Answered step by step

Verified Expert Solution

Question

1 Approved Answer

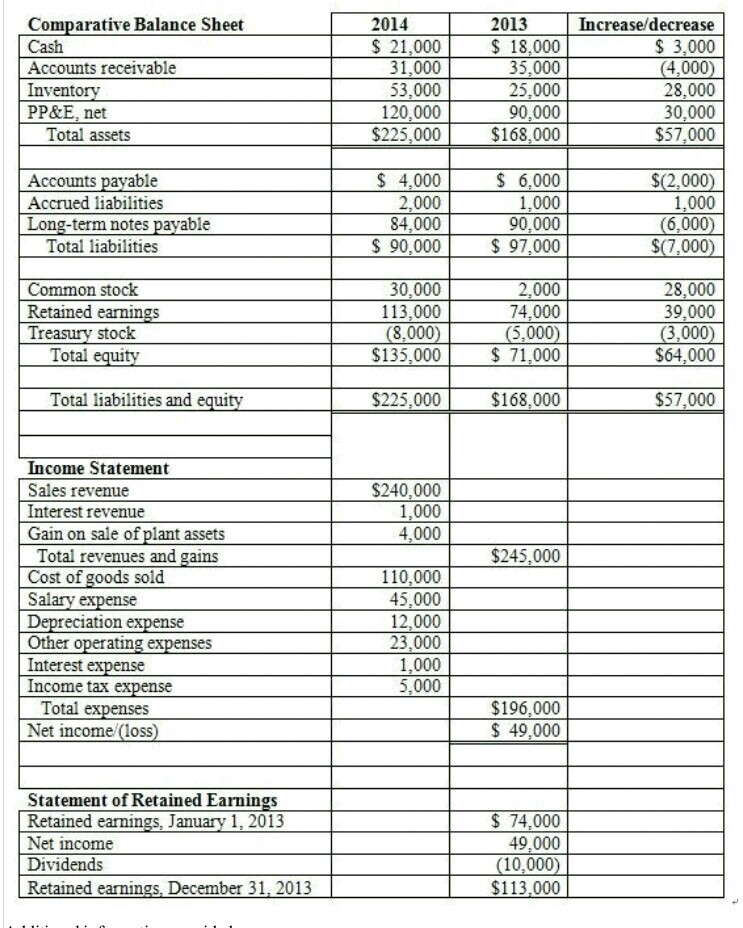

Additional information provided: Equipment costing $52,000 was purchased for cash. Equipment with a net asset value of $10,000 was sold for $14,000 Depreciation expense of

Additional information provided: Equipment costing $52,000 was purchased for cash. Equipment with a net asset value of $10,000 was sold for $14,000 Depreciation expense of $12,000 was recorded during the year. During 2014, the company repaid $40,000 of long-term notes payable During 2014, the company borrowed $34,000 on a new note payable There were no stock retirements during the year. There were no sales of treasury stock te the year.

prepare a complete statement of cash flows with this format

Comparative Balance Sheet Cash Accounts receivable Inventory PP&E, net 2014 2013 21,000 31,000 53,000 120,000 $225,000 18,000 35.000 25,000 90.000 $168.000 Increase/decrease 3.000 4.000 28,000 30,000 $57,000 Total assets S 4,000 2,000 84,000 S90,000 6.000 1,000 90.000 S 97,000 (2,000 Accounts payable Accrued liabilities Long-term notes payable 1,000 6,000 S(7,000 Total liabilities Common stock Retained earnings Treasury stock 30,000 113,000 8.000 S135,000 2.000 74,000 5,000 71.000 28,000 39,000 3,000 $64,000 Total Total liabilities and equity $225.000 $168,000 57,000 Income Statement Sales revenue Interest revenue Gain on sale of plant assets $240,000 1,000 4,000 $245,000 Total revenues and gains Cost of goods sold Sal 110,000 45,000 12,000 23,000 1,000 5,000 eciation e Other operating e Interest Income tax Total expenses Net income oss $196,000 49.000 Statement of Retained Earnings Retained earnings, January 1 2013 Net income Dividends Retained earnings, December 3, 2013 74,000 49.000 10,000 $113,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started