Question

Additional information Sales, purchases, and expenses were occurred evenly throughout the period. Closing inventory on 30 June 2041 was $796,000 and was acquired during June

Additional information

Sales, purchases, and expenses were occurred evenly throughout the period.

Closing inventory on 30 June 2041 was $796,000 and was acquired during June 2041.

Land was acquired by ATL on 1 October 2040 for $1,200,000.

New motor vehicles were delivered and paid for on 1 April 2041 for $760,000. Each motor vehicle has a useful life of ten years, with no residual value. ATL use straight-line method for all motor vehicles.

New machinery assets were delivered and paid for on 31 December 2040 for $912,000. The machinery assets have a useful life of eight years, with no residual value. ATL use straight-line method for all machinery.

The interim dividend was paid on 31 December 2040

The dividend payable was declared on 30 June 2041

ATL borrowed Euro $2,400,000 on 1 October 2040 at an interest rate of 8% per annum, with interest payments at the end of each half-year (i.e., 31 December and 30 June).

Prepare:

1. A statement of Profit or Loss

2. A statement of Changes in Equity

3. A statement of Financial Position

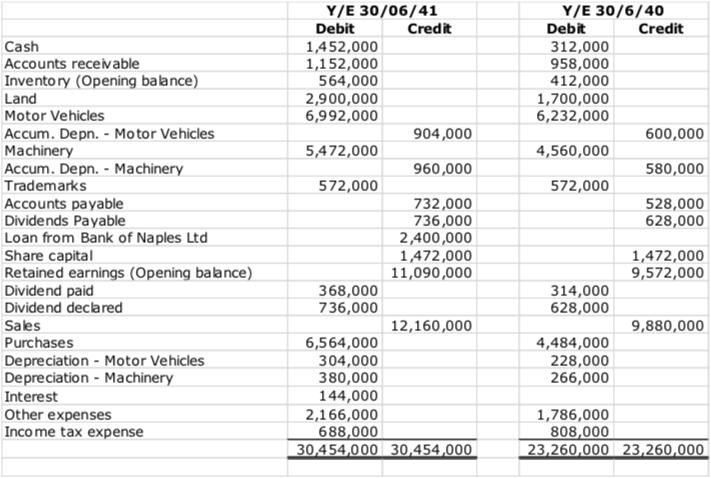

Y/E 30/6/40 Debit Y/E 30/06/41 Debit Credit Credit Cash 1,452,000 1,152,000 564,000 2,900,000 6,992,000 312,000 958,000 412,000 1,700,000 6,232,000 Accounts receivable Invento ry (Opening balance) Land Motor Vehicles Accum. Depn. - Motor Vehicles Machinery Accum. Depn. - Machinery Trademarks 904,000 600,000 5,472,000 4,560,000 960,000 580,000 572,000 572,000 Accounts payable Dividends Payable Loan from Bank of Naples Ltd Share capital Retained earnings (Opening balance) Dividend paid Dividend declared 732,000 736,000 2,400,000 1,472,000 11,090,000 528,000 628,000 1,472,000 9,572,000 368,000 736,000 314,000 628,000 Sales 12,160,000 9,880,000 4,484,000 228,000 266,000 Purchases 6,564,000 304,000 380,000 144,000 2,166,000 688,000 30,454,000 30,454,000 Depreciation - Motor Vehicles Depreciation - Machinery Interest Other expenses Inco me tax expense 1,786,000 808,000 23,260,000 23,260,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The benefit and misfortune account is an explanation that shows the livelihoods and cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started