Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Funding Needed (AFN) or External Funding Needed formula Data Needed for Calculations ACME Roadrunner Eradication Inc. Income Statement as of December 31, 2022 (in

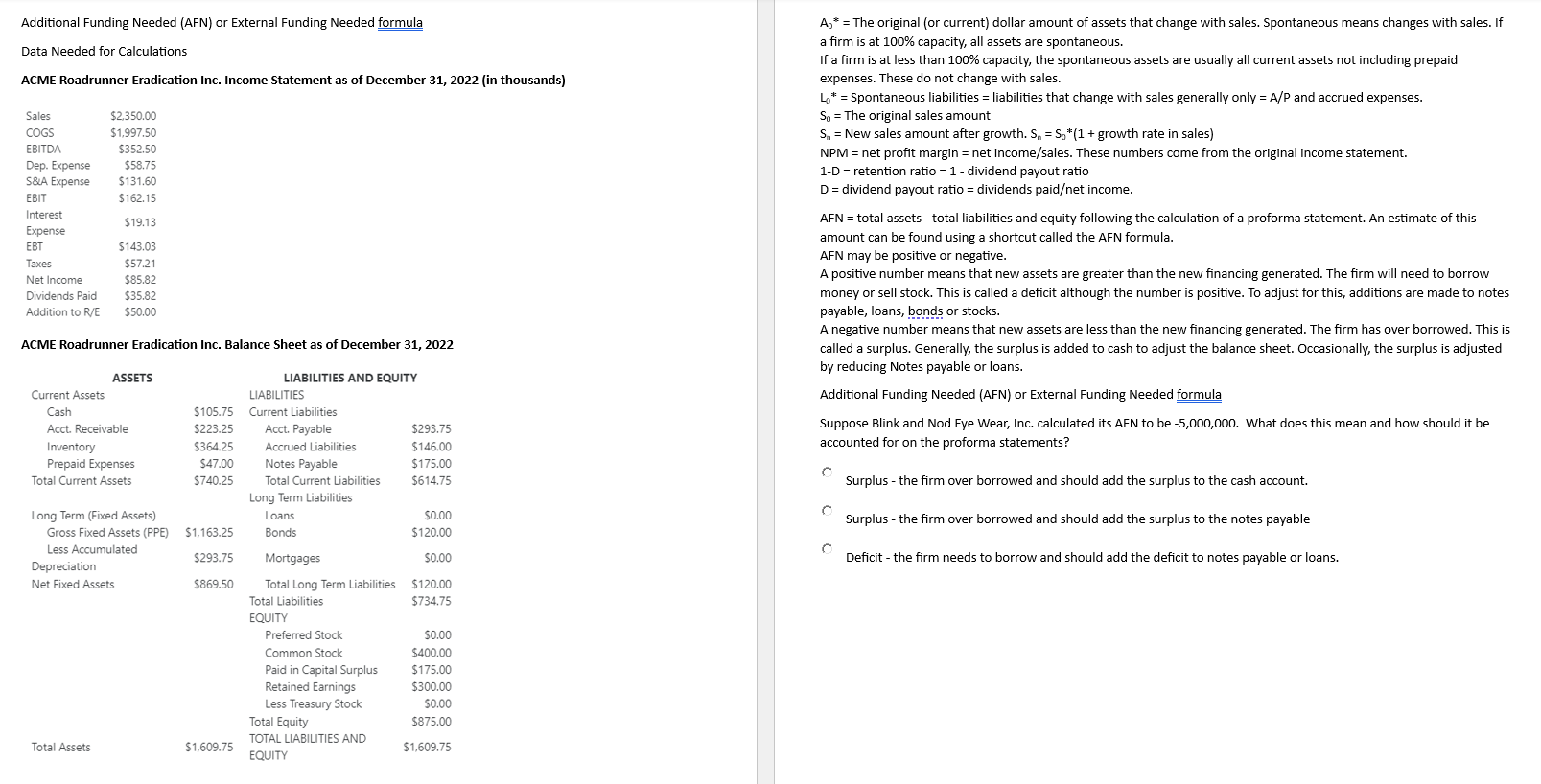

Additional Funding Needed (AFN) or External Funding Needed formula Data Needed for Calculations ACME Roadrunner Eradication Inc. Income Statement as of December 31, 2022 (in thousands) A0= The original (or current) dollar amount of assets that change with sales. Spontaneous means changes with sales. If a firm is at 100% capacity, all assets are spontaneous. If a firm is at less than 100% capacity, the spontaneous assets are usually all current assets not including prepaid expenses. These do not change with sales. L0= Spontaneous liabilities = liabilities that change with sales generally only =A/P and accrued expenses. S0= The original sales amount Sn= New sales amount after growth. Sn=S0(1+ growth rate in sales ) NPM = net profit margin = net income/sales. These numbers come from the original income statement. 1D= retention ratio =1 - dividend payout ratio D= dividend payout ratio = dividends paidet income. AFN = total assets - total liabilities and equity following the calculation of a proforma statement. An estimate of this amount can be found using a shortcut called the AFN formula. AFN may be positive or negative. A positive number means that new assets are greater than the new financing generated. The firm will need to borrow money or sell stock. This is called a deficit although the number is positive. To adjust for this, additions are made to notes payable, loans, bonds or stocks. A negative number means that new assets are less than the new financing generated. The firm has over borrowed. This is called a surplus. Generally, the surplus is added to cash to adjust the balance sheet. Occasionally, the surplus is adjusted by reducing Notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Suppose Blink and Nod Eye Wear, Inc. calculated its AFN to be 5,000,000. What does this mean and how should it be accounted for on the proforma statements? Surplus - the firm over borrowed and should add the surplus to the cash account. Surplus - the firm over borrowed and should add the surplus to the notes payable Deficit - the firm needs to borrow and should add the deficit to notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Data Needed for Calculations ACME Roadrunner Eradication Inc. Income Statement as of December 31, 2022 (in thousands) A0= The original (or current) dollar amount of assets that change with sales. Spontaneous means changes with sales. If a firm is at 100% capacity, all assets are spontaneous. If a firm is at less than 100% capacity, the spontaneous assets are usually all current assets not including prepaid expenses. These do not change with sales. L0= Spontaneous liabilities = liabilities that change with sales generally only =A/P and accrued expenses. S0= The original sales amount Sn= New sales amount after growth. Sn=S0(1+ growth rate in sales ) NPM = net profit margin = net income/sales. These numbers come from the original income statement. 1D= retention ratio =1 - dividend payout ratio D= dividend payout ratio = dividends paidet income. AFN = total assets - total liabilities and equity following the calculation of a proforma statement. An estimate of this amount can be found using a shortcut called the AFN formula. AFN may be positive or negative. A positive number means that new assets are greater than the new financing generated. The firm will need to borrow money or sell stock. This is called a deficit although the number is positive. To adjust for this, additions are made to notes payable, loans, bonds or stocks. A negative number means that new assets are less than the new financing generated. The firm has over borrowed. This is called a surplus. Generally, the surplus is added to cash to adjust the balance sheet. Occasionally, the surplus is adjusted by reducing Notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Suppose Blink and Nod Eye Wear, Inc. calculated its AFN to be 5,000,000. What does this mean and how should it be accounted for on the proforma statements? Surplus - the firm over borrowed and should add the surplus to the cash account. Surplus - the firm over borrowed and should add the surplus to the notes payable Deficit - the firm needs to borrow and should add the deficit to notes payable or loans

Additional Funding Needed (AFN) or External Funding Needed formula Data Needed for Calculations ACME Roadrunner Eradication Inc. Income Statement as of December 31, 2022 (in thousands) A0= The original (or current) dollar amount of assets that change with sales. Spontaneous means changes with sales. If a firm is at 100% capacity, all assets are spontaneous. If a firm is at less than 100% capacity, the spontaneous assets are usually all current assets not including prepaid expenses. These do not change with sales. L0= Spontaneous liabilities = liabilities that change with sales generally only =A/P and accrued expenses. S0= The original sales amount Sn= New sales amount after growth. Sn=S0(1+ growth rate in sales ) NPM = net profit margin = net income/sales. These numbers come from the original income statement. 1D= retention ratio =1 - dividend payout ratio D= dividend payout ratio = dividends paidet income. AFN = total assets - total liabilities and equity following the calculation of a proforma statement. An estimate of this amount can be found using a shortcut called the AFN formula. AFN may be positive or negative. A positive number means that new assets are greater than the new financing generated. The firm will need to borrow money or sell stock. This is called a deficit although the number is positive. To adjust for this, additions are made to notes payable, loans, bonds or stocks. A negative number means that new assets are less than the new financing generated. The firm has over borrowed. This is called a surplus. Generally, the surplus is added to cash to adjust the balance sheet. Occasionally, the surplus is adjusted by reducing Notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Suppose Blink and Nod Eye Wear, Inc. calculated its AFN to be 5,000,000. What does this mean and how should it be accounted for on the proforma statements? Surplus - the firm over borrowed and should add the surplus to the cash account. Surplus - the firm over borrowed and should add the surplus to the notes payable Deficit - the firm needs to borrow and should add the deficit to notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Data Needed for Calculations ACME Roadrunner Eradication Inc. Income Statement as of December 31, 2022 (in thousands) A0= The original (or current) dollar amount of assets that change with sales. Spontaneous means changes with sales. If a firm is at 100% capacity, all assets are spontaneous. If a firm is at less than 100% capacity, the spontaneous assets are usually all current assets not including prepaid expenses. These do not change with sales. L0= Spontaneous liabilities = liabilities that change with sales generally only =A/P and accrued expenses. S0= The original sales amount Sn= New sales amount after growth. Sn=S0(1+ growth rate in sales ) NPM = net profit margin = net income/sales. These numbers come from the original income statement. 1D= retention ratio =1 - dividend payout ratio D= dividend payout ratio = dividends paidet income. AFN = total assets - total liabilities and equity following the calculation of a proforma statement. An estimate of this amount can be found using a shortcut called the AFN formula. AFN may be positive or negative. A positive number means that new assets are greater than the new financing generated. The firm will need to borrow money or sell stock. This is called a deficit although the number is positive. To adjust for this, additions are made to notes payable, loans, bonds or stocks. A negative number means that new assets are less than the new financing generated. The firm has over borrowed. This is called a surplus. Generally, the surplus is added to cash to adjust the balance sheet. Occasionally, the surplus is adjusted by reducing Notes payable or loans. Additional Funding Needed (AFN) or External Funding Needed formula Suppose Blink and Nod Eye Wear, Inc. calculated its AFN to be 5,000,000. What does this mean and how should it be accounted for on the proforma statements? Surplus - the firm over borrowed and should add the surplus to the cash account. Surplus - the firm over borrowed and should add the surplus to the notes payable Deficit - the firm needs to borrow and should add the deficit to notes payable or loans Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started