Question

Additional information: 1. The business uses the periodic method for accounting for inventory and a gross profit percentage of 20% is used. 2. During the

Additional information:

1. The business uses the periodic method for accounting for inventory and a gross profit percentage of 20% is used.

2. During the year, the owner took inventory for personal use, with a selling price of R5 400. This transaction has not yet been recorded in the records of the business.

3. On 31 December 2020, unused supplies and inventory were physically counted and amounted to R2 200 and R124 980 respectively.

4. The equipment was purchased on 01 March 2020 and the residual value of the equipment is estimated to be R40 000 at the end of its useful life. The estimated useful life is 4 years. The straight-line method of depreciation is used.

5. The buildings are depreciated at 5% per annum using the diminishing balance method. No additions were made to buildings.

6. The owner paid his personal house cleaner R9 500 with a business cheque and debited salaries expenses during the year.

7. A debtor was declared insolvent, who owed Magneto R3 500. The total amount must be written off as irrecoverable.

8. An allowance of 5% of the accounts receivable still needs to be made for doubtful debts on 31 December 2020.

9. The business rents out a part of the building to a tenant. The rental agreement stipulates that all rent should be paid in advance on the 1st of each month. The tenant prefers paying upfront on the last day of the previous month and has done so in December as well.

10. Magneto has two advertising contracts, one with AdMore and another with DieTyger. The advertising for each company is R400 per month. Magneto sometimes pays the advertising expense early and sometime late.

11. Magneto took out a loan on 01 April 2020 and interest on the loan is charged at a rate of 10% per annum. The loan agreement also calls for six monthly interest payments at the end of each half-year. A six-monthly payment was made and recorded on 30 September 2020.

12. The investment was taken out on 01 March 2020 and interest will be received annually on 28 February.

You are required to:

a) Prepare the Post-Adjustment Trial Balance of Magneto as AT 31 December 2020. Show all calculations.

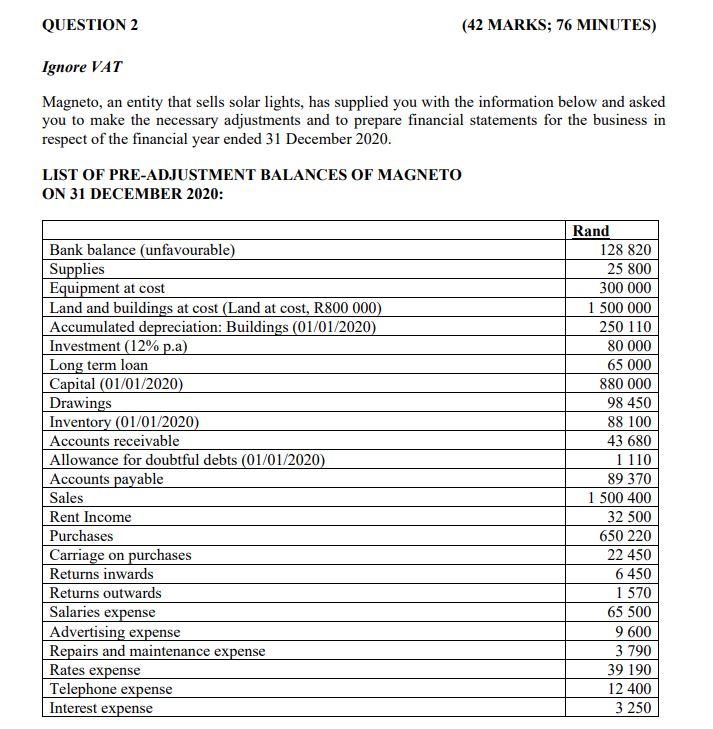

Ignore VAT Magneto, an entity that sells solar lights, has supplied you with the information below and asked you to make the necessary adjustments and to prepare financial statements for the business in respect of the financial year ended 31 December 2020. LIST OF PRE-ADJUSTMENT BALANCES OF MAGNETO ON 21 DFCFMRFR TO?0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started