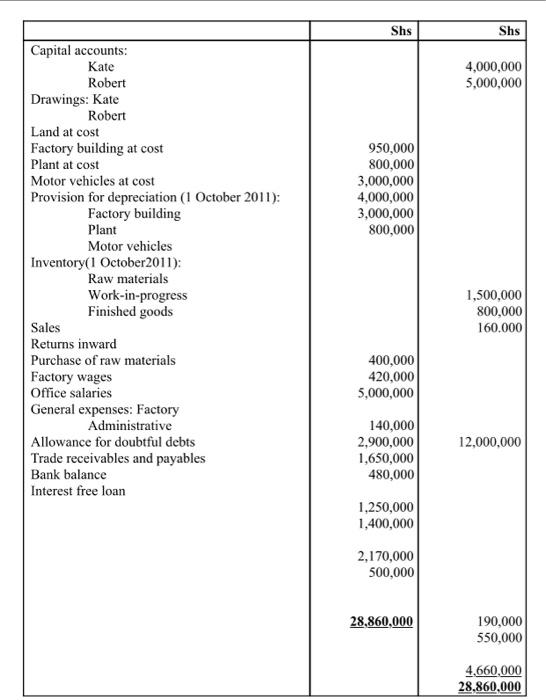

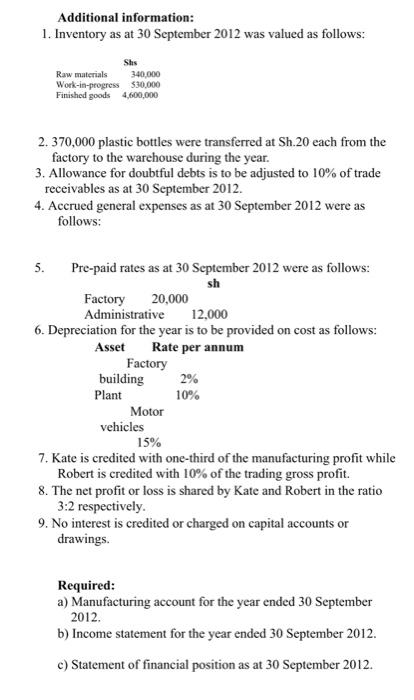

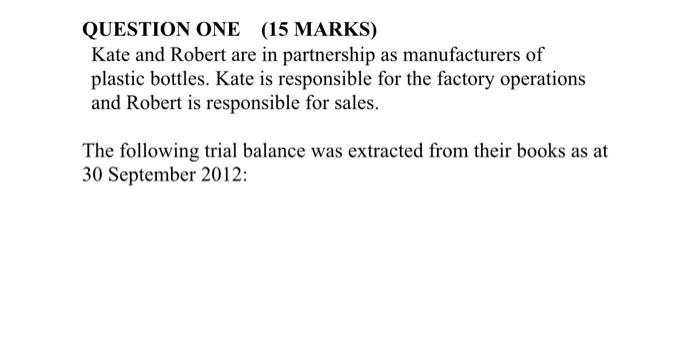

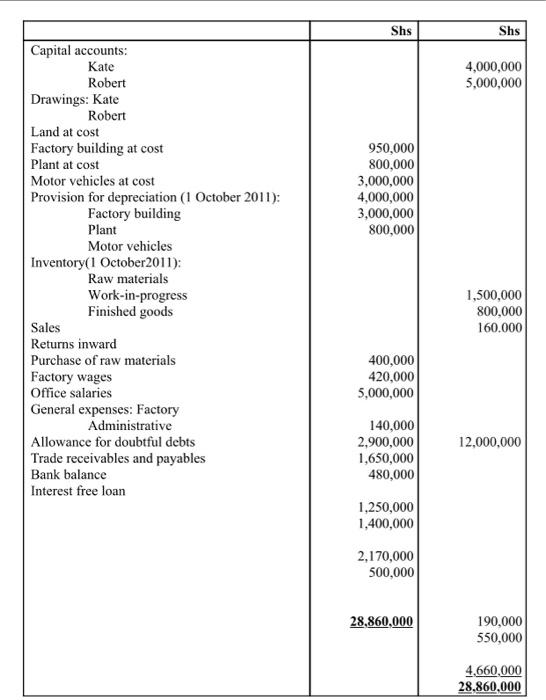

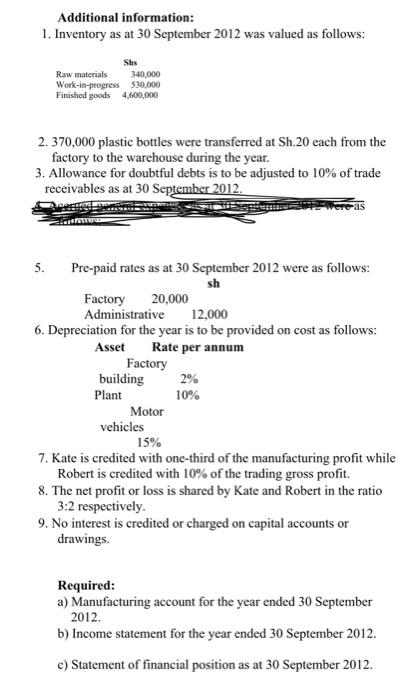

Additional information: 1. Inventory as at 30 September 2012 was valued as follows: 2. 370,000 plastic bottles were transferred at Sh. 20 each from the factory to the warehouse during the year. 3. Allowance for doubtful debts is to be adjusted to 10% of trade receivables as at 30 September 2012 . 4. Accrued general expenses as at 30 September 2012 were as follows: 5. Pre-paid rates as at 30 September 2012 were as follows: Factory 20,000 Administrative 12,000 6. Depreciation for the year is to be provided on cost as follows: Asset Rate per annum Factory building 2% Plant 10% Motor vehicles 15% 7. Kate is credited with one-third of the manufacturing profit while Robert is credited with 10% of the trading gross profit. 8. The net profit or loss is shared by Kate and Robert in the ratio 3:2 respectively. 9. No interest is credited or charged on capital accounts or drawings. Required: a) Manufacturing account for the year ended 30 September 2012. b) Income statement for the year ended 30 September 2012 . c) Statement of financial position as at 30 September 2012. QUESTION ONE (15 MARKS) Kate and Robert are in partnership as manufacturers of plastic bottles. Kate is responsible for the factory operations and Robert is responsible for sales. The following trial balance was extracted from their books as at 30 September 2012: Additional information: 1. Inventory as at 30 September 2012 was valued as follows: 2. 370,000 plastic bottles were transferred at Sh.20 each from the factory to the warehouse during the year. 3. Allowance for doubtful debts is to be adjusted to 10% of trade receivables as at 30 September 2012 . 5. Pre-paid rates as at 30 September 2012 were as follows: Factory 20,000 sh Administrative 12,000 6. Depreciation for the year is to be provided on cost as follows: Asset Rate per annum Factory building 2% Plant 10% Motor vehicles 15% 7. Kate is credited with one-third of the manufacturing profit while Robert is credited with 10% of the trading gross profit. 8. The net profit or loss is shared by Kate and Robert in the ratio 3:2 respectively. 9. No interest is credited or charged on capital accounts or drawings. Required: a) Manufacturing account for the year ended 30 September 2012. b) Income statement for the year ended 30 September 2012 . c) Statement of financial position as at 30 September 2012. Additional information: 1. Inventory as at 30 September 2012 was valued as follows: 2. 370,000 plastic bottles were transferred at Sh. 20 each from the factory to the warehouse during the year. 3. Allowance for doubtful debts is to be adjusted to 10% of trade receivables as at 30 September 2012 . 4. Accrued general expenses as at 30 September 2012 were as follows: 5. Pre-paid rates as at 30 September 2012 were as follows: Factory 20,000 Administrative 12,000 6. Depreciation for the year is to be provided on cost as follows: Asset Rate per annum Factory building 2% Plant 10% Motor vehicles 15% 7. Kate is credited with one-third of the manufacturing profit while Robert is credited with 10% of the trading gross profit. 8. The net profit or loss is shared by Kate and Robert in the ratio 3:2 respectively. 9. No interest is credited or charged on capital accounts or drawings. Required: a) Manufacturing account for the year ended 30 September 2012. b) Income statement for the year ended 30 September 2012 . c) Statement of financial position as at 30 September 2012. QUESTION ONE (15 MARKS) Kate and Robert are in partnership as manufacturers of plastic bottles. Kate is responsible for the factory operations and Robert is responsible for sales. The following trial balance was extracted from their books as at 30 September 2012: Additional information: 1. Inventory as at 30 September 2012 was valued as follows: 2. 370,000 plastic bottles were transferred at Sh.20 each from the factory to the warehouse during the year. 3. Allowance for doubtful debts is to be adjusted to 10% of trade receivables as at 30 September 2012 . 5. Pre-paid rates as at 30 September 2012 were as follows: Factory 20,000 sh Administrative 12,000 6. Depreciation for the year is to be provided on cost as follows: Asset Rate per annum Factory building 2% Plant 10% Motor vehicles 15% 7. Kate is credited with one-third of the manufacturing profit while Robert is credited with 10% of the trading gross profit. 8. The net profit or loss is shared by Kate and Robert in the ratio 3:2 respectively. 9. No interest is credited or charged on capital accounts or drawings. Required: a) Manufacturing account for the year ended 30 September 2012. b) Income statement for the year ended 30 September 2012 . c) Statement of financial position as at 30 September 2012