Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information necessary for determining taxable income: The depreciation expense for the year under MACRS was $64,000The amount of accounts receivable written off as uncollectible

Additional information necessary for determining taxable income:

Additional information necessary for determining taxable income: The depreciation expense for the year under MACRS was $64,000The amount of accounts receivable written off as uncollectible during the year was $22,000BoxCo owns 24% of the corporation from which it received dividends

Required:

Determine the permanent book-tax differences (BTDs)

Organize the Effective Tax Rate ReconciliationFor homework:

Enter the company's Income Statement on an Excel spreadsheet

On a separate Excel worksheet (within the same document), organize a template for the Effective Tax Rate Reconciliation

Use this spreadsheet to complete the Effective Tax Rate Reconciliation assuming the same facts except that:

BoxCo contributed $15,000 to a political action committee

Federal Tax Rate is 40%

The state Tax Rate is 6%

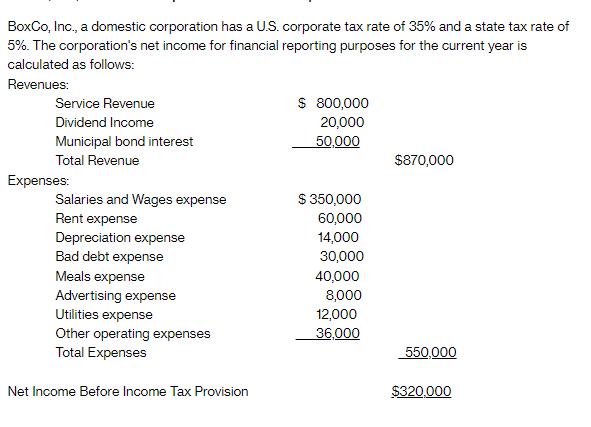

BoxCo, Inc., a domestic corporation has a U.S. corporate tax rate of 35% and a state tax rate of 5%. The corporation's net income for financial reporting purposes for the current year is calculated as follows: Revenues: Service Revenue Dividend Income Municipal bond interest Total Revenue Expenses: Salaries and Wages expense Rent expense Depreciation expense Bad debt expense Meals expense Advertising expense Utilities expense Other operating expenses Total Expenses Net Income Before Income Tax Provision $ 800,000 20,000 50,000 $ 350,000 60,000 14,000 30,000 40,000 8,000 12,000 36,000 $870,000 550,000 $320,000

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Permanent BookTax Differences BTDs Taxexempt interest income on municipal bonds Fines and penalties paid to governments for violation of the law Nonde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started