Question

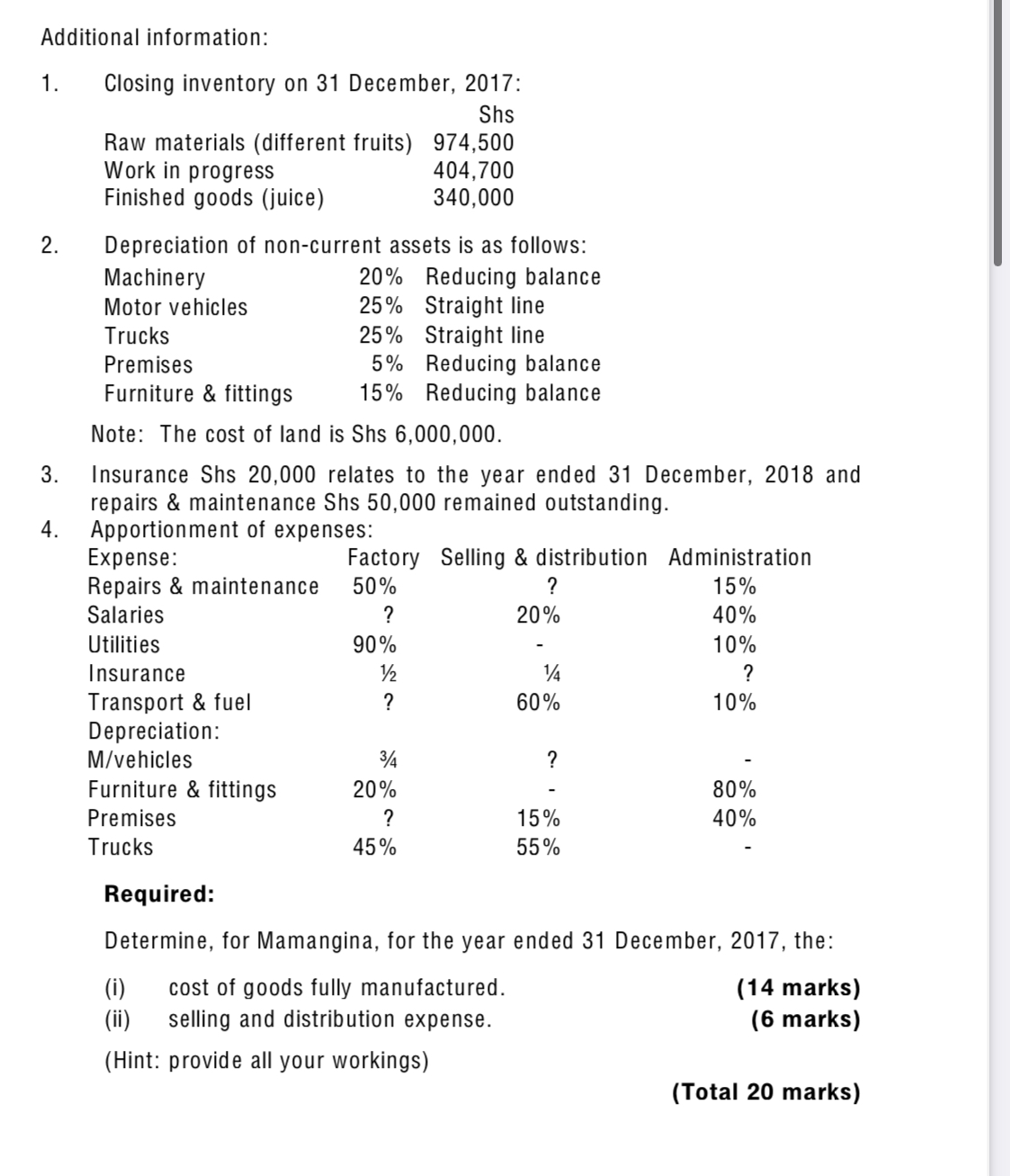

Additional information: 1. Closing inventory on 30 June, 2018 Shs 25,000,000. During the year, stock (secondhand clothes) worth Shs 5,500,000 got burned following a fire

Additional information: 1. Closing inventory on 30 June, 2018 Shs 25,000,000. During the year, stock (secondhand clothes) worth Shs 5,500,000 got burned following a fire outbreak. This stock was not accounted for in the books of account. 2. Abuya Enterprises employed one worker for a salary Shs 400,000 per month However, at the year end, half of his yearly salary was outstanding. 3. Market dues paid covered a period of 15 months. 4. On 1 January, 2018 Abuya Enterprise acquired a delivery van at Shs 24,000,000 cash from the proprietor's personal savings for business use. This was not recorded anywhere in the books of account. He provides for

depreciation on proportionate basis at 25% per annum on cost for all non- current assets. 5. Abuya drew business stock worth Shs 400,000 for his son who was joining University. This was not accounted for in the books of account.

Required: Prepare, for Abuya Enterprises, for the year ended 30 June, 2018, a statement of: (i) profit or loss. (10 marks) (ii) financial position. (10 marks) (Total 20 marks) Question 3 (a) The non-current assets of Sparkle Investments are neither recorded in the books of account nor depreciated. The manager does not deem it necessary to provide for depreciation of non-current assets. However, he has approached you, as an ATD finalist, to educate him about the concept of depreciation.

Required: In your notes, explain to the manager the: (i) importance of including a depreciation charge in the financial statements. (3 marks) (ii) effect of accounting for depreciation on the statements of profit or loss and financial position. (2 marks) (b) Shine Investments deals in real estate and its financial year ends on 31 December. On 30 June, 2016, they purchased an unfinished building A with 10 rental units (of equal values) at a total cost Shs 600,000,000. They incurred Shs 200,000,000 to complete and make it ready for use. On 1 January, 2017, they acquired a completed building B with 5 rental units at Shs 60,000,000 each and spent Shs 10,000,000 to paint all the units. On 30 December, 2018, Shine Investments got a deal to acquire land but did not have the required funds. They decided to sell the 5 rental units purchased on 1 January, 2017 at Shs 80,000,000 each to raise the funds.

The land was purchased at Shs 400,000,000 and Shs 10,000,000 was spent on the transfer of the land title; paid the surveyors Shs 5,000,000 and brokers Shs 2,000,000. On 15 July, 2018, they acquired a completed building D at Shs 120,000,000. It is Shine Investments' policy to charge full year's depreciation in the year of purchase and none in the year of disposal on non-current assets at 2% on straight line basis.

Required:

Prepare, for Shine Investments, for the years ended 31 December 2016, 2017 and 2018 the following accounts: (i) Buildings. (ii) Land. (iii) Accumulated depreciation. (iv) Disposal. (Hint: provide all your workings.) Question 4 Kabode and Kanyama are in partnership sharing profits and losses in the ratio 1:1. On 30 June, 2017 they agreed to admit Kazito into the business on condition that he contributes capital Shs 50 million, Shs 20 million as goodwill and a loan to the business Shs 100 million at 12% interest per annum. The partnership does not maintain a goodwill account. Goodwill is adjusted through the partners' capital accounts. The partnership's statement of financial position before admission of Kazito was as follows (next page):

Assets: Non-current assets: Land & buildings Delivery van Furniture & fittings Machinery Current assets: Inventory Accounts receivable Prepaid insurance Cash & bank balances Total assets Equity & liabilities: Capital account balances: Kabode Kanyama Current account balances: Kabode Kanyama Un-appropriated profits Non-current liabilities: 19% microfinance loan Current liabilities: Accounts payable Accrued interest on microfinance loan Outstanding salaries Total equity & liabilities: Shs '000' 250,000 30,000 15,000 40,000 12,500 36,400 2,100 45,650 431,650 100,000 60,000 36,000 (5,500) 199,870 32,000 6,400 2,080 800 431,650 Additional information: 1. The business revalued all the non-current assets as follows: Assets: Land & Buildings Delivery van Furniture & fittings Machinery Inventory Accounts receivable Shs '000' 350,000 35,000 13,000 50,000 12,000 36,000 2. The three partners were, each, to receive a salary Shs 300,000 per month starting 1 January, 2017 for Kabode and Kanyama, and Kazito starting on

1 July, 2017. The financial year for the partnership runs from 1 January to 31 December each year. 3. The new profit or loss sharing ratio to be 2:2:1 for Kabode, Kanyama and Kazito respectively. 4. Interest on capital is at 8% per annum and 5% per annum on drawings. 5. On 30 June, 2017 Kazito and Kanyama were to bring in furniture worth Shs 5 million and a motor vehicle worth Shs 12 million respectively as additional capital contribution. 6. Kabode and Kanyama decided to share the un-appropriated profits. 7. Drawings made during the year were as follows: Shs '000' Kabode 15,000 Kanyama 18,000 Date 1 July, 2017 1 September, 2017 8. Interest on loan, capital and drawings is always time apportioned.

Required: Prepare, for the partnership, for the year ended 31 December 2017: (a) Revaluation account. (b) Goodwill account. (c) Partners' capital accounts using fluctuation method.

Question 5 (a) The International Accounting Standards Board's (IASB) conceptual framework (framework) for financial reporting lays the foundation for resolving the 'Big' issues in accounting. You can think of it as the 'Why, Who, What, How' of financial reporting. The framework prescribes the nature, function and boundaries within which financial accounting and reporting operate.

Required: In light of the above statement, explain the: (a) purpose and scope of the framework. (9 marks) (b) elements of financial statements. (5 marks) (b) At the end of each accounting period, entities prepare sets of financial statements, in accordance with the International Accounting Standards (IASs), among other requirements, to report on their financial performance, financial position and cash flows, among others.

Required: In respect of IAS 7: Statement of Cash Flows, explain: (i) any three benefits of cash flow statements. (ii) the classification of cash flows.

Question 6 (3 marks) (3 marks) (Total 20 marks) The following balances were extracted from the books of Muliro Ltd as at 31 December, 2016: 10% preference share capital Ordinary share capital (200,000 shares at Shs 1,000) Share premium Net goodwill Treasury bills Motor vehicles Provision for depreciation for motor vehicles General reserve Retained earnings (1 January, 2016) Net profit for the year ended 31 December, 2016 Accounts receivable Closing inventory Accounts payable Cash Bank Interim ordinary dividends paid Additional information: Cr. Shs '000' 80,000 200,000 50,000 24,000 87,250 114,810 36,147 Dr. Shs '000' 64,000 120,000 60,000 46,500 34,500 202,630 69,837 390,000 10,000 794,837 794,837 1. The company's authorised share capital is 800,000 shares 2. Issued 80,000 ordinary shares Shs 1,200 each on 1 of Shs 1,000. January, 2016. 100,000 shares were applied for and the directors agreed to refund the money for the excess 20,000 shares and allot the remaining. These were fully paid for through the bank. 3. Transferred Shs 45 million to the general reserve. 4. Issued 200,000 ordinary shares at a premium to Mr. Senoga in exchange for land and building with values Shs 150 million and Shs 70 million respectively on 31 December, 2016. 5. The motor vehicles were revalued to Shs 40 million on 31 December, 2016.

6. Preference dividends remained accrued. Required:

Prepare, for Muliro Ltd for the year ended 31 December, 2016: (a) Journal entries for the additional notes 2-6 above. (Ignore narrations). (b) Statement of changes in equity. (c) The following accounts: (6 marks) (7 marks) (2 marks) (3 marks) (2 marks) (Total 20 marks) (i) (ii) (iii) Bank. Motor vehicles. Share application and allotment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started