Answered step by step

Verified Expert Solution

Question

1 Approved Answer

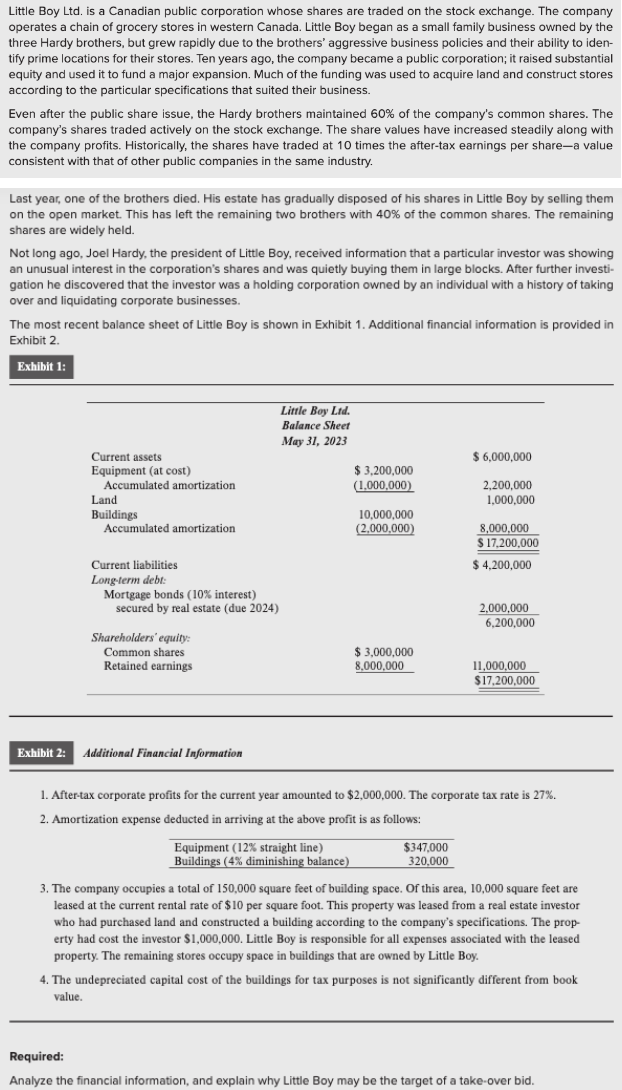

Additional Financial Information After - tax corporate profits for the current year amounted to $ 2 , 0 0 0 , 0 0 0 .

Additional Financial Information

Aftertax corporate profits for the current year amounted to $ The corporate tax rate is

Amortization expense deducted in arriving at the above profit is as follows:

The company occupies a total of square feet of building space. Of this area, square feet are

leased at the current rental rate of $ per square foot. This property was leased from a real estate investor

who had purchased land and constructed a building according to the company's specifications. The prop

erty had cost the investor $ Little Boy is responsible for all expenses associated with the leased

property. The remaining stores occupy space in buildings that are owned by Little Boy.

The undepreciated capital cost of the buildings for tax purposes is not significantly different from book

value.

Required:

Analyze the financial information, and explain why Little Boy may be the target of a takeover bid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started