Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information: 1. The building was revalued during the year 2. Equipment costing $25,000 for which there a provision for depreciation of $5,500 was sold

Additional information:

1. The building was revalued during the year

2. Equipment costing $25,000 for which there a provision for depreciation of $5,500 was sold for a profit of $6,000

3. Dividends paid and proposed for the year amounted to $27,000

Required:

(a). Prepare the Statement of Cash flows for the year ended 31 December 2012.

(b). Does the statement of cash flows prepared express any concern you have about the company's liquidity?

I need help. Please show all workings.

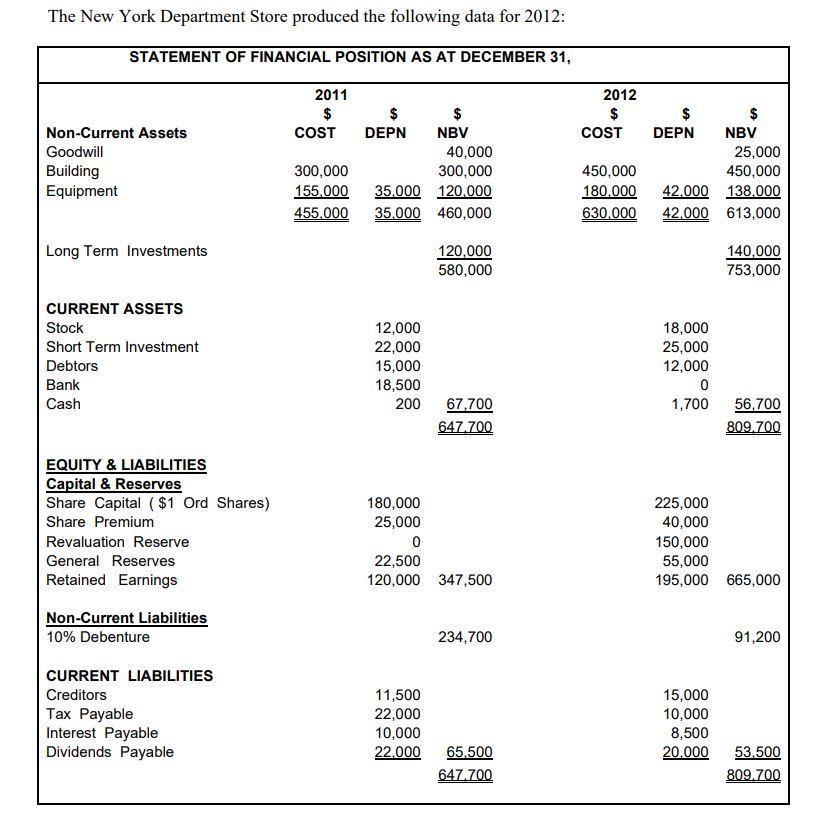

The New York Department Store produced the following data for 2012: STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, Non-Current Assets Goodwill Building Equipment Long Term Investments CURRENT ASSETS Stock Short Term Investment Debtors Bank Cash EQUITY & LIABILITIES Capital & Reserves Share Capital ($1 Ord Shares) Share Premium Revaluation Reserve General Reserves Retained Earnings Non-Current Liabilities 10% Debenture CURRENT LIABILITIES Creditors Tax Payable Interest Payable Dividends Payable 2011 $ COST $ $ DEPN NBV 40,000 300,000 300,000 155,000 35.000 120.000 455,000 35,000 460,000 12,000 22,000 15,000 18,500 200 120,000 580,000 11,500 22,000 10,000 22,000 67,700 647.700 180,000 25,000 0 22,500 120,000 347,500 234,700 65,500 647.700 2012 $ $ COST DEPN 450,000 180,000 42.000 630,000 42,000 18,000 25,000 12,000 0 1,700 $ NBV 15,000 10,000 8,500 20,000 25,000 450,000 138.000 613,000 140,000 753,000 56,700 809,700 225,000 40,000 150,000 55,000 195,000 665,000 91,200 53,500 809,700

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer To prepare the Statement of Cash Flows for the year ended 31 December 2012 we need to analyze the changes in the various accounts between 2011 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started