Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information 3 Inventory at 31 March 20X9 was valued at $250,000. Buildings and plant and machinery are depreciated on a straight-line basis (assuming

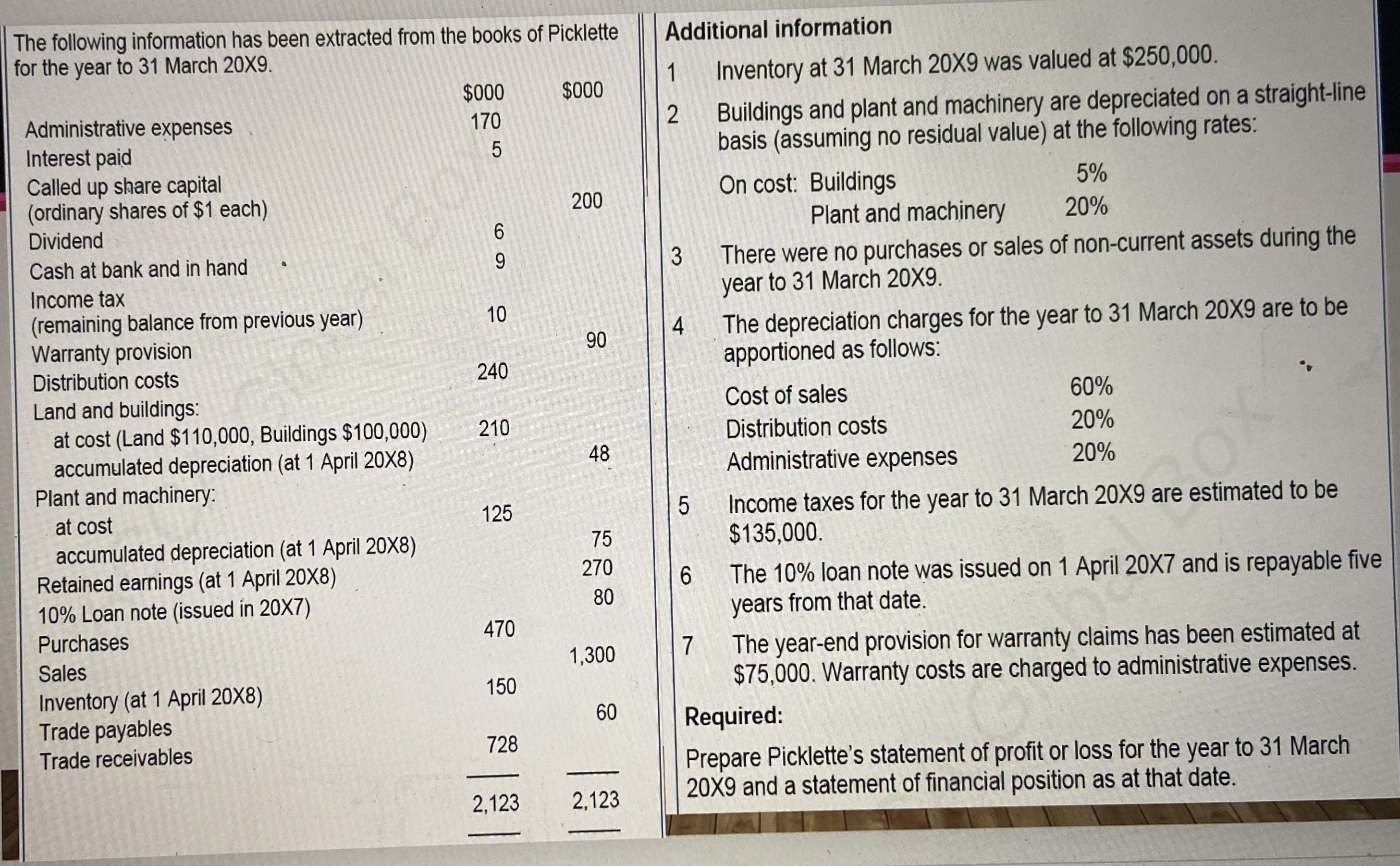

Additional information 3 Inventory at 31 March 20X9 was valued at $250,000. Buildings and plant and machinery are depreciated on a straight-line basis (assuming no residual value) at the following rates: On cost: Buildings Plant and machinery 5% 20% There were no purchases or sales of non-current assets during the year to 31 March 20X9. 1 $000 170 $000 2 The following information has been extracted from the books of Picklette for the year to 31 March 20X9. Administrative expenses Interest paid Called up share capital (ordinary shares of $1 each) Dividend Cash at bank and in hand Income tax (remaining balance from previous year) Warranty provision 5 69 10 10 200 4 90 90 The depreciation charges for the year to 31 March 20X9 are to be apportioned as follows: 60% 20% Administrative expenses 20% Cost of sales Distribution costs Income taxes for the year to 31 March 20X9 are estimated to be $135,000. The 10% loan note was issued on 1 April 20X7 and is repayable five years from that date. The year-end provision for warranty claims has been estimated at $75,000. Warranty costs are charged to administrative expenses. Required: Prepare Picklette's statement of profit or loss for the year to 31 March 20X9 and a statement of financial position as at that date. Distribution costs 240 Land and buildings: at cost (Land $110,000, Buildings $100,000) 210 accumulated depreciation (at 1 April 20X8) 48 Plant and machinery: at cost 125 5 accumulated depreciation (at 1 April 20X8) 75 Retained earnings (at 1 April 20X8) 270 6 10% Loan note (issued in 20X7) 80 Purchases 470 Sales 1,300 7 Inventory (at 1 April 20X8) 150 Trade payables 60 Trade receivables 728 2,123 2,123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare Picklettes statement of profit or loss for the year to 31 March 20X9 we need to ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started