Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Information: a) Rent revenue is tax assessable when it is received in cash b) Government grant is not tax assessable c) Doubtful debts are

| Additional Information: | ||||||||

| a) | Rent revenue is tax assessable when it is received in cash | |||||||

| b) | Government grant is not tax assessable | |||||||

| c) | Doubtful debts are tax deductible when the company actually incurs bad debts/write offs | |||||||

| d) | For accounting purposes, plant is depreciated using the straight line method at a rate of: | 10% | per annum | |||||

| For tax purposes, however, plant is depreciated at a rate of: | 15% | per annum | ||||||

| e) | Depreciation of buildings and entertainment expense are not allowed as tax deductions | |||||||

| f) | Employee entitlements including annual leave are tax deductible when they are paid in cash to the employees | |||||||

| g) | Insurance expense is tax deductible when it is paid in cash | |||||||

| h) | Warranty expense is tax deductible when it is paid in cash | |||||||

| i) | Aggregated turnover for the years ended 30 June 2019 and 2020 is in excess of $25 million and it is expected that turnover will exceed $50 million in the year ended 30 June 2021 | |||||||

| Required: | ||||||||

| ||||||||

| ) | Using Sheet 3 ("Calculating DTA_DTL 2020"), calculate the Deferred Tax Asset and Deferred Tax Liability balances as at 30th June 2020 - show all relevant workings. Prepare the deferred tax journal entry for the year ended 30th June 2020. Note that you are NOT required to prepare a journal entry to offset the Deferred Tax Asset and Deferred Tax Liability balances. () | |||||||

| 3) | Assume that by 1 December 2020 there was a change in tax rate | from: | 30% | |||||

| to: | 27.50% | |||||||

| Using Sheet 4 ("Change in Tax Rate") briefly discuss the accounting treatment under accounting standard AASB112 "Income Taxes" for the Deferred Tax Asset and Deferred Tax Liability balances as at 1 December 2020 given that the company may now be in a lower tax threshold for the 2020-2021 financial year (maximum 100 words in the space provided). | ||||||||

| Should you believe an accounting change is necessary, prepare the journal entry to record the effect of the change in tax rate. () | ||||||||

| Note that the opening balances of DTA and DTL for the year ended 30 June 2021 are the closing balances for the year ended 30 June 2020 from part (b) | ||||||||

| In each of the four sheets, you can only enter data (text or numbers) in cells shaded in yellow. | ||||||||

| All marks will be awarded to numbers only, except for the discussion in Part (c). | ||||||||

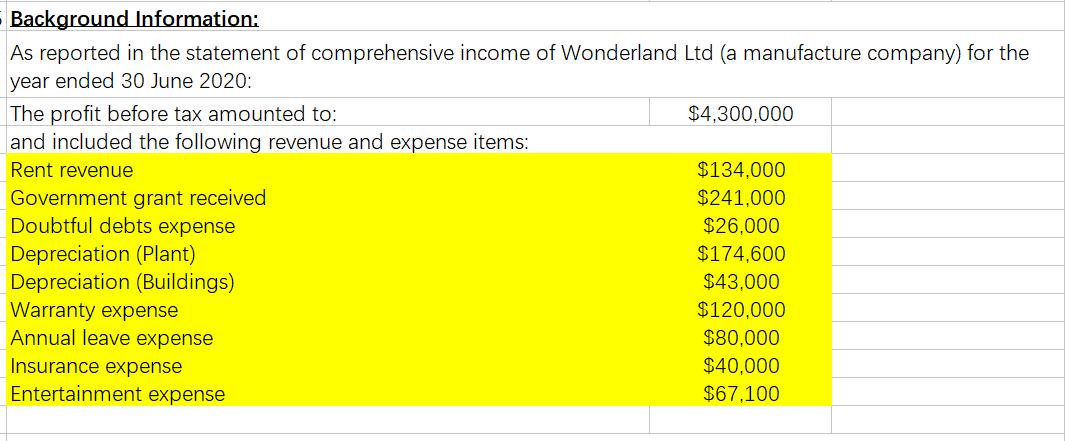

Background Information: As reported in the statement of comprehensive income of Wonderland Ltd (a manufacture company) for the year ended 30 June 2020: The profit before tax amounted to: and included the following revenue and expense items: Rent revenue Government grant received Doubtful debts expense Depreciation (Plant) Depreciation (Buildings) Warranty expense Annual leave expense Insurance expense Entertainment expense $4,300,000 $134,000 $241,000 $26,000 $174,600 $43,000 $120,000 $80,000 $40,000 $67,100

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer 2 Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started