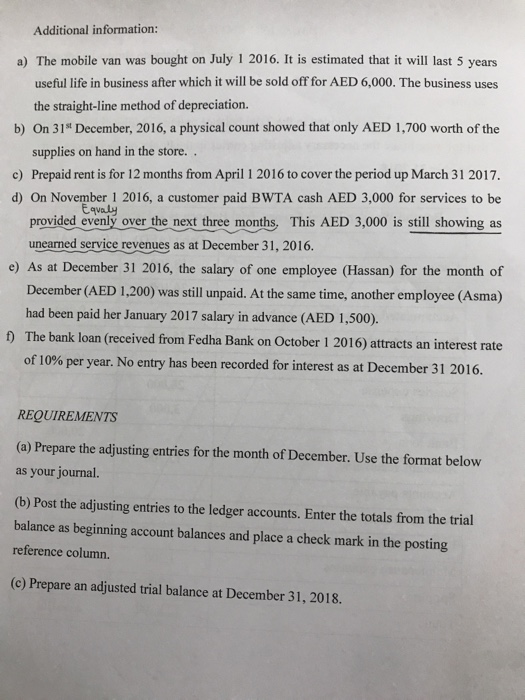

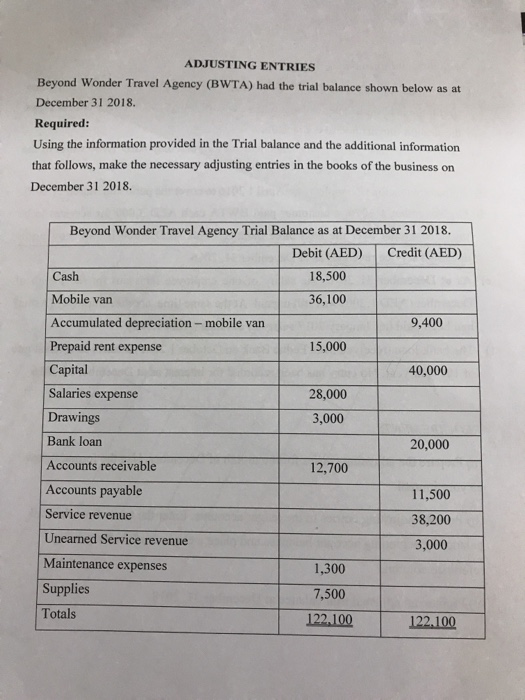

Additional information: a) The mobile van was bought on July 1 2016. It is estimated that it will last 5 years useful life in business after which it will be sold off for AED 6,000. The business uses the straight-line method of depreciation. b) On 31st December, 2016, a physical count showed that only AED 1,700 worth of the supplies on hand in the store. c) Prepaid rent is for 12 months from April 1 2016 to cover the period up March 31 2017. d) On November 1 2016, a customer paid BWTA cash AED 3,000 for services to be provided evenly over the next three months This AED 3,000 is still showing as Eqvaly unearned service revenues as at December 31, 2016. e) As at December 31 2016, the salary of one employee (Hassan) for the month of December (AED 1.200) was still unpaid. At the same time, another employee (Asma) had been paid her January 2017 salary in advance (AED 1,500). f) The bank loan (received from Fedha Bank on October 1 2016) attracts an interest rate of 10% per year. No entry has been recorded for interest as at December 31 2016. REQUIREMENTS (a) Prepare the adjusting entries for the month of December. Use the format below as your journal. (b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances and place a check mark in the posting reference column. (c) Prepare an adjusted trial balance at December 31, 2018. ADJUSTING ENTRIES Beyond Wonder Travel Agency (BWTA) had the trial balance shown below as at December 31 2018. Required: Using the information provided in the Trial balance and the additional information that follows, make the necessary adjusting entries in the books of the business on December 31 2018. Beyond Wonder Travel Agency Trial Balance as at December 31 2018. Debit (AED) Credit (AED) Cash Mobile van Accumulated depreciation- mobile van Prepaid rent expense Capital Salaries expense Drawings Bank loan Accounts receivable Accounts payable Service revenue Unearned Service revenue Maintenance expenses Supplies Totals 18,500 36,100 9,400 15,000 40,000 28,000 3,000 20,000 12,700 11,500 38,200 3,000 1,300 7,500 122,100 122.100