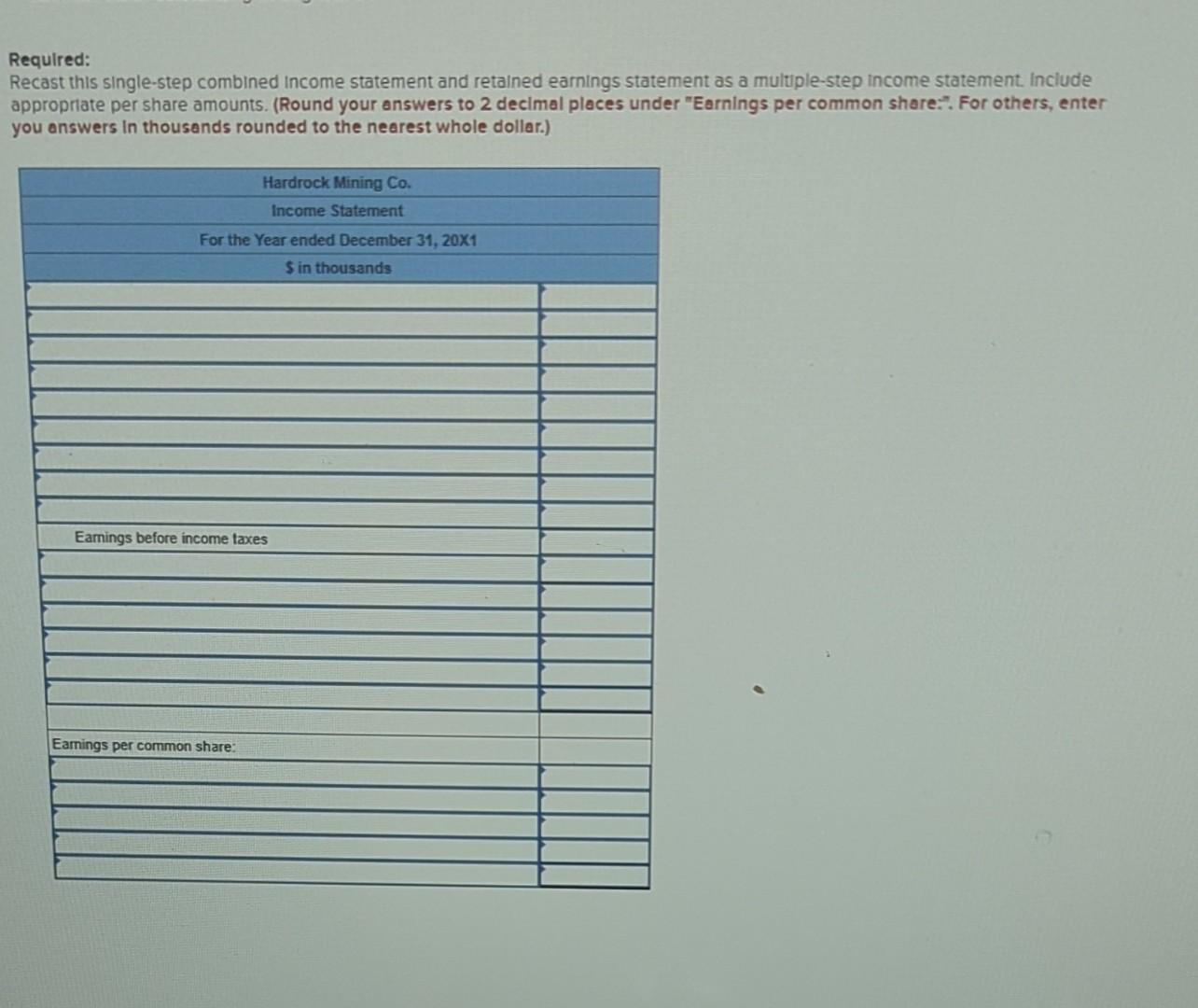

Additional facts gleaned from notes to Hardrock's financlal statements follow (dollar amounts In thousands): a. Other, net for 201 included a corporate restructuring charge of $8,777 and a pre-tax profit of $12,000 on discontinued operations. The remainder of the category is composed of Investment losses. b. Marketing, administrative, and other expenses for 20x1 included a loss on currency translation of $55. c. All of these transactions were subject to Hardrock's income tax rate of 21%. d. Hardrock disclosed earnings per share data only in the notes to the financlal statements. The company had 10,000,000 shares of common stock outstanding throughout 20X1. Required: Recast this single-step combined Income statement and retained earnings statement as a multiple-step income statement. Include approprlate per share amounts. (Round your answers to 2 declmal places under "Earnings per common share:". For others, enter you onswers in thousands rounded to the nearest whole dollar.) Requlred: Recast this single-step combined income statement and retained earnings statement as a multiple-step income statement. Include appropriate per share amounts. (Round your answers to 2 decimal places under "Earnings per common share:". For others, enter you onswers in thousands rounded to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started