Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information: Financial info - Costs and Revenues Non-Financial Info - effect on employee turnover, environment, the overall image of the company. This means, we

Additional information:

Financial info - Costs and Revenues

Non-Financial Info - effect on employee turnover, environment, the overall image of the company.

This means, we cant make our decision purely based on the number then, for our conclusion we need to consider both the factors (for question 1 and 2)

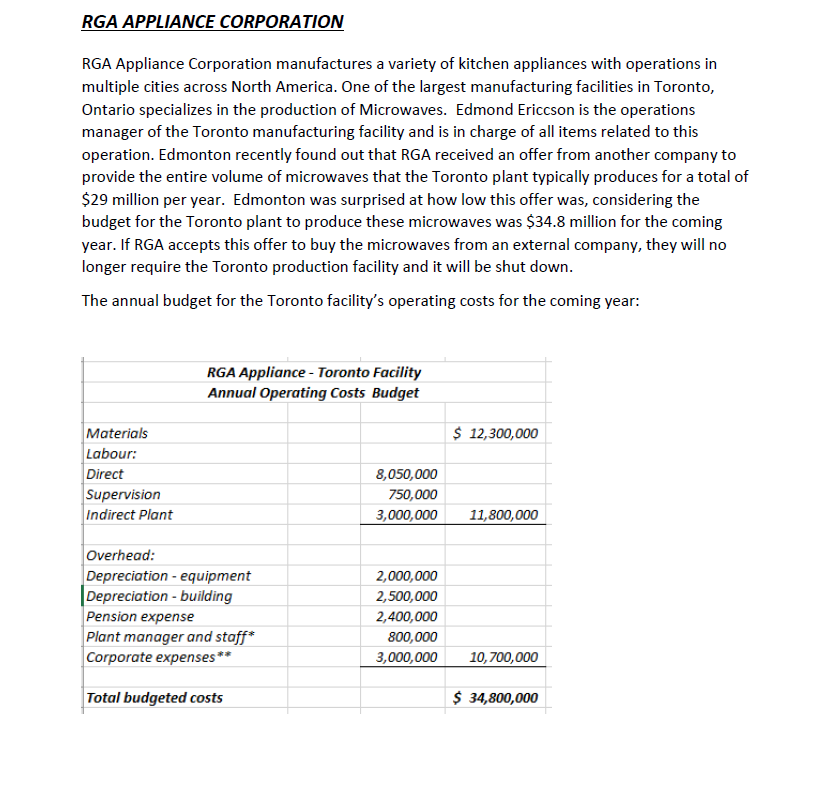

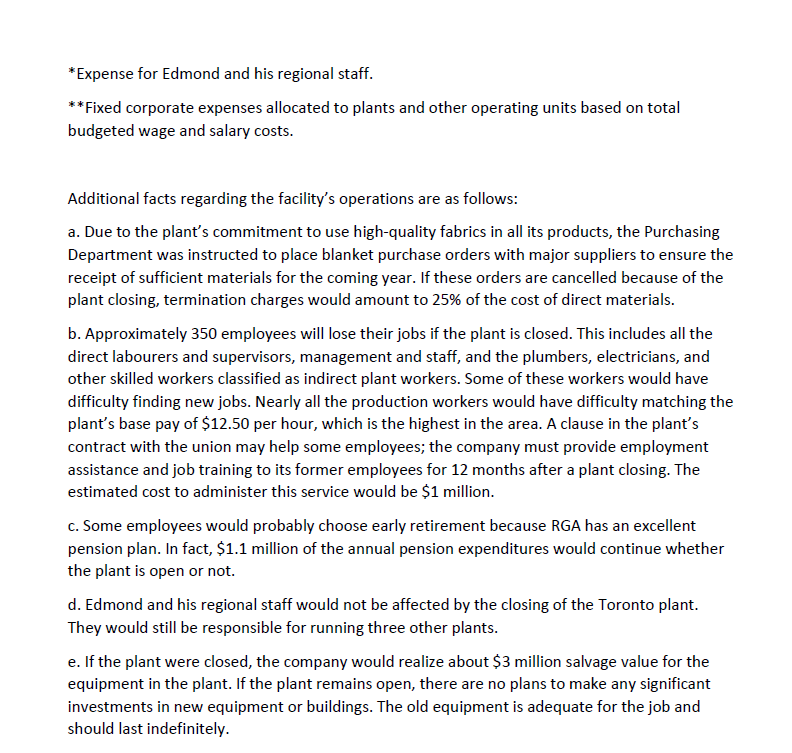

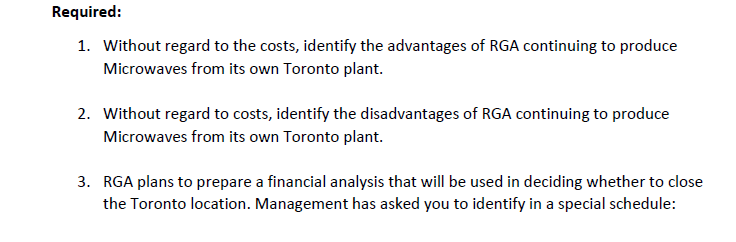

RGA APPLIANCE CORPORATION RGA Appliance Corporation manufactures a variety of kitchen appliances with operations in multiple cities across North America. One of the largest manufacturing facilities in Toronto, Ontario specializes in the production of Microwaves. Edmond Ericcson is the operations manager of the Toronto manufacturing facility and is in charge of all items related to this operation. Edmonton recently found out that RGA received an offer from another company to provide the entire volume of microwaves that the Toronto plant typically produces for a total of $29 million per year. Edmonton was surprised at how low this offer was, considering the budget for the Toronto plant to produce these microwaves was $34.8 million for the coming year. If RGA accepts this offer to buy the microwaves from an external company, they will no longer require the Toronto production facility and it will be shut down. The annual budget for the Toronto facility's operating costs for the coming year: RGA Appliance - Toronto Facility Annual Operating costs Budget $ 12,300,000 Materials Labour: Direct Supervision Indirect Plant 8,050,000 750,000 3,000,000 11,800,000 Overhead: Depreciation - equipment |Depreciation - building Pension expense Plant manager and staff* Corporate expenses** 2,000,000 2,500,000 2,400,000 800,000 3,000,000 10,700,000 Total budgeted costs $ 34,800,000 * Expense for Edmond and his regional staff. **Fixed corporate expenses allocated to plants and other operating units based on total budgeted wage and salary costs. Additional facts regarding the facility's operations are as follows: a. Due to the plant's commitment to use high-quality fabrics in all its products, the Purchasing Department was instructed to place blanket purchase orders with major suppliers to ensure the receipt of sufficient materials for the coming year. If these orders are cancelled because of the plant closing, termination charges would amount to 25% of the cost of direct materials. b. Approximately 350 employees will lose their jobs if the plant is closed. This includes all the direct labourers and supervisors, management and staff, and the plumbers, electricians, and other skilled workers classified as indirect plant workers. Some of these workers would have difficulty finding new jobs. Nearly all the production workers would have difficulty matching the plant's base pay of $12.50 per hour, which is the highest in the area. A clause in the plant's contract with the union may help some employees; the company must provide employment assistance and job training to its former employees for 12 months after a plant closing. The estimated cost to administer this service would be $1 million. C. Some employees would probably choose early retirement because RGA has an excellent pension plan. In fact, $1.1 million of the annual pension expenditures would continue whether the plant is open or not. d. Edmond and his regional staff would not be affected by the closing of the Toronto plant. They would still be responsible for running three other plants. e. If the plant were closed, the company would realize about $3 million salvage value for the equipment in the plant. If the plant remains open, there are no plans to make any significant investments in new equipment or buildings. The old equipment is adequate for the job and should last indefinitely. Required: 1. Without regard to the costs, identify the advantages of RGA continuing to produce Microwaves from its own Toronto plant. 2. Without regard to costs, identify the disadvantages of RGA continuing to produce Microwaves from its own Toronto plant. 3. RGA plans to prepare a financial analysis that will be used in deciding whether to close the Toronto location. Management has asked you to identify in a special schedule: a) The annual budgeted costs that are relevant to the decision regarding closing the plant (show the dollar amounts). b) The annual budgeted costs that are not relevant to the decision regarding closing the plant and explain why they are not relevant (show the dollar amounts). c) Any non-recurring costs that would arise due to the closing of the plant and explain how they would affect the decision (show the dollar amounts). 4. Using the information from the response above, prepare an incremental analysis comparing the alternatives. 5. Prepare a Memo for RGA's Management explaining to them whether the plant should be closed. Use a combination of financial and non-financial considerations in your responseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started