Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information 1. The rental income was received from Mr. Abdul Gupta for the period 1 August 2021 until 31 January 2023. 2. The outstanding

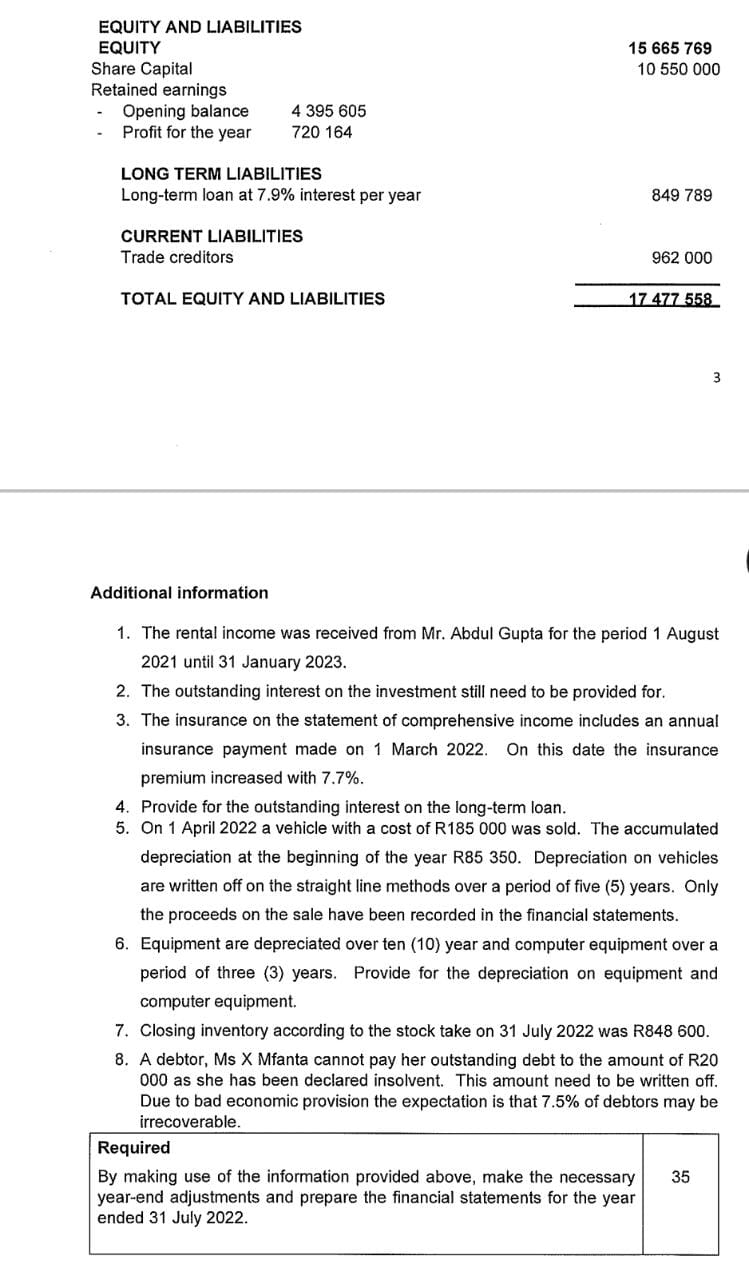

Additional information 1. The rental income was received from Mr. Abdul Gupta for the period 1 August 2021 until 31 January 2023. 2. The outstanding interest on the investment still need to be provided for. 3. The insurance on the statement of comprehensive income includes an annual insurance payment made on 1 March 2022. On this date the insurance premium increased with 7.7%. 4. Provide for the outstanding interest on the long-term loan. 5. On 1 April 2022 a vehicle with a cost of R185 000 was sold. The accumulated depreciation at the beginning of the year R85 350. Depreciation on vehicles are written off on the straight line methods over a period of five (5) years. Only the proceeds on the sale have been recorded in the financial statements. 6. Equipment are depreciated over ten (10) year and computer equipment over a period of three (3) years. Provide for the depreciation on equipment and computer equipment. 7. Closing inventory according to the stock take on 31 July 2022 was R848 600 . 8. A debtor, Ms X Mfanta cannot pay her outstanding debt to the amount of R20 000 as she has been declared insolvent. This amount need to be written off. Due to bad economic provision the expectation is that 7.5% of debtors may be irrecoverable. Required By making use of the information provided above, make the necessary 35 year-end adjustments and prepare the financial statements for the year ended 31 July 2022

Additional information 1. The rental income was received from Mr. Abdul Gupta for the period 1 August 2021 until 31 January 2023. 2. The outstanding interest on the investment still need to be provided for. 3. The insurance on the statement of comprehensive income includes an annual insurance payment made on 1 March 2022. On this date the insurance premium increased with 7.7%. 4. Provide for the outstanding interest on the long-term loan. 5. On 1 April 2022 a vehicle with a cost of R185 000 was sold. The accumulated depreciation at the beginning of the year R85 350. Depreciation on vehicles are written off on the straight line methods over a period of five (5) years. Only the proceeds on the sale have been recorded in the financial statements. 6. Equipment are depreciated over ten (10) year and computer equipment over a period of three (3) years. Provide for the depreciation on equipment and computer equipment. 7. Closing inventory according to the stock take on 31 July 2022 was R848 600 . 8. A debtor, Ms X Mfanta cannot pay her outstanding debt to the amount of R20 000 as she has been declared insolvent. This amount need to be written off. Due to bad economic provision the expectation is that 7.5% of debtors may be irrecoverable. Required By making use of the information provided above, make the necessary 35 year-end adjustments and prepare the financial statements for the year ended 31 July 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started