Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional Information for 2024: 1. Purchased Investment in bonds for $111,000. 2. Sold land for $27,400. The land originally was purchased for $36,000, resulting

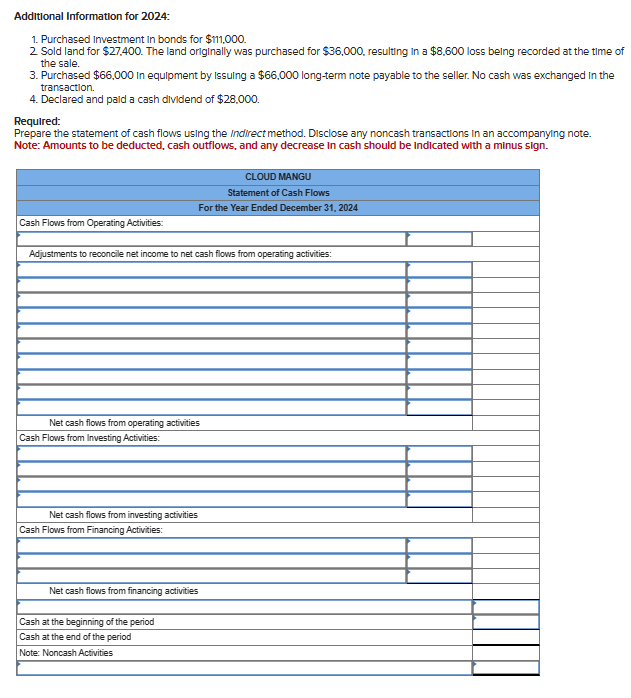

Additional Information for 2024: 1. Purchased Investment in bonds for $111,000. 2. Sold land for $27,400. The land originally was purchased for $36,000, resulting in a $8,600 loss being recorded at the time of the sale. 3. Purchased $66,000 in equipment by Issuing a $66,000 long-term note payable to the seller. No cash was exchanged in the transaction. 4. Declared and paid a cash dividend of $28,000. Required: Prepare the statement of cash flows using the Indirect method. Disclose any noncash transactions in an accompanying note. Note: Amounts to be deducted, cash outflows, and any decrease in cash should be indicated with a minus sign. CLOUD MANGU Statement of Cash Flows For the Year Ended December 31, 2024 Cash Flows from Operating Activities: Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activities Cash Flows from Investing Activities: Net cash flows from investing activities Cash Flows from Financing Activities: Net cash flows from financing activities Cash at the beginning of the period Cash at the end of the period Note: Noncash Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started