Additional Information for 2019 includes:

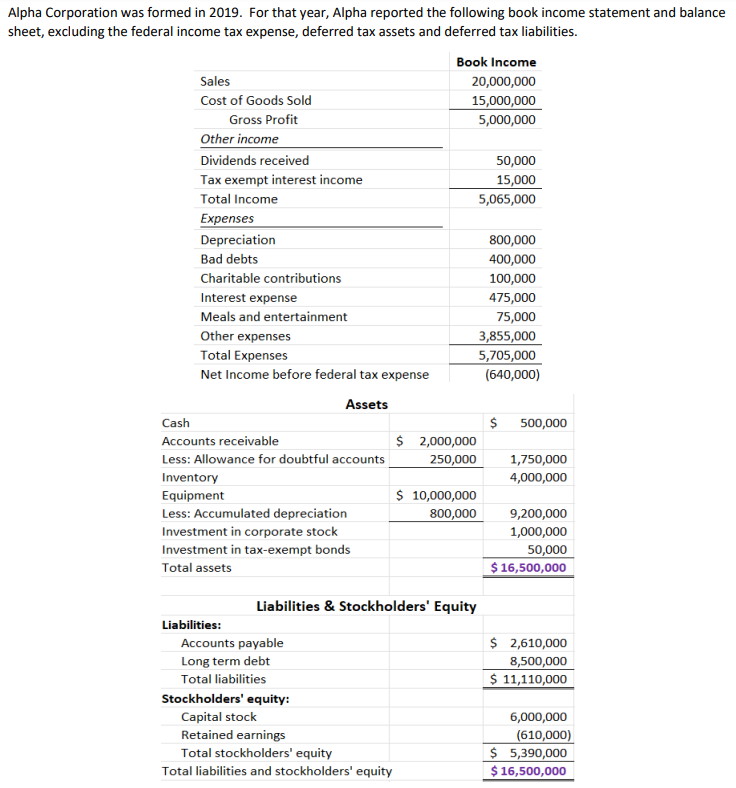

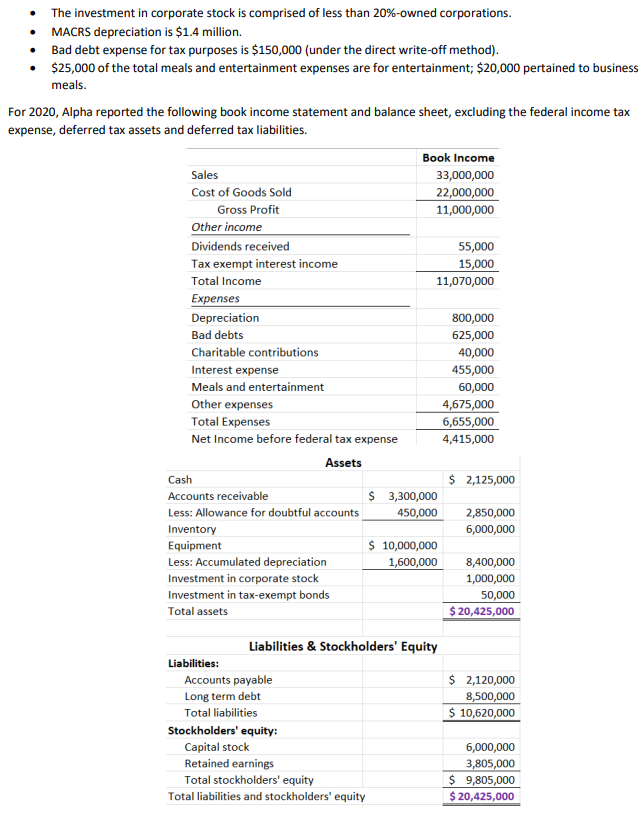

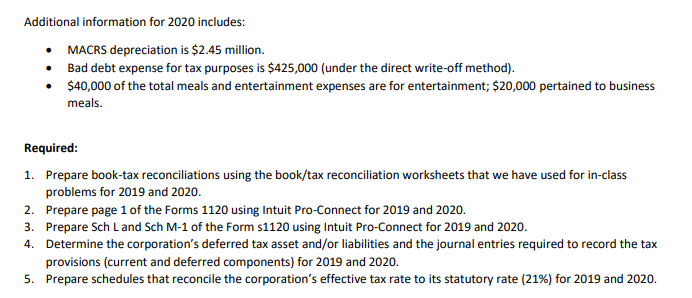

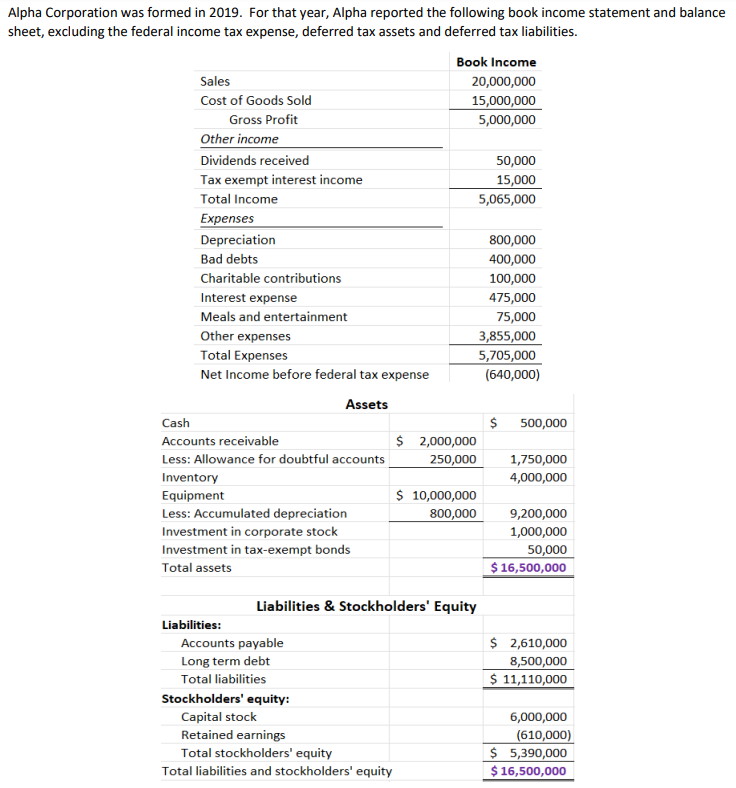

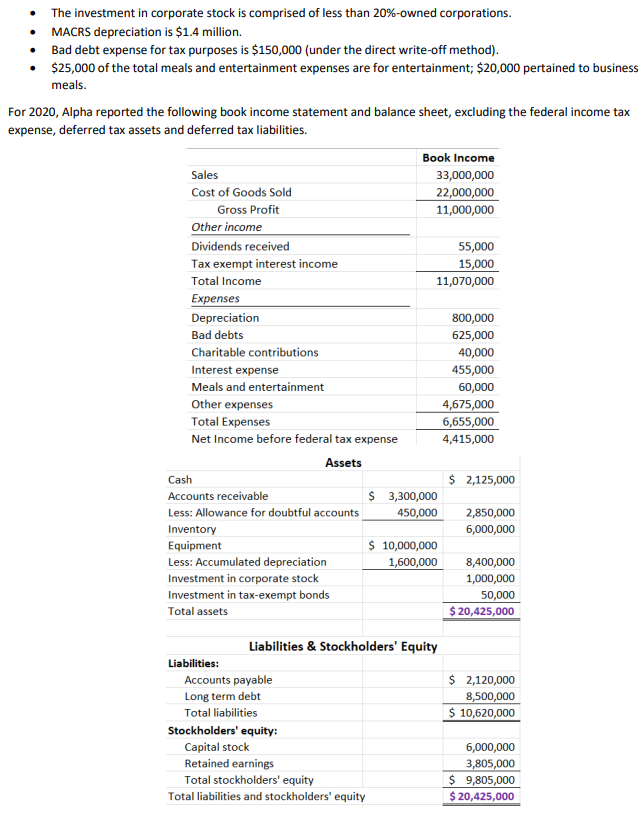

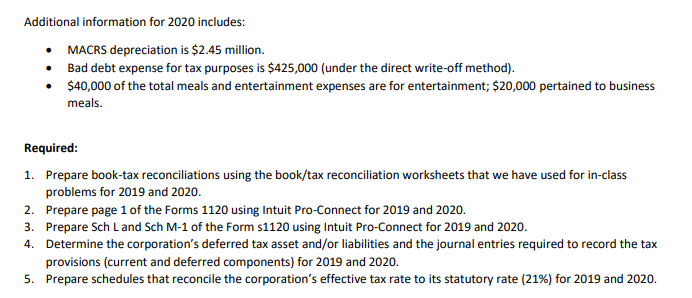

Alpha Corporation was formed in 2019. For that year, Alpha reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets and deferred tax liabilities. Book Income Sales 20,000,000 Cost of Goods Sold 15,000,000 Gross Profit 5,000,000 Other income Dividends received 50,000 Tax exempt interest income 15,000 Total Income 5,065,000 Expenses Depreciation 800,000 Bad debts 400,000 Charitable contributions 100,000 Interest expense 475,000 Meals and entertainment 75,000 Other expenses 3,855,000 Total Expenses 5,705,000 Net Income before federal tax expense (640,000) Assets Cash $ 500,000 Accounts receivable $ 2,000,000 Less: Allowance for doubtful accounts 250,000 1,750,000 Inventory 4,000,000 Equipment $ 10,000,000 Less: Accumulated depreciation 800,000 9,200,000 Investment in corporate stock 1,000,000 Investment in tax-exempt bonds 50,000 Total assets $ 16,500,000 Liabilities & Stockholders' Equity Liabilities: Accounts payable Long term debt Total liabilities Stockholders' equity: Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2,610,000 8,500,000 $ 11,110,000 6,000,000 (610,000) $ 5,390,000 $ 16,500,000 The investment in corporate stock is comprised of less than 20%-owned corporations. MACRS depreciation is $1.4 million. Bad debt expense for tax purposes is $150,000 (under the direct write-off method). $25,000 of the total meals and entertainment expenses are for entertainment; $20,000 pertained to business meals. For 2020, Alpha reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets and deferred tax liabilities. Book Income Sales 33,000,000 Cost of Goods Sold 22,000,000 Gross Profit 11,000,000 Other income Dividends received 55,000 Tax exempt interest income 15,000 Total Income 11,070,000 Expenses Depreciation 800,000 Bad debts 625,000 Charitable contributions 40,000 Interest expense 455,000 Meals and entertainment 60,000 Other expenses 4,675,000 Total Expenses 6,655,000 Net Income before federal tax expense 4,415,000 Assets Cash $ 2,125,000 Accounts receivable $ 3,300,000 Less: Allowance for doubtful accounts 450,000 2,850,000 Inventory 6,000,000 Equipment $ 10,000,000 Less: Accumulated depreciation 1,600,000 8,400,000 Investment in corporate stock 1,000,000 Investment in tax-exempt bonds 50,000 Total assets $ 20,425,000 $ 2,120,000 8,500,000 $ 10,620,000 Liabilities & Stockholders' Equity Liabilities: Accounts payable Long term debt Total liabilities Stockholders' equity: Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 6,000,000 3,805,000 $ 9,805,000 $ 20,425,000 Additional information for 2020 includes: MACRS depreciation is $2.45 million. Bad debt expense for tax purposes is $425,000 (under the direct write-off method). $40,000 of the total meals and entertainment expenses are for entertainment; $20,000 pertained to business meals. Required: 1. Prepare book-tax reconciliations using the book/tax reconciliation worksheets that we have used for in-class problems for 2019 and 2020. 2. Prepare page 1 of the Forms 1120 using Intuit Pro-Connect for 2019 and 2020. 3. Prepare Sch Land Sch M-1 of the Form s1120 using Intuit Pro-Connect for 2019 and 2020. 4. Determine the corporation's deferred tax asset and/or liabilities and the journal entries required to record the tax provisions (current and deferred components) for 2019 and 2020. 5. Prepare schedules that reconcile the corporation's effective tax rate to its statutory rate (21%) for 2019 and 2020. Alpha Corporation was formed in 2019. For that year, Alpha reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets and deferred tax liabilities. Book Income Sales 20,000,000 Cost of Goods Sold 15,000,000 Gross Profit 5,000,000 Other income Dividends received 50,000 Tax exempt interest income 15,000 Total Income 5,065,000 Expenses Depreciation 800,000 Bad debts 400,000 Charitable contributions 100,000 Interest expense 475,000 Meals and entertainment 75,000 Other expenses 3,855,000 Total Expenses 5,705,000 Net Income before federal tax expense (640,000) Assets Cash $ 500,000 Accounts receivable $ 2,000,000 Less: Allowance for doubtful accounts 250,000 1,750,000 Inventory 4,000,000 Equipment $ 10,000,000 Less: Accumulated depreciation 800,000 9,200,000 Investment in corporate stock 1,000,000 Investment in tax-exempt bonds 50,000 Total assets $ 16,500,000 Liabilities & Stockholders' Equity Liabilities: Accounts payable Long term debt Total liabilities Stockholders' equity: Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 2,610,000 8,500,000 $ 11,110,000 6,000,000 (610,000) $ 5,390,000 $ 16,500,000 The investment in corporate stock is comprised of less than 20%-owned corporations. MACRS depreciation is $1.4 million. Bad debt expense for tax purposes is $150,000 (under the direct write-off method). $25,000 of the total meals and entertainment expenses are for entertainment; $20,000 pertained to business meals. For 2020, Alpha reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax assets and deferred tax liabilities. Book Income Sales 33,000,000 Cost of Goods Sold 22,000,000 Gross Profit 11,000,000 Other income Dividends received 55,000 Tax exempt interest income 15,000 Total Income 11,070,000 Expenses Depreciation 800,000 Bad debts 625,000 Charitable contributions 40,000 Interest expense 455,000 Meals and entertainment 60,000 Other expenses 4,675,000 Total Expenses 6,655,000 Net Income before federal tax expense 4,415,000 Assets Cash $ 2,125,000 Accounts receivable $ 3,300,000 Less: Allowance for doubtful accounts 450,000 2,850,000 Inventory 6,000,000 Equipment $ 10,000,000 Less: Accumulated depreciation 1,600,000 8,400,000 Investment in corporate stock 1,000,000 Investment in tax-exempt bonds 50,000 Total assets $ 20,425,000 $ 2,120,000 8,500,000 $ 10,620,000 Liabilities & Stockholders' Equity Liabilities: Accounts payable Long term debt Total liabilities Stockholders' equity: Capital stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 6,000,000 3,805,000 $ 9,805,000 $ 20,425,000 Additional information for 2020 includes: MACRS depreciation is $2.45 million. Bad debt expense for tax purposes is $425,000 (under the direct write-off method). $40,000 of the total meals and entertainment expenses are for entertainment; $20,000 pertained to business meals. Required: 1. Prepare book-tax reconciliations using the book/tax reconciliation worksheets that we have used for in-class problems for 2019 and 2020. 2. Prepare page 1 of the Forms 1120 using Intuit Pro-Connect for 2019 and 2020. 3. Prepare Sch Land Sch M-1 of the Form s1120 using Intuit Pro-Connect for 2019 and 2020. 4. Determine the corporation's deferred tax asset and/or liabilities and the journal entries required to record the tax provisions (current and deferred components) for 2019 and 2020. 5. Prepare schedules that reconcile the corporation's effective tax rate to its statutory rate (21%) for 2019 and 2020