Answered step by step

Verified Expert Solution

Question

1 Approved Answer

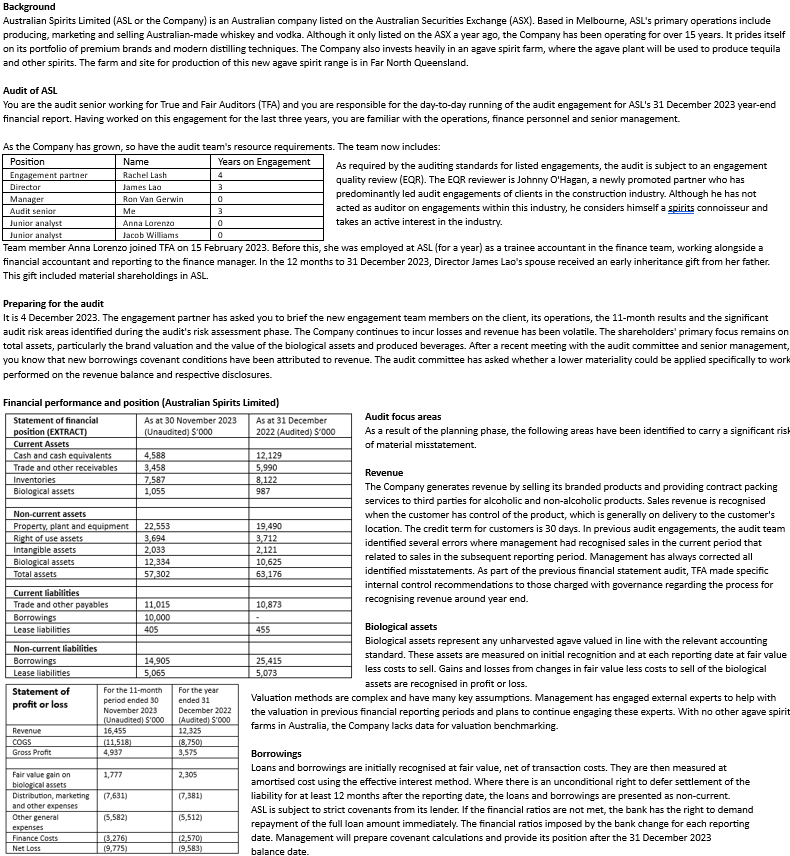

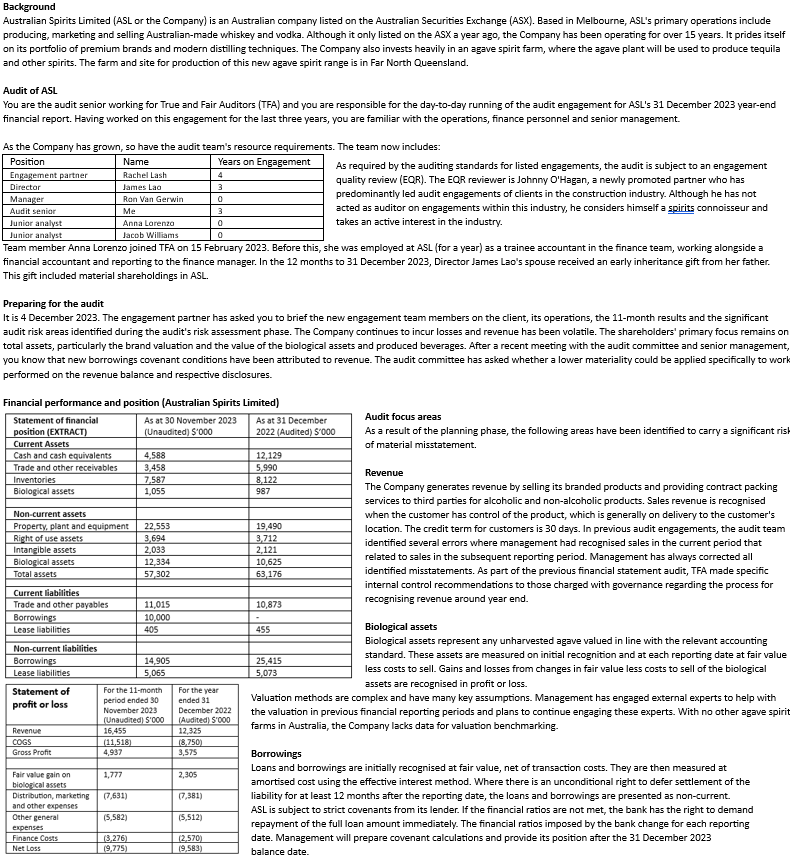

Additional Information Materiality - Determining overall materiality Profit before tax Users of the financial statements of profit - oriented entities are generally concerned with reported

Additional Information

Materiality Determining overall materiality

Profit before tax

Users of the financial statements of profitoriented entities are generally concerned with reported earnings at the pretax levels. When pretax profit fluctuates significantly from one year to another or the entity is making losses, it is useful to consider materiality relating to normalised pretax profit or to consider an alternative benchmark. Acceptable range is

Revenue from operations

In the case where profit before tax is volatile or losses are being made, revenue may be considered an acceptable benchmark. However, where revenue is also volatile, it may be appropriate to consider an alternative benchmark. Acceptable range is

Total assets

Where an entity's activities ultimately stem from the assets held, or the users have a vested interest in the performance of the underlying assets, total assets may be a more appropriate basis for determining overall materiality. Acceptable range is

Net assets

If pretax profit is relatively unstable and the company is in a startup phase, and if the users are concerned with some indicator of changes in shareholders' equity, net assets may be an appropriate benchmark. Acceptable range is

The lower end of the respective ranges should be used where there is one or more of the following:

A heightened public interest in the financial report.

Inherent complexities and a history of misstatements in engagements.

Determining specific materiality

An entity may have financial statement areas where misstatements of lesser amounts than materiality for the financial statements as a whole could reasonably be expected to influence the economic decisions of financial statement users. In these cases, we will also determine the specific materiality levels to be applied to those areas. In considering whether to apply specific materiality levels to particular financial statement areas, we may find it useful to obtain an understanding of the views and expectations of those charged with governance and management.

Specific materiality will be calculated as of this account balance or class of transactions.

Questions

Explain why the following accounts have been assessed as having a significant risk of material misstatement:

i Revenue.

ii Biological assets.

iii. Borrowings.

For each of the significant risks in e identify the key assertion at risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started